Genpact Ltd (G) Boasts a Stellar GF Score of 94: A Comprehensive Analysis

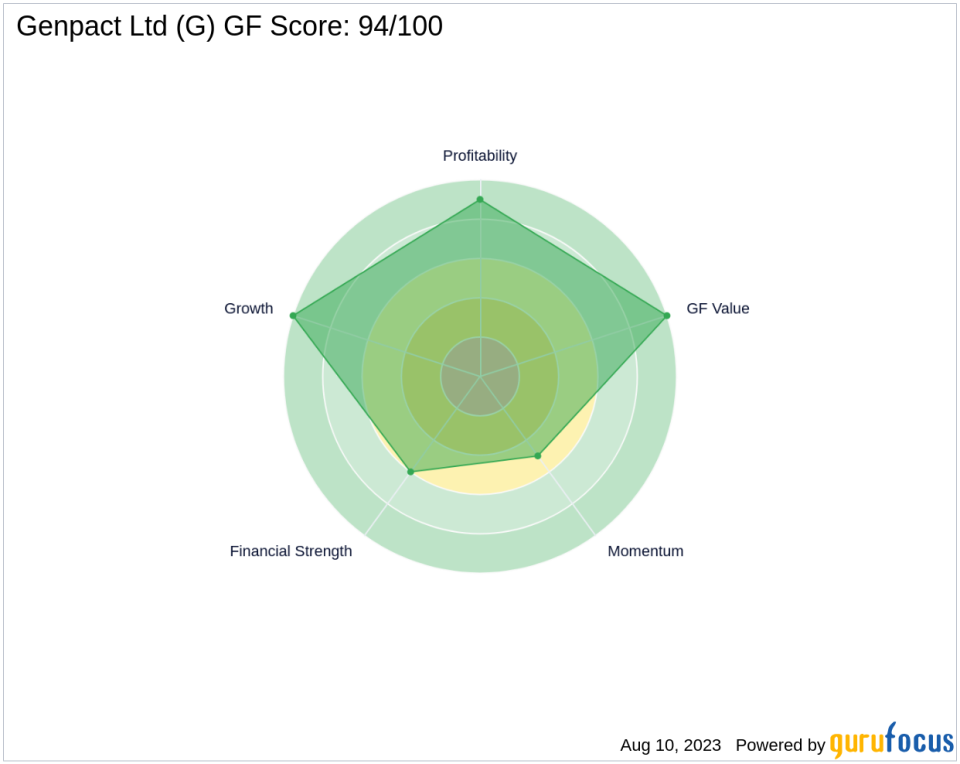

Genpact Ltd (NYSE:G), a prominent player in the software industry, is currently trading at $37.83 with a market capitalization of $6.97 billion. The stock has seen a gain of 6.26% today and a modest increase of 0.99% over the past four weeks. In this article, we will delve into Genpact's impressive GF Score of 94/100, which indicates the highest outperformance potential according to GuruFocus' ranking system. This score is a comprehensive measure of a stock's performance potential, taking into account five key aspects: Financial Strength, Profitability Rank, Growth Rank, GF Value Rank, and Momentum Rank.

Financial Strength: A Solid Foundation

Genpact's Financial Strength rank stands at 6/10, indicating a robust financial situation. The company's interest coverage ratio is 9.68, suggesting it can comfortably meet its interest obligations. Its debt to revenue ratio is 0.39, which is relatively low, indicating a manageable debt burden. Furthermore, the Altman Z score of 3.36 suggests a low probability of bankruptcy.

Profitability Rank: Consistent and High

Genpact's Profitability Rank is an impressive 9/10. The company's Operating Margin is 12.93%, and its Piotroski F-Score is 6, indicating a healthy financial situation. Despite a slight downtrend in the 5-year average operating margin (-0.70%), the company has consistently been profitable for the past 10 years, which is a positive sign for investors.

Growth Rank: Stellar Performance

With a perfect Growth Rank of 10/10, Genpact has demonstrated strong growth in terms of revenue and profitability. The company's 5-year revenue growth rate is 10.60%, and its 3-year revenue growth rate is 8.80%. Additionally, its 5-year EBITDA growth rate is 9.20%, indicating a consistent increase in its business operations.

GF Value Rank: Attractive Valuation

Genpact's GF Value Rank is 10/10, suggesting that the stock is attractively valued. This rank is determined by the price-to-GF-Value ratio, a proprietary metric calculated based on historical multiples and an adjustment factor based on a company's past returns and growth.

Momentum Rank: Room for Improvement

The company's Momentum Rank is 5/10, indicating a moderate momentum in its stock price. This rank is determined using the standardized momentum ratio and other momentum indicators.

Competitive Analysis: A Strong Contender

When compared to its competitors, Genpact holds a strong position. Science Applications International Corp (NYSE:SAIC) has a GF Score of 83, Clarivate PLC (NYSE:CLVT) has a GF Score of 54, and Globant SA (NYSE:GLOB) has a GF Score of 93. Genpact's GF Score of 94 outperforms these competitors, indicating its strong potential for future performance.

In conclusion, Genpact's high GF Score, robust financial strength, consistent profitability, strong growth, attractive valuation, and competitive position make it a compelling choice for investors. However, as with any investment, it's crucial to conduct thorough research and consider various factors before making a decision.

This article first appeared on GuruFocus.