Geospace Technologies Corp (GEOS) Reports Strong First Quarter with Record Revenue

Revenue: $50.0 million, a 60% increase year-over-year.

Net Income: $12.7 million, compared to a net loss of $0.1 million in the previous year.

Earnings Per Share: $0.94 per diluted share, a significant increase from ($0.01) per diluted share.

Oil and Gas Markets Segment: Revenue of $39.9 million, up 98% from the previous year.

Balance Sheet Strength: $34.0 million in cash, cash equivalents, and short-term investments.

Capital Expenditure: Anticipated budget of $7.0 million for fiscal year 2024.

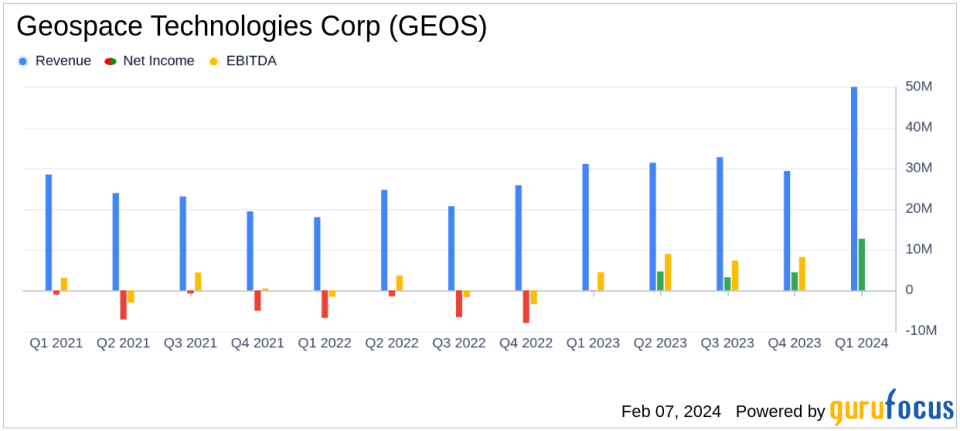

On February 7, 2024, Geospace Technologies Corp (NASDAQ:GEOS) released its 8-K filing, announcing a robust start to the fiscal year with the highest quarterly revenue in nearly ten years and a return to profitability. The company, known for its seismic instruments and equipment for the oil and gas industry, reported a significant increase in demand for its products, particularly the newly released Mariner Seismic Data Acquisition Product.

Company Overview

Geospace Technologies Corp operates through three segments: oil and gas markets, adjacent markets, and emerging markets. The oil and gas markets segment, which is the primary revenue driver, includes exploration and reservoir characterization products and services. The adjacent markets business offers imaging and industrial products, while the emerging markets segment explores new opportunities, including smart infrastructure solutions.

Financial Highlights and Challenges

The company's financial performance in the first quarter of fiscal year 2024 was marked by a 60% increase in revenue to $50.0 million, compared to $31.1 million in the same quarter of the previous year. Net income saw a dramatic turnaround, reaching $12.7 million, or $0.94 per diluted share, from a net loss of $0.1 million, or ($0.01) per diluted share, in the prior year. This performance underscores the importance of Geospace's strategic focus on high-demand products like the Mariner.

Despite this success, the company's management acknowledges the potential for "lumpy" revenue streams quarter to quarter, particularly in the oil and gas markets segment. The $30 million sale of a Mariner system, which significantly boosted first-quarter revenue, is not expected to recur in the foreseeable future, highlighting the challenges of predicting revenue consistency in this industry.

Segment Performance

The oil and gas markets segment's revenue nearly doubled to $39.9 million, driven by the Mariner sale. However, the adjacent markets segment experienced a 9% decrease in revenue, attributed to lower demand for smart water meter cable and connector products. The emerging markets segment showed modest revenue growth, with a backlog of approximately $1.8 million expected to be recognized during fiscal year 2024.

Balance Sheet and Liquidity

Geospace Technologies Corp ended the quarter with a strong balance sheet, including $34.0 million in cash, cash equivalents, and short-term investments. The company also reported a capital expenditure budget of $7.0 million for fiscal year 2024, with $5.0 million earmarked for additions to its rental equipment.

"Demand for our newest technology ocean bottom node, known as the Mariner, was paramount in delivering our first quarter performance," stated Walter R. (Rick) Wheeler, President and CEO of Geospace Technologies.

Analysis and Outlook

The company's performance in the first quarter of fiscal year 2024 suggests a positive outlook, with a strong emphasis on profitability and disciplined financial management. The significant increase in revenue and net income demonstrates Geospace's ability to capitalize on market demand for its innovative products. However, the management's cautious tone regarding future sales volatility indicates that while the company is on a solid path, it must continue to navigate the cyclical nature of the oil and gas industry.

For more detailed information and analysis, investors are encouraged to review the full earnings report and listen to the conference call scheduled for February 8, 2024.

Geospace Technologies' commitment to delivering value to shareholders is evident in its latest financial results, positioning the company as a noteworthy player in the oil and gas equipment industry. With a focus on technological innovation and strategic market positioning, GEOS is poised to continue its growth trajectory in the coming fiscal periods.

Explore the complete 8-K earnings release (here) from Geospace Technologies Corp for further details.

This article first appeared on GuruFocus.