Gentex (GNTX) Q3 Earnings & Sales Top Estimates, Rise Y/Y

Gentex Corporation’s GNTX third-quarter 2023 earnings of 45 cents per share surpassed the Zacks Consensus Estimate of 42 cents and increased 45% from the year-ago quarter, thanks to higher-than-expected sales from the Automotive unit.

This Zeeland-based automotive products supplier reported net sales of $575.8 million, beating the Zacks Consensus Estimate of $559 million. Sales also increased 17% from the year-ago period. The company recorded a gross margin of 33.2%, an increase of 340 basis points from the third quarter of 2022, due to higher sales, favorable product mix, cost recoveries and improvements in freight and tariff-related costs.

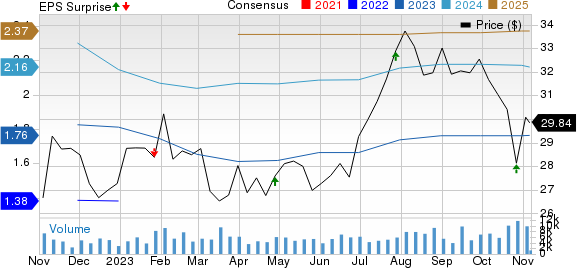

Gentex Corporation Price, Consensus and EPS Surprise

Gentex Corporation price-consensus-eps-surprise-chart | Gentex Corporation Quote

Segmental Performance

The Automotive segment’s net sales — contributing the most to Gentex’s revenues — totaled $564.5 million in the third quarter, 17% higher than $480.9 million reported in the year-ago quarter and beat our estimate of $546.6 million. In the reported quarter, auto-dimming mirror shipments in the North American market increased 6% to 3,980,000 units. Shipments rose 12% year over year in the international markets to 8,624,000 units. Total shipments increased 10% to 12,604,000 units.

Other net sales, which include dimmable aircraft windows and fire protection products, decreased from the year-ago quarter’s $12.7 million to $11.3 million and missed our estimate of $12.3 million. Fire protection sales decreased by $5.3 million from the year-ago quarter. Dimmable aircraft window sales increased by $4 million year over year.

Financial Tidbits

Total operating expenses rose 14.2% year over year to $69 million in third-quarter 2023. Engineering and R&D expenses increased to $40.2 million from $33.5 million. SG&A expenses rose to $28.8 million from $26.8 million recorded in the corresponding quarter of 2022.

Gentex paid a dividend of 12 cents per share in the quarter. During the quarter, it repurchased 0.8 million shares of its common stock at an average price of $32.41 per share. As of Sep 30, 2023, the company had nearly 18 million shares remaining for buyback per its previously announced share repurchase plan. Gentex had cash and cash equivalents of nearly $260.6 million as of Sep 30, 2023.

2023 Guidance

Gentex’s 2023 net sales are estimated in the range of $2.2-$2.3 billion. The gross margin is projected in the band of 32.5%-33%. Capital expenditure is anticipated within $200-$215 million. Operating expenses are estimated in the band of $260-$270 million.

Zacks Rank & Key Picks

Gentex currently carries a Zacks Rank #3 (Hold).

A few top-ranked players in the auto space include Toyota TM, Honda HMC and Stellantis STLA. While TM and HMC sport a Zacks Rank #1 (Strong Buy) each, STLA carries a Zacks Rank #2 (Buy) currently. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for TM’s fiscal 2024 sales and EPS implies year-over-year growth of 10.5% and 30.9%, respectively. The earnings estimate for fiscal 2024 and 2025 has been revised upward by 45 cents and 40 cents, respectively, in the past seven days.

The Zacks Consensus Estimate for HMC’s fiscal 2024 sales and EPS implies year-over-year growth of 7.7% and 31%, respectively. The earnings estimate for fiscal 2024 and 2025 has been revised upward by 9 cents and 24 cents, respectively, in the past 30 days.

The Zacks Consensus Estimate for STLA’s 2023 sales and EPS implies year-over-year growth of 8% and 10.2%, respectively. The earnings estimate for 2023 and 2024 has been revised upward by 27 cents and 13 cents, respectively, in the past seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

Gentex Corporation (GNTX) : Free Stock Analysis Report

Stellantis N.V. (STLA) : Free Stock Analysis Report