Genesis Energy LP (GEL): An Undervalued Gem in the Energy Sector?

Genesis Energy LP (NYSE:GEL) witnessed a daily gain of 2.69%, with a commendable 3-month gain of 15.05%. The company also reported Earnings Per Share (EPS) (EPS) of 0.04. With these figures, the question arises: is Genesis Energy LP modestly undervalued? This article explores the company's valuation, financial strength, profitability, and growth to provide a comprehensive analysis of its intrinsic value.

Company Overview

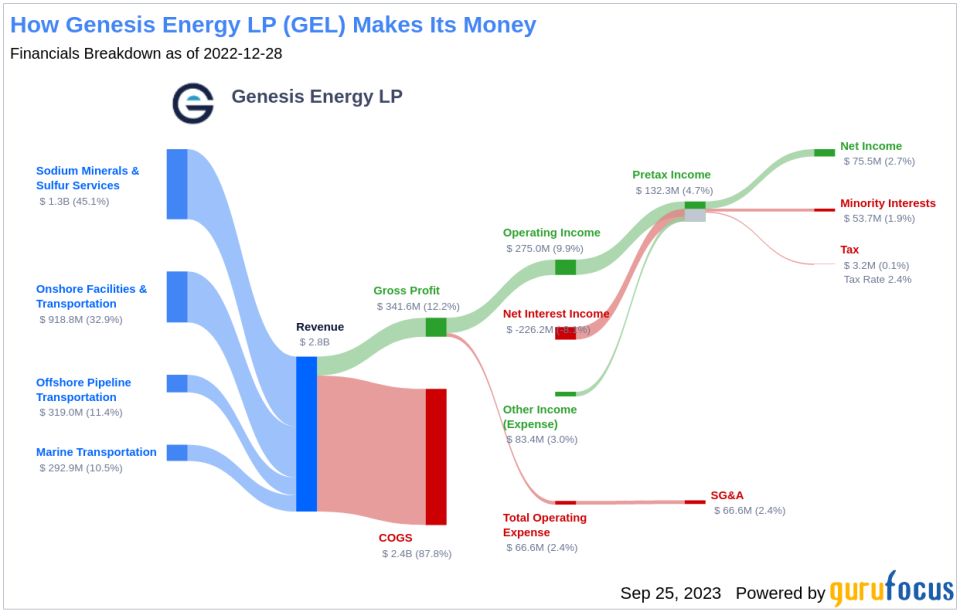

Genesis Energy LP is a US-based limited partnership focusing on the midstream segment of the crude oil and natural gas industry. The company provides services to crude oil and natural gas producers, and industrial and commercial enterprises. Genesis Energy LP operates in offshore pipeline transportation, sodium minerals and sulfur services, onshore facilities and transportation, and marine transportation sectors. The company generates maximum revenue from the offshore pipeline transportation segment.

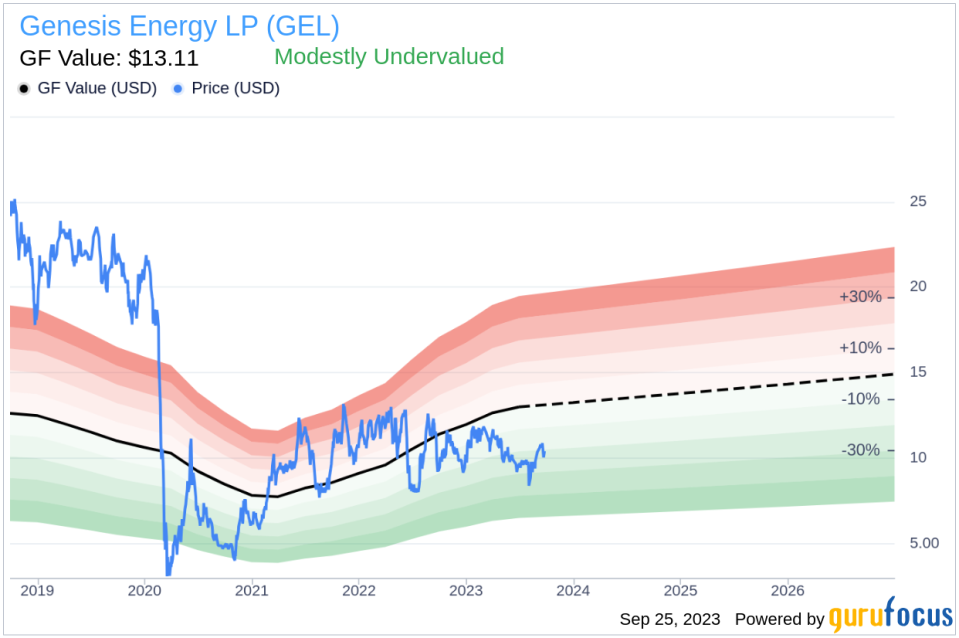

Genesis Energy LP's stock price currently stands at $10.31, while its GF Value, an estimation of fair value, is $13.11. This discrepancy indicates that the stock is modestly undervalued. The company has a market cap of $1.30 billion and reported sales of $3 billion.

