GF Score Analysis: A Deep Dive into Evertec Inc's Performance

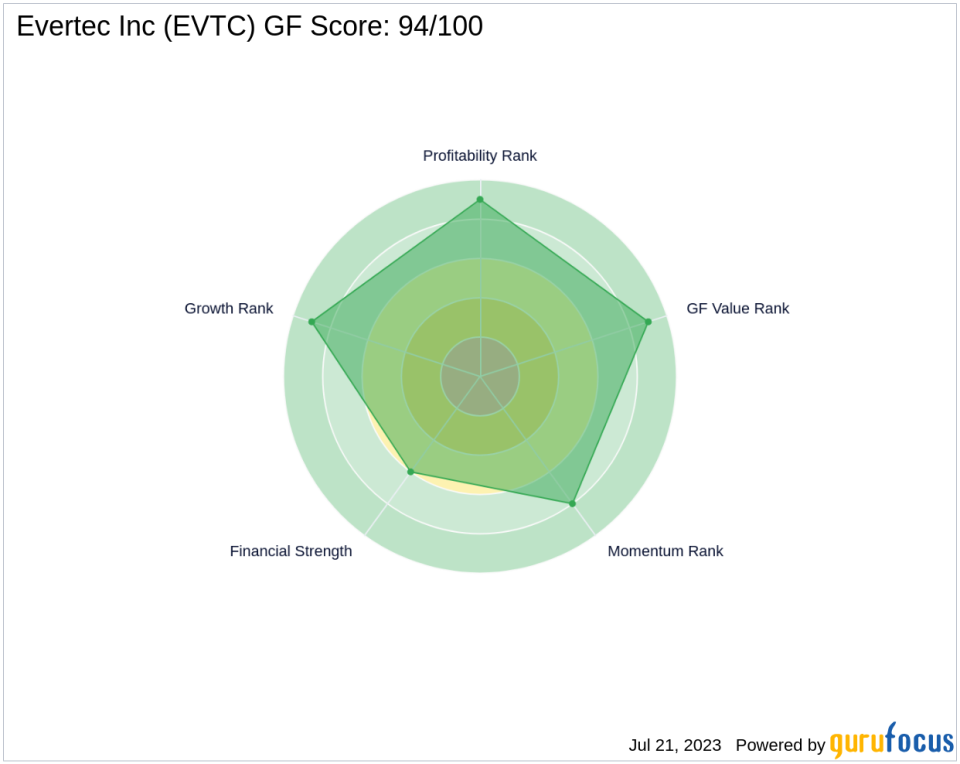

Evertec Inc (NYSE:EVTC) is a prominent player in the software industry. As of July 22, 2023, the company's stock price stands at $41.37, with a market capitalization of $2.69 billion. The stock has seen a gain of 4.47% today and a significant increase of 13.07% over the past four weeks. The company's impressive performance is reflected in its GF Score of 94 out of 100, indicating a high outperformance potential.

Evertec's Financial Strength

The Financial Strength rank measures a company's financial situation based on its debt burden, debt to revenue ratio, and Altman Z-Score. Evertec's Financial Strength rank is 6 out of 10, indicating a relatively strong financial position. The company's interest coverage is 6.09, and its debt to revenue ratio is 0.67, both of which are favorable. Furthermore, its Altman Z score of 4.66 suggests a low risk of bankruptcy.

Profitability Rank of Evertec

The Profitability Rank assesses a company's profitability and its likelihood of remaining profitable. Evertec's Profitability Rank is 9 out of 10, indicating high profitability. The company's Operating Margin is 24.12%, and its Piotroski F-Score is 5, both of which contribute to its high profitability rank. Additionally, the company has shown consistent profitability over the past 9 years.

Growth Rank Analysis

The Growth Rank measures a company's growth in terms of revenue and profitability. Evertec's Growth Rank is 9 out of 10, indicating strong growth. The company's 5-year revenue growth rate is 9.70%, and its 3-year revenue growth rate is 10.40%. Its 5-year EBITDA growth rate is an impressive 18.10%, further solidifying its strong growth rank.

Evertec's GF Value Rank

The GF Value Rank is determined by the price-to-GF-Value ratio, which is calculated based on historical multiples and an adjustment factor based on a company's past returns and growth. Evertec's GF Value Rank is 9 out of 10, indicating that the stock is reasonably valued.

Momentum Rank of Evertec

The Momentum Rank is determined using the standardized momentum ratio and other momentum indicators. Evertec's Momentum Rank is 8 out of 10, suggesting that the stock has strong momentum and is likely to continue its upward trend.

Comparison with Competitors

When compared to its main competitors in the software industry, Evertec stands out with its high GF Score. Shift4 Payments Inc (NYSE:FOUR) has a market cap of $4.01 billion and a GF Score of 60. NetScout Systems Inc (NASDAQ:NTCT) has a market cap of $2.12 billion and a GF Score of 77. Bottomline Technologies Inc (NASDAQ:EPAY) has a market cap of $2.59 billion and a GF Score of 60. Evertec's GF Score of 94 clearly outperforms these competitors.

Conclusion

In conclusion, Evertec's overall performance, as indicated by its GF Score of 94, is impressive. The company's strong financial strength, high profitability, robust growth, reasonable valuation, and strong momentum suggest a high potential for outperformance in the future. Investors should consider Evertec as a promising investment opportunity.

This article first appeared on GuruFocus.