Genpact: A Quality Compounder at a Fair Price

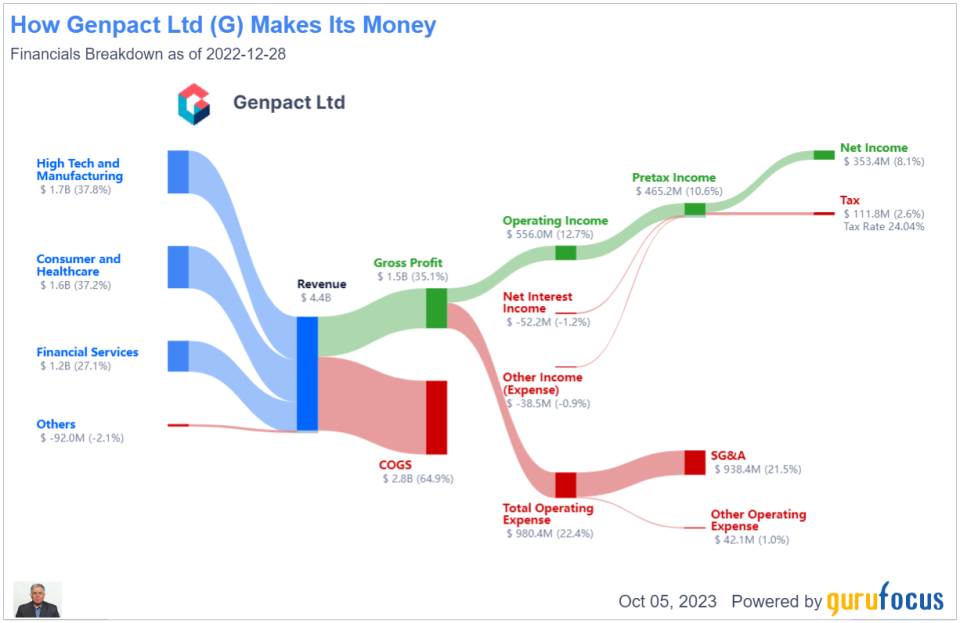

Information technology and professional services company Genpact Ltd. (NYSE:G) is domiciled in Bermuda, but does business globally but with a large presence in India. Its clients are industry verticals and operate in banking and financial services, insurance, capital markets, consumer product goods, life sciences, infrastructure, manufacturing and services, health care and high-tech. The company's services include aftermarket, direct procurement, risk and compliance, human resources, IT, industrial solutions, collections, finance and accounting and media services.

Spun off of General Electric (NYSE:GE) in 2007, a majority of Genpact's operational employees are based in India and services are performed from India due to lower labor costs, but most of its clients are based in North America (70%) and Europe (15%). Outsourced professional services are a sticky business, because once an organization has outsourced core business processes to an outsourcer like Genpact, changing providers or bringing the function in-house becomes very difficult and if the services provided are satisfactory, organization tend to stay with the contractor over the long term as they get to know each other's business processes and people very well. Thus the business is "sticky" because of switching costs and has a narrow moat.

The company reports in three business segments, Banking, Capital Markets and Insurance, Consumer Goods, Retail, Life Sciences and Health Care and High Tech, Manufacturing and Services.

Genpact caught my eye when I was looking for companies caught up in the recent stock market weakness, but have strong balance sheets and are good candidates to bounce back in the coming year. The company seems to fit the bill with a strong balance sheet, a low debt-to-Ebitda ratio (2.26) and strong free cash flow.

