GF Score Analysis: Central Valley Community Bancorp (CVCY)

Central Valley Community Bancorp (NASDAQ:CVCY) is a financial institution operating in the banking industry. As of July 24, 2023, the company's stock price stands at $16.03, with a market capitalization of $189.345 million. The stock has seen a gain of 4.12% today and a 9.00% increase over the past four weeks. This article will delve into the company's GF Score and its various components, providing a comprehensive analysis of its financial strength, profitability, growth, GF Value, and momentum.

Understanding the GF Score

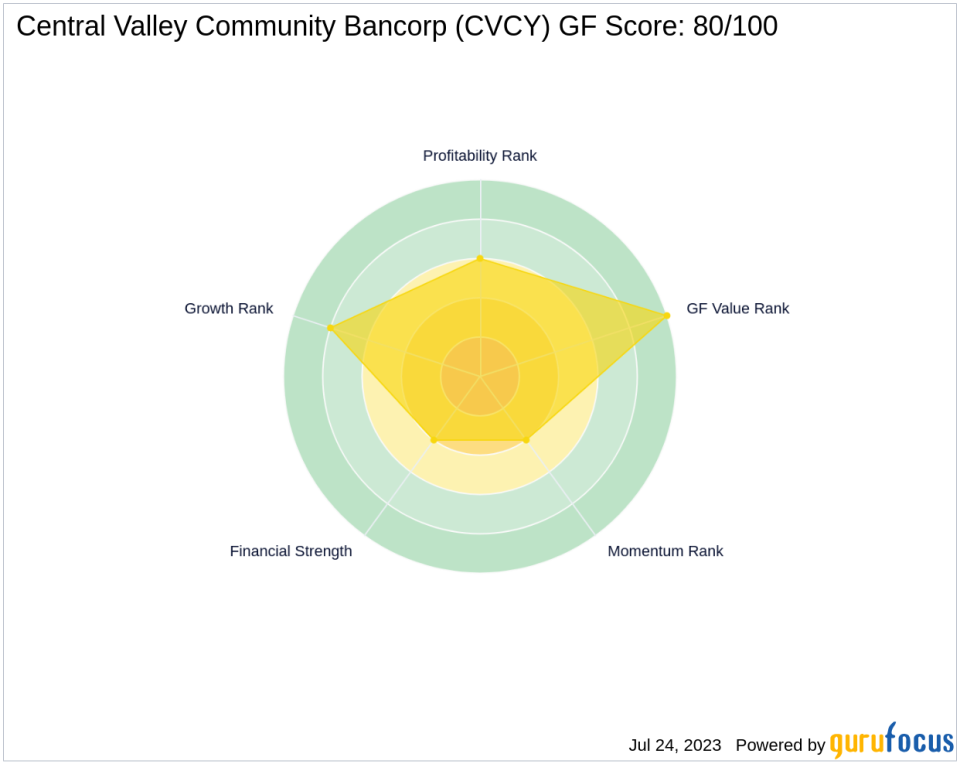

The GF Score is a stock performance ranking system developed by GuruFocus. It evaluates five key aspects of a company's valuation: Financial Strength, Profitability Rank, Growth Rank, GF Value Rank, and Momentum Rank. The GF Score ranges from 0 to 100, with 100 being the highest rank. A higher GF Score generally indicates higher returns, making it a valuable tool for investors. Central Valley Community Bancorp currently holds a GF Score of 80, suggesting it is likely to have average performance.

Financial Strength Analysis

The Financial Strength component of the GF Score measures a company's financial situation. It considers factors such as interest coverage, debt to revenue ratio, and the Altman Z score. Central Valley Community Bancorp has a Financial Strength Rank of 4/10, indicating a moderate level of financial stability.

Profitability Rank Analysis

The Profitability Rank assesses a company's profitability and its likelihood of maintaining it. It takes into account factors such as the Operating Margin, Piotroski F-Score, and the trend of the Operating Margin. Central Valley Community Bancorp has a Profitability Rank of 6/10, suggesting a relatively stable profitability status.

Growth Rank Analysis

The Growth Rank measures a company's revenue and profitability growth. Central Valley Community Bancorp has a Growth Rank of 8/10, indicating a strong growth trajectory in recent years.

GF Value Rank Analysis

The GF Value Rank is determined by the price-to-GF-Value ratio, a proprietary metric calculated based on historical multiples and an adjustment factor based on a company's past returns and growth. Central Valley Community Bancorp has a GF Value Rank of 10/10, suggesting it is currently undervalued.

Momentum Rank Analysis

The Momentum Rank is determined using the standardized momentum ratio and other momentum indicators. Central Valley Community Bancorp has a Momentum Rank of 4/10, indicating a moderate level of momentum in its stock price.

Comparative Analysis

When compared to its competitors in the banking industry, Central Valley Community Bancorp holds a competitive edge with its GF Score of 80. Blue Ridge Bankshares Inc (BRBS) has a GF Score of 47, Princeton Bancorp Inc (NASDAQ:BPRN) has a GF Score of 72, and ChoiceOne Financial Services Inc (NASDAQ:COFS) has a GF Score of 66.

Conclusion

In conclusion, Central Valley Community Bancorp presents a promising investment opportunity based on its GF Score and its components. The company's strong growth, undervalued status, and competitive GF Score make it a compelling choice for investors. However, its moderate financial strength and momentum suggest that investors should also consider other factors and conduct further research before making investment decisions.

This article first appeared on GuruFocus.