Genuine Parts Co Reports Solid Earnings Growth and Dividend Increase for 2023

Revenue Growth: Full-year sales increased by 4.5% to $23.1 billion.

Earnings Per Share (EPS): Diluted EPS for the year rose by 12.3% to $9.33.

Free Cash Flow: Generated $923 million in free cash flow for the year.

Dividend: Declared a 5% dividend increase, marking the 68th consecutive year of dividend hikes.

2024 Outlook: Revenue growth projected between 3% to 5%, with adjusted diluted EPS of $9.70 to $9.90.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

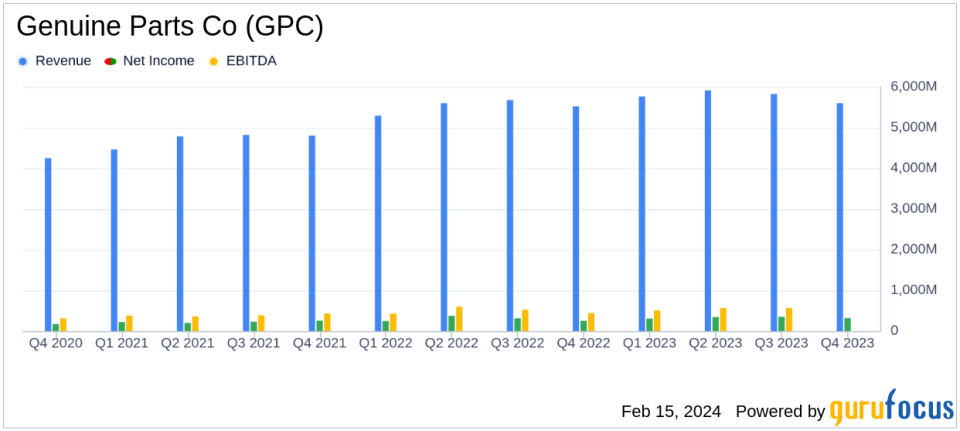

On February 15, 2024, Genuine Parts Co (NYSE:GPC), a global distributor of automotive and industrial replacement parts, released its 8-K filing, disclosing its financial results for the fourth quarter and full year of 2023. The company reported a modest sales increase of 1.1% in the fourth quarter, bringing full-year sales to $23.1 billion, a 4.5% increase from the previous year. This growth was driven by strategic acquisitions and favorable foreign currency impacts, despite a slight decrease in comparable sales.

Genuine Parts Co's automotive segment, which accounts for approximately 60% of sales, saw a 0.8% increase in global sales for the quarter, while the industrial segment experienced a 1.7% rise. The company's diverse business model and strategic initiatives helped offset softer results in the U.S. automotive business, with the industrial and international automotive businesses exceeding expectations.

The company's net income for the fourth quarter was $317 million, a significant increase of 25.8% compared to the prior year. Diluted earnings per share (EPS) also saw a substantial rise, up by 27.7% to $2.26. For the full year, diluted EPS increased by 12.3% to $9.33. These figures reflect Genuine Parts Co's ability to grow earnings at a double-digit rate for the third consecutive year, despite a challenging environment.

GPC's strong cash flow performance is notable, with $1.4 billion in cash from operations and $923 million in free cash flow for the year. The company's disciplined capital allocation strategy included returning $788 million to shareholders through cash dividends and share repurchases. The Board of Directors approved a 5% increase in the regular quarterly cash dividend, continuing a 68-year streak of dividend growth.

The company also announced a global restructuring initiative aimed at aligning assets and improving business efficiency. This includes a voluntary retirement offer in the U.S. and optimization of distribution centers and other facilities. GPC expects to incur costs of approximately $100 million to $200 million related to the restructuring in 2024, with anticipated savings of $20 million to $40 million for the year, and $45 million to $90 million on an annualized basis.

Looking ahead, Genuine Parts Co provided a 2024 outlook with expected revenue growth of 3% to 5% and adjusted diluted EPS of $9.70 to $9.90. The company's guidance takes into account recent business trends, strategic initiatives, and the global economic outlook, among other factors.

GPC's financial achievements and strategic positioning underscore its resilience and adaptability in a dynamic market. The company's commitment to delivering value to customers and shareholders alike remains a cornerstone of its operations, as evidenced by its consistent financial performance and proactive business strategies.

For value investors and potential GuruFocus.com members, Genuine Parts Co's latest earnings report reflects a company with a robust financial foundation and a clear strategy for growth and shareholder returns. The company's ability to navigate market challenges while delivering solid financial results makes it a noteworthy consideration for those seeking stable investments with a history of reliable dividend growth.

Explore the complete 8-K earnings release (here) from Genuine Parts Co for further details.

This article first appeared on GuruFocus.