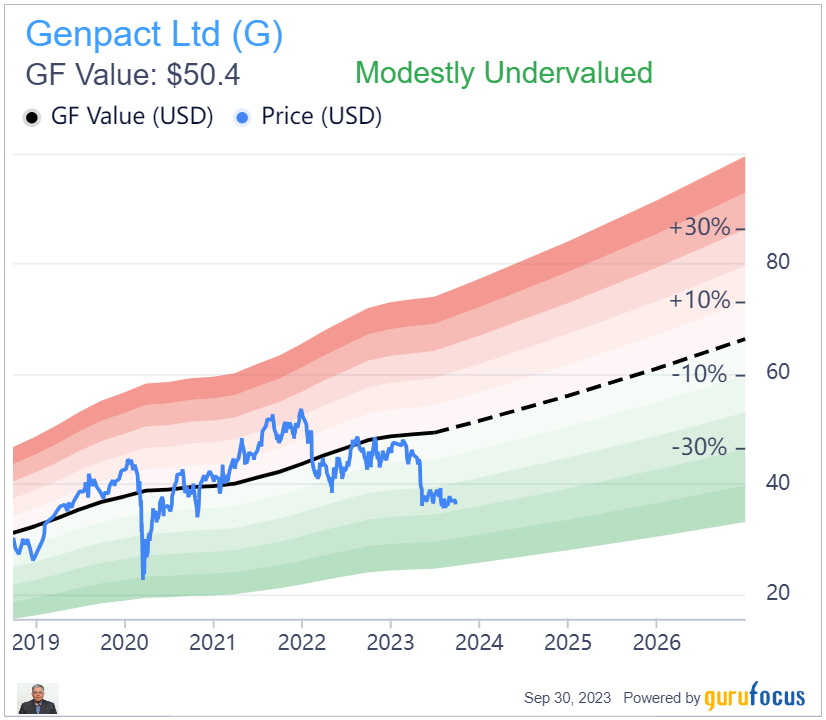

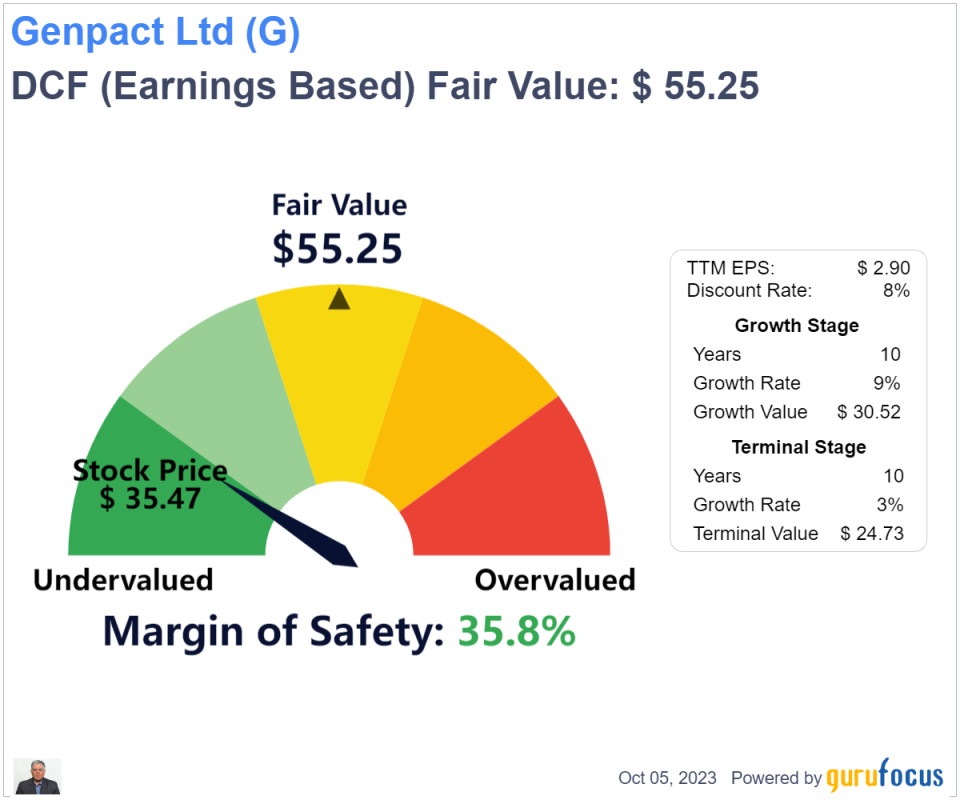

Looking at the GF Value Line, I see the stock is about 30% below the intrinsic value calculated by GuruFocus. It is based on historical ratios, past financial performance and analysts' future earnings projections.

Looking at the GF Score chart, I note the very strong profitability and growth ranks. The financial strength is acceptable at 6 out of 10 and the only weak rating is momentum.

Modestly Undervalued | ||

92 | of 100 | |

5 | of 5 | |

10 | of 10 | |

6 | of 10 | |

9 | of 10 | |

9 | of 10 | |

4 | of 10 | |

9 | of 10 |

The company is a services business, so it is asset light. As such, the return on equity at around 22% and return on invested capital of approximately 12% are on the high side. Genpact has been consistently profitable since being spun off in 2007 and boasts a perfect predictability rank of 5 out of 5. GuruFocus backtesting has confirmed that companies with highly predictable revenue and earnings provide superior total returns.

Growth

Genpact's growth rate over the past decade has been excellent.

