Genuine Parts (GPC) to Report Q2 Earnings: What's in Store?

Genuine Parts Company GPC is slated to release second-quarter 2023 results on Jul 20, before market open.

The Zacks Consensus Estimate for earnings per share is pegged at $2.31, implying growth of 5% from the year-ago reported number. The consensus estimate has moved north by a penny in the past thirty days.

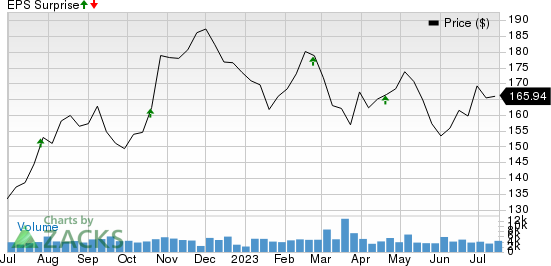

The Zacks Consensus Estimate for revenues is pegged at $5.95 billion, suggesting a year-over-year increase of 6.15%. Over the trailing four quarters, Genuine Parts surpassed earnings estimates on each occasion, the average surprise being 8.15%. This is depicted in the graph below:

Genuine Parts Company Price and EPS Surprise

Genuine Parts Company price-eps-surprise | Genuine Parts Company Quote

Q1 Highlights

In first-quarter 2023, GPC’s adjusted earnings per share of $2.14 surpassed the consensus mark of $2.02 and rose 15.1% year over year. Higher-than-expected sales and operating profits across both segments resulted in this outperformance. The company reported net sales of $5,765.1 million, outpacing the Zacks Consensus Estimate of $5,686 million. The top line rose 8.9% year over year.

Factors at Play

The increasing longevity of vehicles is serving as a key catalyst for auto replacement and repair companies. This is likely to have boosted demand for GPC’s products, thereby aiding its revenues.

The company is also riding high on strategic acquisitions. The Kaman Distribution Group buyout, completed in January 2022, has strengthened Genuine Parts’ market-leading position in the North American industrial platform. The buyout is expected to generate more than $50 million in annual run-rate synergies over three years, out of which it generated $30 million in 2022 and is likely to generate more in 2023 and 2024.

Segment-wise, the Zacks Consensus Estimate for second-quarter revenues from Automotive is pegged at $3,617 million, indicating a rise from $3,505.8 million recorded in the previous quarter. However, the Zacks Consensus Estimate for second-quarter revenues from Industrial is pegged at $2,241.5 million, indicating a decline from $2,259 million recorded in the previous quarter.

Earnings Whispers

Our proven model predicts an earnings beat for GPC this time around. Per our mode, a positive Earnings ESP, when combined with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), increases the odds of an earnings beat.

Earnings ESP: GPC has an Earnings ESP of +0.79%. This is because the Most Accurate Estimate is pegged 2 cents higher than the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: GPC currently carries a Zacks Rank of #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Other Stocks With the Favorable Combination

Here are a few players from the auto space that, according to our model, also have the right combination of elements to post an earnings beat this time around.

Autoliv ALV will release second-quarter 2023 results on Jul 21. The company has an Earnings ESP of +3.82% and carries a Zacks Rank #3.

The Zacks Consensus Estimate for Autoliv’s to-be-reported quarter’s earnings and revenues is pegged at $1.44 per share and $2.49 billion, respectively. ALV surpassed earnings estimates in three of the trailing four quarters and missed once, the average surprise being 26.93%.

General Motors Company GM will release second-quarter 2023 results on Jul 25. The company has an Earnings ESP of +9.37% and has a Zacks Rank #3.

The Zacks Consensus Estimate for General Motors’ to-be-reported quarter’s earnings and revenues is pegged at $1.66 per share and $42.46 billion, respectively. GM surpassed earnings estimates in three of the trailing four quarters and missed once, the average surprise being 15.50%.

Oshkosh Corporation OSK will release second-quarter 2023 results on Jul 27. The company has an Earnings ESP of +21.36% and sports a Zacks Rank #1.

The Zacks Consensus Estimate for Oshkosh’s to-be-reported quarter’s earnings and revenues is pegged at $1.62 per share and $2.24 billion, respectively. OSK surpassed earnings estimates once in the trailing four quarters and missed three times, the average negative surprise being 4.37%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Genuine Parts Company (GPC) : Free Stock Analysis Report

Autoliv, Inc. (ALV) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Oshkosh Corporation (OSK) : Free Stock Analysis Report