Gentex Corp (GNTX) Posts Record Sales and Profit Growth in Q4 and Full-Year 2023

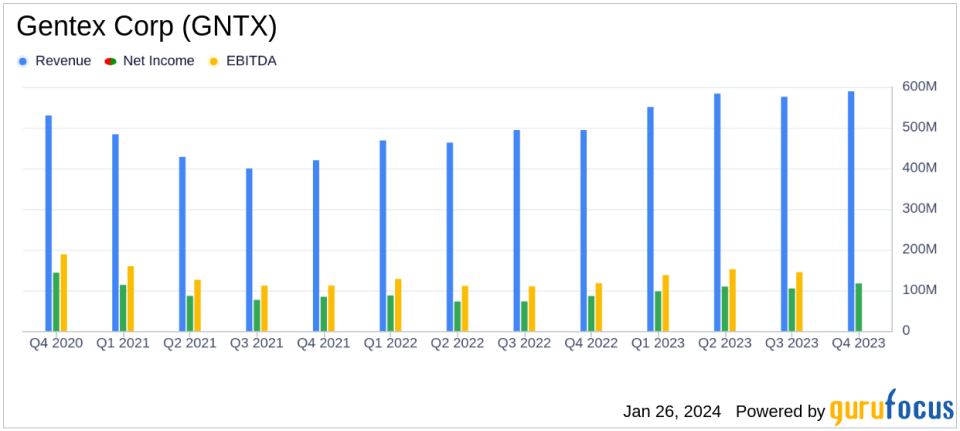

Net Sales: Q4 sales hit a record $589.1 million, up 19% YOY; full-year sales reached $2.30 billion, a 20% increase.

Gross Profit Margin: Improved to 34.5% in Q4, up 330 basis points YOY; annual margin rose to 33.2%, up 140 basis points.

Net Income: Q4 net income surged 36% to $116.9 million; full-year net income climbed 34% to $428.4 million.

Earnings Per Share: EPS for Q4 increased by 35% to $0.50; annual EPS also up 35% to $1.84.

Full Display Mirror Shipments: Grew by 45% in 2023, contributing to the company's revenue outperformance.

Capital Return: $256.9 million returned to shareholders, including $144.7 million in share repurchases and $112.2 million in dividends.

On January 26, 2024, Gentex Corp (NASDAQ:GNTX), a pioneer in digital vision, connected car, dimmable glass, and fire protection technologies, announced its financial results for the fourth quarter and the full year ended December 31, 2023. The company's 8-K filing revealed a series of financial records, indicating robust growth and operational efficiency.

Founded in 1974, Gentex began with smoke-detection equipment and has since become a major player in the automotive industry, with automotive revenue accounting for approximately 98% of its total revenue. The company has consistently developed new applications for its technology to maintain a competitive edge. Based in Zeeland, Michigan, Gentex has a history of innovation, particularly with its electrochromic technology used in glare-control mirrors.

Financial Highlights and Operational Performance

Gentex's performance in the fourth quarter and throughout 2023 was marked by significant sales growth and margin improvements. The company set new quarterly and annual sales records, with net sales in Q4 reaching $589.1 million, a 19% increase over the same period in 2022. For the full year, net sales soared to $2.30 billion, marking a 20% increase compared to the previous year.

The gross profit margin for Q4 improved substantially to 34.5%, up from 31.2% in the same quarter of the previous year. This improvement was attributed to recurring price increases, one-time cost recoveries, and operational efficiencies. For the full year, the gross margin reached 33.2%, up from 31.8% in 2022. These margin enhancements reflect Gentex's successful execution of its gross margin recovery plan, which is set to continue into 2024 with a focus on bill of material reductions and other cost-saving measures.

Net income and earnings per share (EPS) also saw impressive growth. Q4 net income increased by 36% to $116.9 million, with EPS growing 35% to $0.50. The full-year figures were equally strong, with net income up 34% to $428.4 million and EPS increasing by 35% to $1.84.

Strategic Developments and Future Outlook

Gentex's Full Display Mirror (FDM) shipments were a particular highlight, with a 45% increase in units shipped during 2023. This growth contributed to the company's revenue outperformance in its primary markets. Gentex also continued to return capital to shareholders, with $256.9 million returned in 2023, including share repurchases and dividends.

Looking ahead, Gentex provided guidance for 2024, with revenue expected to be between $2.45 and $2.55 billion and a gross margin target of 34% to 35%. The company also anticipates elevated R&D expenses as it continues to innovate at a rapid pace.

President and CEO Steve Downing expressed confidence in Gentex's strategic direction, stating,

Calendar year 2023 turned out to be a remarkable year for the Company... We believe this revenue outperformance versus the underlying market is evidence that our product strategy is effective and is creating our targeted results."

For detailed financial tables and further insights into Gentex Corp's performance, readers are encouraged to view the full 8-K filing.

Gentex's strong financial results and strategic initiatives position the company well for continued growth and shareholder value creation. As the automotive industry evolves, Gentex's commitment to innovation and market outperformance is expected to drive further success.

Explore the complete 8-K earnings release (here) from Gentex Corp for further details.

This article first appeared on GuruFocus.