Getting In Cheap On Ikena Oncology, Inc. (NASDAQ:IKNA) Is Unlikely

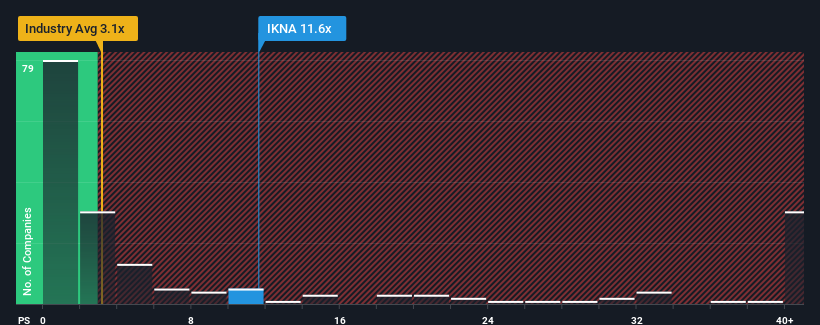

With a price-to-sales (or "P/S") ratio of 11.6x Ikena Oncology, Inc. (NASDAQ:IKNA) may be sending very bearish signals at the moment, given that almost half of all the Pharmaceuticals companies in the United States have P/S ratios under 3.1x and even P/S lower than 0.9x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Ikena Oncology

How Has Ikena Oncology Performed Recently?

Ikena Oncology could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying to much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ikena Oncology.

Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Ikena Oncology's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 50%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 14% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 14% each year as estimated by the five analysts watching the company. With the industry predicted to deliver 31% growth each year, that's a disappointing outcome.

In light of this, it's alarming that Ikena Oncology's P/S sits above the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Ikena Oncology currently trades on a much higher than expected P/S for a company whose revenues are forecast to decline. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. Unless these conditions improve markedly, it'll be a challenging time for shareholders.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Ikena Oncology (2 are potentially serious!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Ikena Oncology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here