German Dividend Stock Standouts To Watch In February 2024

In the past week, as well as over the last year, Germany's market has shown a steady, unwavering performance with no significant ups or downs. However, with earnings projected to rise by an annual rate of 13%, investors may find opportunities in German dividend stocks that offer both stability and potential for growth in this consistent market landscape.

Top 10 Dividend Stocks In Germany

Click here to see the full list of Top Dividend Stocks.

Name | Dividend Yield |

Edel SE KGaA (XTRA:EDL) | 5.88% |

Mensch und Maschine Software (XTRA:MUM) | 2.68% |

FORTEC Elektronik (XTRA:FEV) | 3.53% |

CEWE Stiftung KGaA (XTRA:CWC) | 2.41% |

Talanx (XTRA:TLX) | 3.00% |

Siemens (XTRA:SIE) | 2.77% |

Mercedes-Benz Group (XTRA:MBG) | 8.00% |

FRoSTA (DB:NLM) | 2.76% |

Hannover Rück (XTRA:HNR1) | 2.62% |

DATAGROUP (XTRA:D6H) | 2.68% |

Let's explore 3 standout options from the Top Dividend Stocks screener.

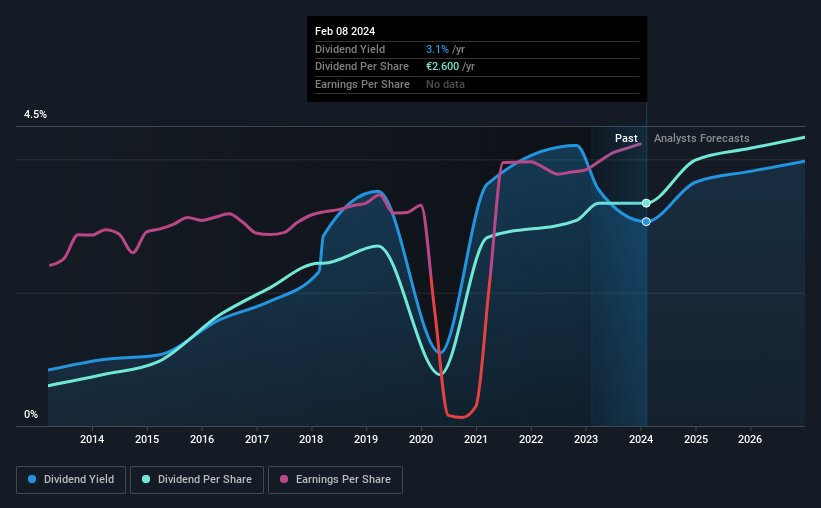

FORTEC Elektronik (XTRA:FEV)

FORTEC Elektronik operates within the niche of display technology, embedded systems, and power supplies, serving both German and international markets with a market capitalization of €78.34 million. Its revenue streams are primarily from data visualization (€72.51 million) and power supplies (€41.78 million). Analysis of FORTEC Elektronik in the context of dividend stocks reveals a company with a solid financial foundation; it has significantly reduced its debt over the past five years while maintaining an upward trajectory in earnings growth, outpacing its 5-year average last year. The firm's net profit margin has also seen improvement. Importantly for dividend investors, FORTEC Elektronik's dividends appear sustainable with reasonable payout ratios from both earnings and cash flow perspectives, although its yield is modest compared to Germany's top dividend payers. Dividend reliability is underscored by a decade-long history of stable payouts despite not being classified as high-growth in terms of expected annual profit or revenue forecasts. Dive into the specifics of FORTEC Elektronik here with our thorough analysis report.

