Genpact Ltd (G) Reports Robust Full Year and Q4 2023 Earnings, Propels Dividend Growth

Revenue Growth: Full year revenue reached $4.48 billion, a 2% increase year-over-year, with Digital Operations and Data-Tech-AI services contributing significantly.

Net Income Surge: Net income soared by 79% to $631 million for the full year, bolstered by a significant non-recurring tax benefit.

Earnings Per Share: Diluted EPS jumped 81% to $3.41, while adjusted diluted EPS rose 9% to $2.98.

Dividend Increase: Quarterly dividend up by 11%, reflecting confidence in the company's financial health and commitment to shareholder returns.

Operational Efficiency: Adjusted income from operations margin stood at 17.0%, indicating improved operational efficiency.

Capital Allocation: Genpact repurchased 6 million shares and maintained a disciplined approach to capital allocation.

Future Outlook: Projected total revenue for 2024 is estimated to be between $4.57 billion and $4.61 billion, with continued growth in key service areas.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

On February 8, 2024, Genpact Ltd (NYSE:G) released its 8-K filing, detailing the full year and fourth quarter results for 2023. The global professional services firm, known for its business process management services, has reported a solid financial performance despite a challenging macroeconomic environment.

Genpact's services span across various industry verticals, including banking, financial services, insurance, and high-tech, among others. As a General Electric spin-off, Genpact continues to leverage its heritage to deliver innovative services and drive growth.

Financial Performance Highlights

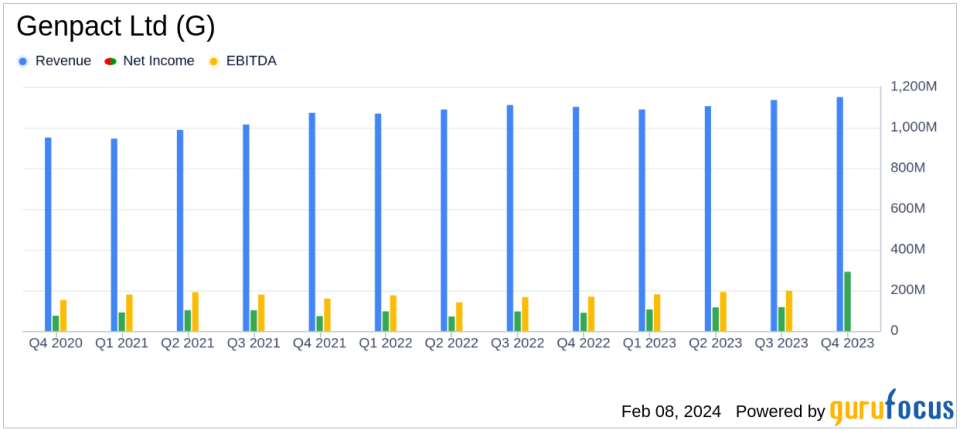

For the full year of 2023, Genpact reported a total revenue of $4.48 billion, marking a 2% increase from the previous year, with a 3% rise on a constant currency basis. The company's Digital Operations services generated $2.48 billion, up by 3% (4% constant currency), while Data-Tech-AI services contributed $1.99 billion, also up by 2%. These segments represent the core of Genpact's revenue, indicating a balanced growth across its service portfolio.

Net income saw a significant jump to $631 million, an 79% increase, which included a one-time tax benefit of $170 million related to an intercompany transfer of intellectual property. This benefit also reflected in the diluted earnings per share (EPS), which stood at $3.41, an 81% increase. The adjusted diluted EPS, which excludes certain non-recurring items, was $2.98, up by 9%.

Genpact's operational efficiency is evident from its adjusted income from operations, which rose by 6% to $763 million, with a margin of 17.0%. The company's new bookings were robust at approximately $4.9 billion, a 26% increase from the previous year, showcasing strong demand for its services.

Capital Allocation and Shareholder Returns

Reflecting its financial strength, Genpact declared an 11% increase in its quarterly dividend, signaling confidence in its ongoing performance and commitment to shareholder returns. The company also repurchased approximately 6 million shares for a total consideration of $225 million, further underscoring its prudent capital allocation strategy.

Looking Ahead

For 2024, Genpact anticipates total revenue to be in the range of $4.57 billion to $4.61 billion, with growth in both Digital Operations and Data-Tech-AI services. The company expects to maintain a gross margin of approximately 35% and an adjusted income from operations margin of around 17%. The adjusted diluted EPS is projected to be between $3.00 and $3.03.

Genpact's CEO, BK Kalra, emphasized the company's focus on enhancing execution and laying a strong foundation for future growth. Despite the external challenges, Genpact's strategic initiatives and operational discipline position it well to navigate the evolving business landscape.

Investors and analysts are invited to participate in the conference call discussing these results, with a live webcast available on the Genpact Investor Relations website. A replay and transcript of the call will also be provided for those unable to attend.

Genpact's full-year and fourth-quarter performance reflects a resilient business model and an ability to deliver growth amidst global economic headwinds. With a clear strategy and disciplined execution, Genpact continues to build on its strengths and deliver value to its clients and shareholders alike.

Explore the complete 8-K earnings release (here) from Genpact Ltd for further details.

This article first appeared on GuruFocus.