GF Score Analysis: Oak Valley Bancorp (OVLY)

Oak Valley Bancorp (NASDAQ:OVLY) is a renowned player in the banking industry. As of July 24, 2023, the company's stock price stands at $27.41, with a market capitalization of $227.001 million. The stock has seen a gain of 4.34% today and an 8.63% increase over the past four weeks. This article aims to provide a comprehensive analysis of Oak Valley Bancorp's GF Score and other key financial ranks, offering valuable insights to investors.

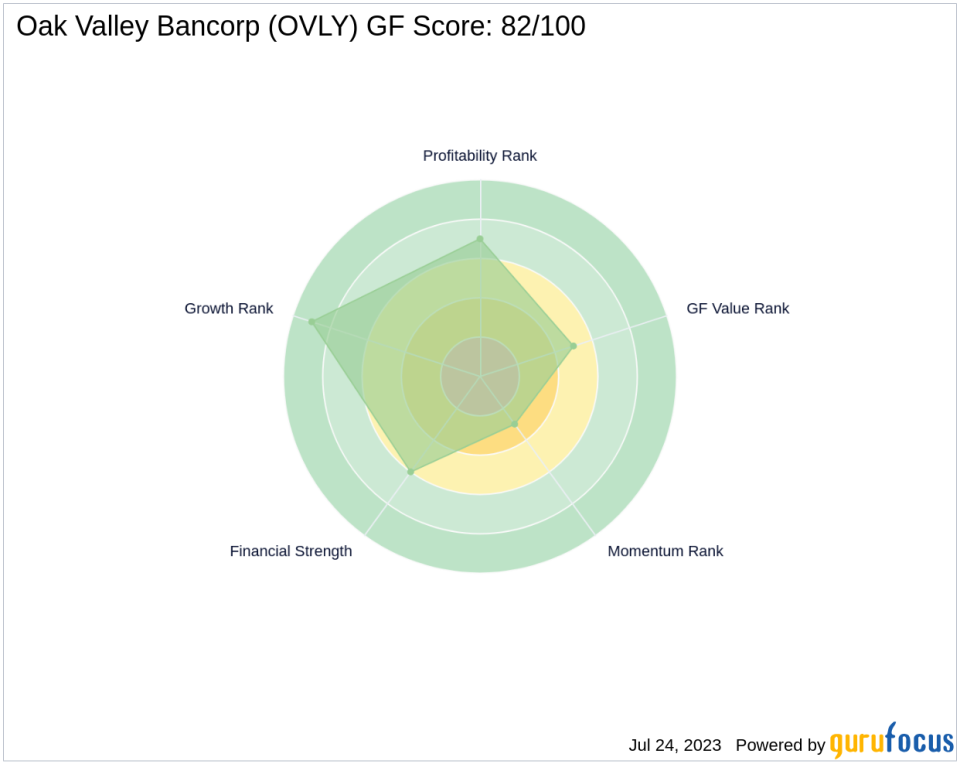

GF Score Analysis

The GF Score is a stock performance ranking system developed by GuruFocus. It uses five aspects of valuation and has been found to be closely correlated with the long-term performances of stocks. Oak Valley Bancorp's GF Score is 82 out of 100, indicating good outperformance potential. This suggests that the company's stock is likely to generate higher returns than those with lower GF Scores.

Financial Strength Rank Analysis

The Financial Strength Rank measures the robustness of a company's financial situation. It considers factors such as interest coverage, debt to revenue ratio, and Altman Z score. Oak Valley Bancorp's Financial Strength Rank is 6 out of 10, indicating a relatively strong financial situation.

Profitability Rank Analysis

The Profitability Rank assesses a company's profitability and its likelihood to remain profitable. It considers factors such as Operating Margin, Piotroski F-Score, and the consistency of profitability. Oak Valley Bancorp's Profitability Rank is 7 out of 10, suggesting a high level of profitability.

Growth Rank Analysis

The Growth Rank measures a company's growth in terms of its revenue and profitability. Oak Valley Bancorp's Growth Rank is 9 out of 10, indicating strong growth prospects for the company.

GF Value Rank Analysis

The GF Value Rank is determined by the price-to-GF-Value ratio, a proprietary metric calculated based on historical multiples and an adjustment factor based on a company's past returns and growth. Oak Valley Bancorp's GF Value Rank is 5 out of 10, suggesting a fair valuation of the company's stock.

Momentum Rank Analysis

The Momentum Rank is determined using the standardized momentum ratio and other momentum indicators. Oak Valley Bancorp's Momentum Rank is 3 out of 10, indicating a relatively low momentum for the company's stock.

Competitor Analysis

Oak Valley Bancorp's main competitors in the banking industry are Bank7 Corp (NASDAQ:BSVN), NASB Financial Inc (NASB), and Parke Bancorp Inc (NASDAQ:PKBK). With a GF Score of 82, Oak Valley Bancorp outperforms Bank7 Corp (GF Score: 78), NASB Financial Inc (GF Score: 67), and Parke Bancorp Inc (GF Score: 70), indicating a strong competitive position.

In conclusion, Oak Valley Bancorp's high GF Score, strong Financial Strength Rank, and high Profitability and Growth Ranks suggest promising prospects for the company. However, investors should also consider the company's relatively low Momentum Rank and fair GF Value Rank when making investment decisions.

This article first appeared on GuruFocus.