11.10% | 10.60% | 5.90% | |

9.30% | 7.50% | 21.70% | |

9.80% | 9.80% | 18.20% | |

9.40% | 9.20% | 10.30% | |

10.90% | 18.90% | 46.90% | |

- | 15.00% | 12.90% | |

7.50% | 7.60% | 11.70% | |

7.20% | 4.70% | -20.90% |

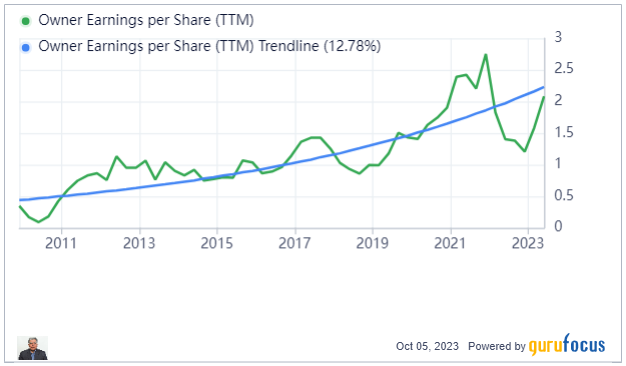

The company has compounded owner earnings per share at a rapid pace (over 12% compound annual growth rate) through the past decade and more. This is an impressive and rare accomplishment.

Owner earnings is a key metric popularized by Warren Buffett (Trades, Portfolio). Buffett explained it as follows: Owner earning equals the sum of net income and depreciation, depletion, amortization and other non-cash charges minus average annual maintenance capital expenditures. Owner earnings is similar to free cash flow, but I think a superior metric because it starts from net earnings, so takes stock-based compensation as well as maintenance capital expenditures into account. Unlike free cash flow, owner earnings includes stock-based compensation, which can be a significant expense for some companies.

The good thing about Genpact is it is strong and consistent, which reinforces my belief that this is a quality compounder.

Valuation

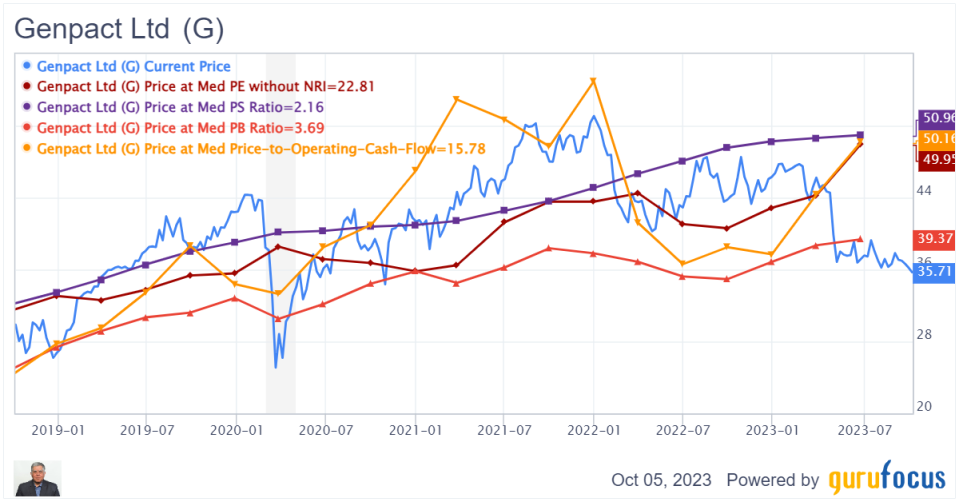

I compared Genpact's stock price with its 10-year median justified price-earnings, price-sales, price-book and price-to-operating cash flow ratios. These median justified values are well above the current stock price, which is indicative of solid value.

The company pays a dividend, which is currently 1.52% with a dividend payout ratio of 24%. The company is also buying back shares. Its three-year buyback ratio is 1.3%. This leads me to believe the company is shareholder friendly.

My attempt at valuing Genpact using the GuruFocus discounted cash flow calculator arrived at value, which is in the ball park of the GF Value, confirming that the company is undervalued at the time of writing.

Conclusion

Every year during the month of October, I look for stocks that have strong financial strength, but are trading near their 52-week lows and may be subject to selling due to tax-loss harvesting. My strategy is to buy some of these stocks in the October to mid-December time period and then sell them in January, thus taking advantage of this seasonal pattern.

Genpact fits this criteria for a short-term flip, though it is also a high-quality, asset-light business with a high ROE and is likely a candidate for a long-term hold. The risk to my thesis in that the U.S. economy tips into a recession, which can delay a bounce back.

This article first appeared on GuruFocus.