GF Score Analysis: MiX Telematics Ltd (MIXT)

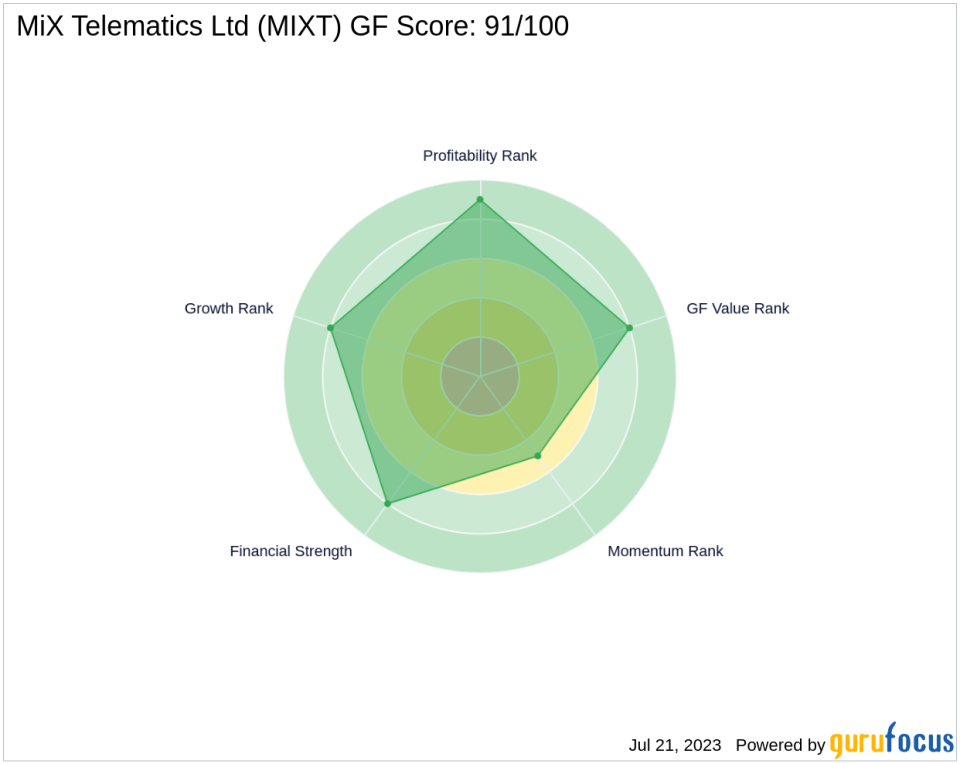

Based in the software industry, MiX Telematics Ltd (NYSE:MIXT) is a leading global provider of fleet and mobile asset management solutions. As of July 22, 2023, the company's stock price stands at $6.47, with a market capitalization of $148.561 million. Today, the stock has seen a gain of 3.52%, although it has experienced a slight loss of -1.83% over the past four weeks. In this article, we will delve into the company's GF Score of 91/100, which indicates the highest outperformance potential, and analyze its financial strength, profitability, growth, value, and momentum ranks.

Financial Strength Analysis

MiX Telematics Ltd boasts a Financial Strength Rank of 8/10, indicating a robust financial situation. The company's interest coverage ratio is 5.98, suggesting it can comfortably meet its interest obligations. Furthermore, its debt to revenue ratio is 0.14, indicating a low debt burden. The company's Altman Z-Score of 3.03 further underscores its financial stability.

Profitability Rank Analysis

The company's Profitability Rank stands at an impressive 9/10. Its Operating Margin is 8.01%, and it has a Piotroski F-Score of 6, indicating a healthy financial situation. Despite a 5-year average operating margin trend of -10.10%, the company has consistently been profitable over the past ten years. Its Predictability Rank of 3.5 further suggests a high likelihood of continued profitability.

Growth Rank Analysis

MiX Telematics Ltd has a Growth Rank of 8/10, reflecting strong revenue and profitability growth. The company's 5-year revenue growth rate is 8.20%, and its 3-year revenue growth rate is 3.60%. Its 5-year EBITDA growth rate is 2.90%, indicating steady growth in its business operations.

GF Value Rank Analysis

The company's GF Value Rank is 8/10, suggesting that it is reasonably valued. This rank is determined by the price-to-GF-Value ratio, a proprietary metric calculated based on historical multiples and an adjustment factor based on the company's past returns, growth, and future business performance estimates.

Momentum Rank Analysis

With a Momentum Rank of 5/10, MiX Telematics Ltd's stock performance is moderate. This rank is determined using the standardized momentum ratio and other momentum indicators, reflecting the average of the performances from 12 months ago to 1 month ago and 6 months ago to 1 month ago, divided by the beta of the stock over the past 12 months.

Competitor Analysis

When compared to its competitors in the software industry, MiX Telematics Ltd holds a strong position. Sebata Holdings Ltd (JSE:SEB) has a GF Score of 46, Salesforce Inc (NYSE:CRM) has a GF Score of 93, and SAP SE (XTER:SAP) has a GF Score of 85. This comparison suggests that MiX Telematics Ltd is performing well within its industry.

Conclusion

In conclusion, MiX Telematics Ltd's overall GF Score of 91/100 suggests a high potential for outperformance. The company's strong financial strength, profitability, growth, value, and momentum ranks indicate a robust financial situation and promising future performance. Investors should consider these factors when making investment decisions.

This article first appeared on GuruFocus.