Understanding GF Value

The GF Value is a proprietary measure of a stock's intrinsic value, computed based on historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line denotes the stock's ideal fair trading value.

According to the GF Value, Genesis Energy LP is modestly undervalued. If the stock price is significantly above the GF Value Line, the stock may be overvalued and have poor future returns. Conversely, if the stock's share price is significantly below the GF Value Line, the stock may be undervalued and have high future returns.

Given that Genesis Energy LP is relatively undervalued, the long-term return of its stock is likely to be higher than its business growth.

Financial Strength

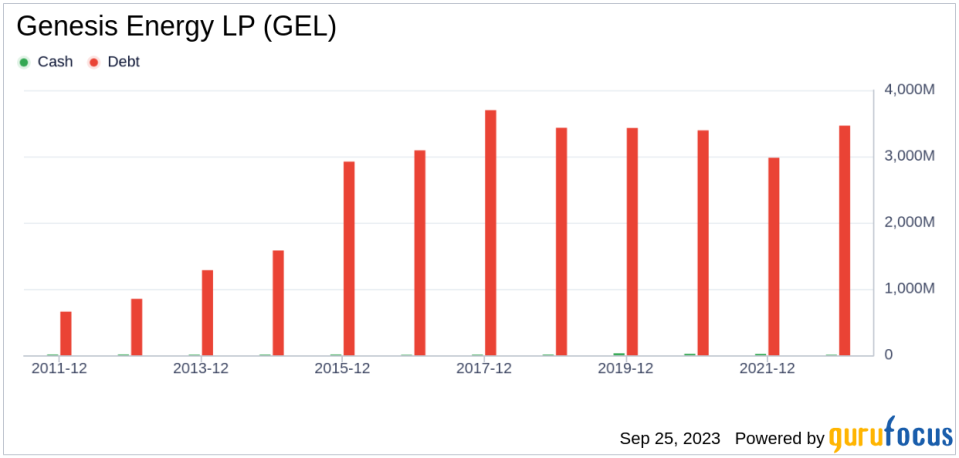

Investing in companies with poor financial strength carries a higher risk of permanent loss of capital. Therefore, it's crucial to review the financial strength of a company before deciding to buy its stock. Genesis Energy LP's cash-to-debt ratio is 0, which is worse than 0% of 1034 companies in the Oil & Gas industry. The company's overall financial strength is ranked 3 out of 10 by GuruFocus, indicating poor financial strength.

Profitability and Growth

Genesis Energy LP has been profitable 7 over the past 10 years. The company had a revenue of $3 billion and Earnings Per Share (EPS) of $0.04 over the past twelve months. Its operating margin is 10.52%, which ranks better than 54.17% of 984 companies in the Oil & Gas industry. The company's overall profitability is ranked 6 out of 10, indicating fair profitability.

Furthermore, growth is a significant factor in the valuation of a company. Genesis Energy LP's 3-year average revenue growth rate is worse than 63.34% of 862 companies in the Oil & Gas industry. The company's 3-year average EBITDA growth rate is 0.3%, which ranks worse than 68.4% of 829 companies in the Oil & Gas industry.

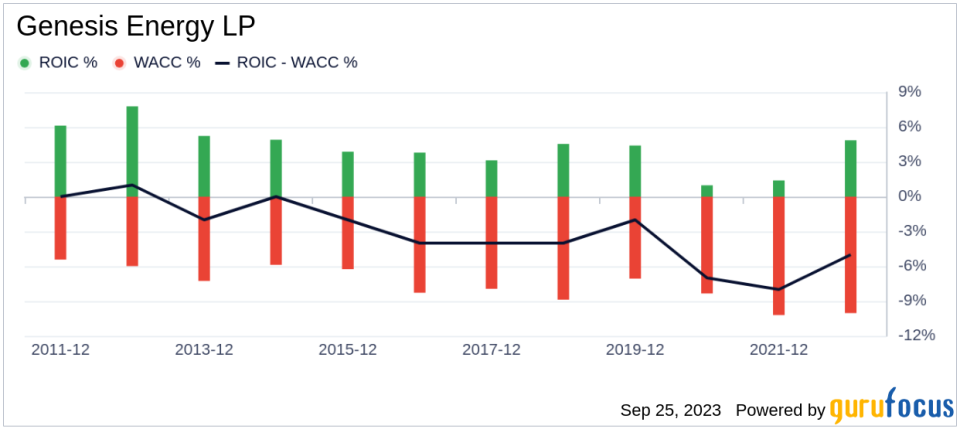

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can also evaluate its profitability. Genesis Energy LP's ROIC is 5.49 while its WACC is 8.81. If the ROIC exceeds the WACC, the company is likely creating value for its shareholders.

Conclusion

In conclusion, Genesis Energy LP appears to be modestly undervalued. The company's financial condition is poor, its profitability is fair, and its growth ranks worse than 68.4% of 829 companies in the Oil & Gas industry. For more information about Genesis Energy LP stock, check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.