Genie Energy Ltd. (GNE) Reports Record Revenue in Q4 and Full Year 2023 Despite Operational Loss

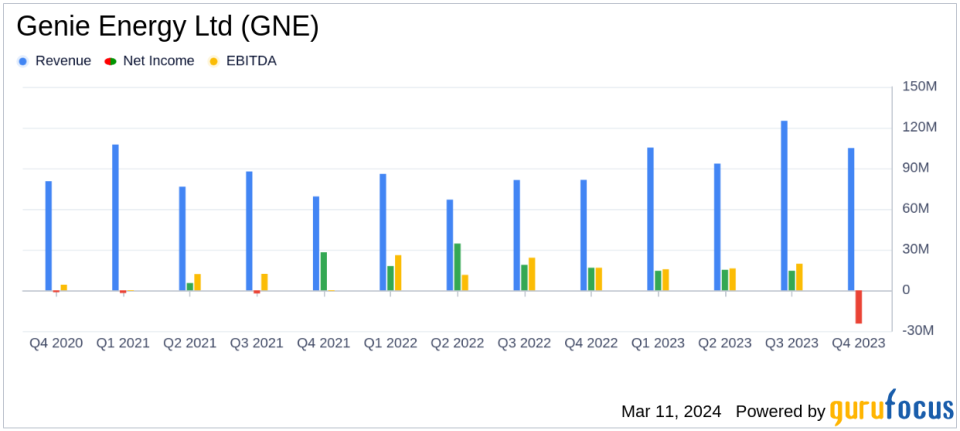

Revenue: Genie Energy Ltd. (NYSE:GNE) achieved record revenue in Q4 and full year 2023, with a year-over-year increase of 28.9% and 35.9%, respectively.

Adjusted EBITDA: Full-year 2023 Adjusted EBITDA exceeded the upper range of prior guidance, despite a 38.0% decrease in Q4 compared to the previous year.

Net Loss: GNE reported a net loss attributable to common stockholders of $24.5 million in Q4, primarily due to a one-time non-cash charge for insurance loss reserve.

Non-GAAP Financials: Non-GAAP net income and EPS, excluding the insurance loss reserve, stood at $10.0 million and $0.37 for Q4, and $53.7 million and $2.06 for the full year.

Liquidity: Cash and cash equivalents, restricted cash, and marketable equity securities rose by 55% year-over-year to $163.4 million, with no debt outstanding.

Dividend: A quarterly dividend of $0.075 per share was paid to Class A and Class B common stockholders on February 28, 2024.

Outlook: GNE anticipates 2024 Adjusted EBITDA to be within the $40 to $50 million range, with continued growth in customer base and renewables.

On March 11, 2024, Genie Energy Ltd. (NYSE:GNE) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, which operates through its Genie Retail Energy (GRE) and Genie Renewables (GREW) segments, reported record revenues for both the quarter and the full year, driven by significant customer growth and expansion in renewable energy operations.

Financial Performance and Challenges

Despite the record revenues, Genie Energy faced a challenging quarter with a loss from operations of $34.2 million compared to income from operations of $15.5 million in the same quarter of the previous year. This loss was largely attributed to a one-time $45.1 million non-cash charge related to a loss reserve at the company's newly established captive insurance operations. Adjusted EBITDA for Q4 decreased by 38.0% to $11.4 million, reflecting the strong gross margin achieved in Q4 of the previous year and increased investment in customer acquisitions in 2023.

The net loss attributable to Genie common stockholders was $24.5 million, with a loss per diluted share (EPS) of $(0.90). However, when excluding the impact of the insurance loss reserve, non-GAAP net income and EPS were $10.0 million and $0.37, respectively. These figures highlight the importance of adjusting for non-recurring items to understand the underlying performance of the company.

Financial Achievements and Importance

Genie Energy's financial achievements in 2023, particularly the growth in revenue and cash reserves, are significant for a company in the Utilities - Regulated industry. The increase in liquidity, with cash and cash equivalents, restricted cash, and marketable equity securities rising to $163.4 million, positions the company well for future growth and investment opportunities. Additionally, the redemption and retirement of the remaining $8.4 million of outstanding preferred stock strengthens the company's balance sheet and reflects prudent capital management.

Key Financial Metrics

Key financial metrics from Genie Energy's income statement and balance sheet include:

Financial Metric | Q4 2023 | Q4 2022 | Change |

|---|---|---|---|

Total Revenue | $104.9M | $81.4M | 28.9% |

Adjusted EBITDA | $11.4M | $18.5M | (38.0%) |

Net Loss Attributable to Genie Common Stockholders | $(24.5M) | $16.2M | na |

Diluted Loss EPS | $(0.90) | $0.59 | na |

Cash and Cash Equivalents | $163.4M | $105.1M | 55% |

These metrics are crucial as they provide insights into the company's operational efficiency, profitability, and financial health. The increase in revenue indicates successful customer acquisition and market expansion, while the Adjusted EBITDA reflects the company's ability to generate earnings from its core operations.

"The Company's strong 2023 performance resulted from the measures we took in 2022 and 2023 to re-position the Company, and we expect that 2023's key trends will help us to deliver outstanding results in 2024," said Michael Stein, CEO of Genie Energy.

Analysis of Company's Performance

Genie Energy's performance in 2023 demonstrates resilience and strategic growth, particularly in its customer base and renewable energy segment. The company's ability to pivot and adapt to market conditions, as evidenced by its portfolio management moves in 2022 and customer growth in 2023, has established a new baseline for Adjusted EBITDA and positioned it for sustained profitability.

Looking ahead, the company expects to maintain its Adjusted EBITDA within the $40 to $50 million range for 2024,

Explore the complete 8-K earnings release (here) from Genie Energy Ltd for further details.

This article first appeared on GuruFocus.