Genpact's (G) Stock Declines 8% Despite Q3 Earnings Beat

Genpact Limited G reported mixed third-quarter 2023 results, wherein earnings beat the Zacks Consensus Estimate, but revenues missed.

The stock has declined 7.9% since the earnings release on Nov 8, as the 2023 revenue guidance was weak. The company currently expects revenues to be around $4.45 billion compared with the previous expectation of $4.59-$4.64 billion. The current guidance is lower than the Zacks Consensus Estimate of $4.51 billion.

Quarterly EPS of 67 cents surpassed the consensus estimate by 3.1% and stayed flat on a year-over-year basis. Revenues of $1.1 billion missed the consensus mark by 2.3% but increased 2.2% year over year.

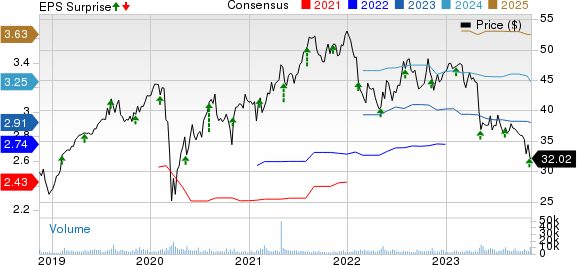

Genpact Limited Price, Consensus and EPS Surprise

Genpact Limited price-consensus-eps-surprise-chart | Genpact Limited Quote

Other Quarterly Details

Data-Tech-AI services revenues (representing 44% of total revenues) were down 2% year over year on a reported as well as constant currency basis to $500 million. Yet, the metric missed our estimate of $548.5 million.

Digital Operations services revenues of $636 million (56%) inched up 6% year over year on a reported basis as well as at cc. This surpassed our projection of $624.8 million.

Adjusted income from operations totaled $195 million, up 3% year over year. Adjusted operating income margin of 17.2% increased 20 basis points year over year.

Genpact exited the quarter with cash and cash equivalents of $541 million compared with $491.3 million recorded at the end of the previous quarter. Long-term debt was $1.2 billion, flat with the prior quarter.

The company generated $76.7 million in cash from operating activities, while capex was $11.3 million. Genpact returned $18.7 million to shareholders through dividends.

2023 Guidance

Adjusted EPS is expected to be around $2.89 (prior view: $2.91-$2.94). The guidance is below the Zacks Consensus Estimate of $2.91.

Adjusted income from operations margin is expected to be 17%, up from 16.8% expected previously.

Genpact currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Interpublic Group of Companies, Inc.’s IPG third-quarter 2023 earnings and revenues missed the Zacks Consensus Estimate.

IPG’s adjusted earnings were 70 cents per share, which lagged the consensus estimate by 6.7% but increased 11.1% on a year-over-year basis. Net revenues of $2.31 billion missed the consensus estimate by 3.3%. In the year-ago quarter, IPG’s net revenues were $2.3 billion. Total revenues of $2.68 billion increased 1.5% year over year.

Equifax Inc. EFX reported lower-than-expected third-quarter 2023 results. Adjusted earnings (excluding 45 cents from non-recurring items) were $1.76 per share, missing the Zacks Consensus Estimate by 1.1% but increasing 1.7% from the year-ago figure.

EFX’s total revenues of $1.32 billion missed the consensus estimate by 0.7% and increased 6% from the year-ago figure on a reported basis and 6.5% on a local-currency basis.

Fiserv, Inc. FI reported impressive third-quarter 2023 results, wherein earnings and revenues surpassed the Zacks Consensus Estimate. Adjusted earnings per share of $1.96 exceeded the consensus mark by 1% and increased 20% year over year. Adjusted revenues of $4.62 billion surpassed the consensus estimate by 0.53% and increased 8.2% year over year.

FI’s organic revenue growth was 12% in the quarter, driven by 20% and 6% growth in the Acceptance and Payments segments, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Interpublic Group of Companies, Inc. (The) (IPG) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

Genpact Limited (G) : Free Stock Analysis Report

Fiserv, Inc. (FI) : Free Stock Analysis Report