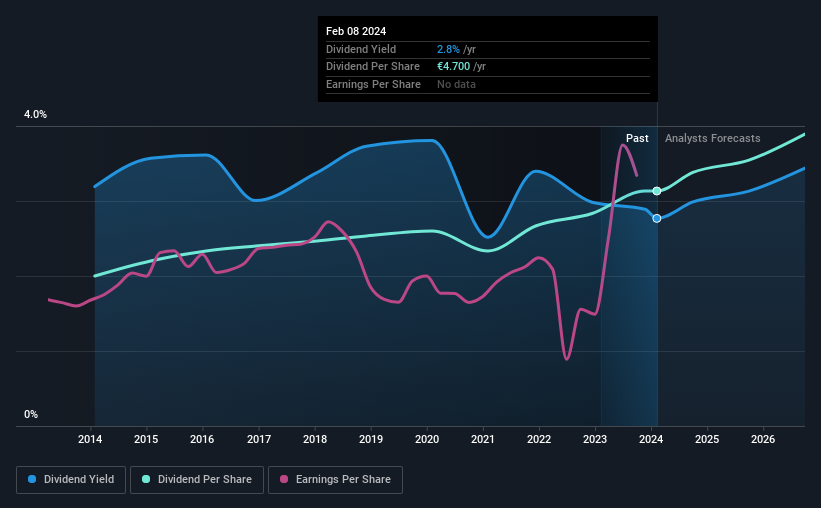

Heidelberg Materials (XTRA:HEI)

Heidelberg Materials, a global supplier of cement, aggregates, concrete, and asphalt with a market capitalization of €15.73 billion, anchors its operations in the production and distribution of building materials. Financial scrutiny reveals a company that has prudently managed debt levels, reducing its debt to equity ratio over five years and maintaining earnings growth above industry average during this period. Despite an earnings growth slowdown in the past year compared to its five-year rate, Heidelberg Materials' net profit margin has improved. For dividend seekers, HEI presents mixed signals; while dividends are well-covered by both earnings and cash flow with low payout ratios indicating sustainability, payments have been historically volatile over the last decade. Additionally, HEI's dividend yield trails behind Germany's top quartile payers—a factor for investors to weigh against its solid interest coverage and manageable debt profile. Navigate through the intricacies of Heidelberg Materials with our comprehensive report here.

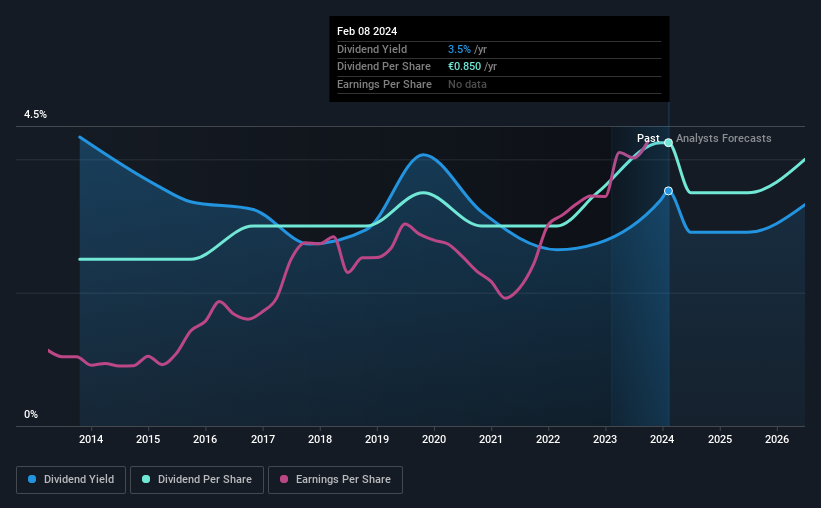

Siemens (XTRA:SIE)

Siemens, a multifaceted technology company with operations spanning automation and digitalization, generates significant revenue from its Industrial Businesses segments, including Mobility, Digital Industries, Smart Infrastructure, and Siemens Healthineers. Despite a market capitalization of €133 billion, it may not be the premier choice for dividend-focused portfolios in Germany due to its low dividend yield relative to the market's top payers. However, analysis highlights positives such as consistent profit growth over five years and an improved net profit margin from last year. Additionally, Siemens' debt is well-covered by operating cash flow and both earnings and cash flows comfortably cover dividends—indicating sustainability. While debt levels are considered high with a rising debt to equity ratio over time, reliable dividend payments over the past decade coupled with stable dividends per share offer reassurance to investors prioritizing steady income streams despite modest forecasted earnings growth. Click here and access our complete analysis report to understand the dynamics of Siemens.

Key Takeaways

The Simply Wall St screener has been an invaluable resource in pinpointing top dividend stocks in Germany for investors seeking stability and income. Get an in-depth perspective on all the Top Dividend Stocks by using our screener here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com