GEO Group (GEO) Beats Q2 EPS Estimates, Updates 2023 Outlook

The GEO Group GEO reported a second-quarter adjusted net income of 24 cents per share, surpassing the Zacks Consensus Estimate of 20 cents. Results reflect better-than-expected revenues for the quarter.

This provider of support services for secure facilities, processing centers and re-entry centers, as well as enhanced in-custody rehabilitation, post-release support and electronic monitoring programs, reported total revenues of $593.9 million, exceeding the Zacks Consensus Estimate of $588.3 million.

Reflecting positive sentiments, shares were up more than 1.7% during Wednesday’s regular trading session.

On a year-over-year basis, GEO’s adjusted net income of 24 cents per share significantly declined from 42 cents reported in the year-ago quarter, while revenues were up nearly 1%. Second-quarter 2023 adjusted EBITDA came in at $129.0 million, down from $132.3 million in the year-ago period.

The quarterly results reflect a year-over-year increase of $26.1 million in net interest expenses due to completed debt transactions and higher interest rates.

According to George C. Zoley, executive chairman of GEO, “Our diversified business units delivered overall strong operational and financial performance during the first half of 2023 despite some headwinds in our Electronic Monitoring and Supervision Services segment.”

Guidance

In response to evolving participant levels under the U.S. Department of Homeland Security's Intensive Supervision and Appearance Program (“ISAP”), GEO revised its guidance for the full-year 2023.

While the number of ISAP participants declined throughout July and in early August of 2023, which was longer than what the company previously estimated, GEO maintains its belief that participant counts will stabilize and begin to moderately increase.

GEO now expects full-year GAAP net income between $95 and $110 million based on estimated annual revenues of approximately $2.4 billion. It expects its full-year 2023 adjusted EBITDA to come in the range of $490-$520 million.

For the third quarter, GEO anticipates net income between $19 and $26 million on quarterly revenues in the band of $588-$603 million. Adjusted EBITDA is projected in the band of $115-$130 million. For the fourth quarter, net income is projected between $19 and $27 million on quarterly revenue projections in the range of $595-$610 million, together with adjusted EBITDA in the range of $115-$130 million.

GEO currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

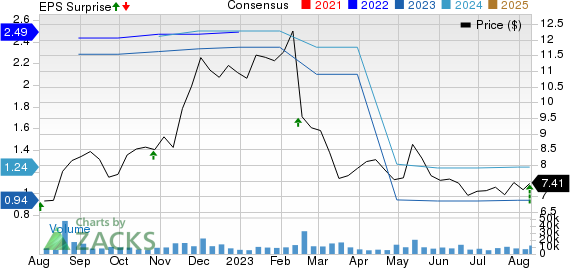

Geo Group Inc (The) Price, Consensus and EPS Surprise

Geo Group Inc (The) price-consensus-eps-surprise-chart | Geo Group Inc (The) Quote

Performance of Other REITs

Public Storage PSA reported a second-quarter 2023 core funds from operations (FFO) per share of $4.28, which increased 7.3% year over year. The core FFO per share, excluding the impact of PS Business Parks, was also $4.28, which rose 11.5% from the year-ago quarter’s tally. Both figures surpassed the Zacks Consensus Estimate of $4.20.

PSA’s results showed a better-than-anticipated top line. Public Storage also benefited from its expansion efforts through acquisitions, developments and extensions. It also revised its 2023 outlook.

Prologis PLD reported a second-quarter 2023 core FFO per share of $1.83, beating the Zacks Consensus Estimate of $1.68. The figure also compared favorably with the year-ago quarter’s figure of $1.11.

Results of Prologis, which announced the acquisition of industrial properties from opportunistic real estate funds affiliated with Blackstone worth $3.1 billion in June, reflect robust leasing activity and solid rent growth. PLD also raised the midpoint of its 2023 core FFO per share guidance.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Public Storage (PSA) : Free Stock Analysis Report

Prologis, Inc. (PLD) : Free Stock Analysis Report

Geo Group Inc (The) (GEO) : Free Stock Analysis Report