GF Score Analysis: Preferred Bank (PFBC)

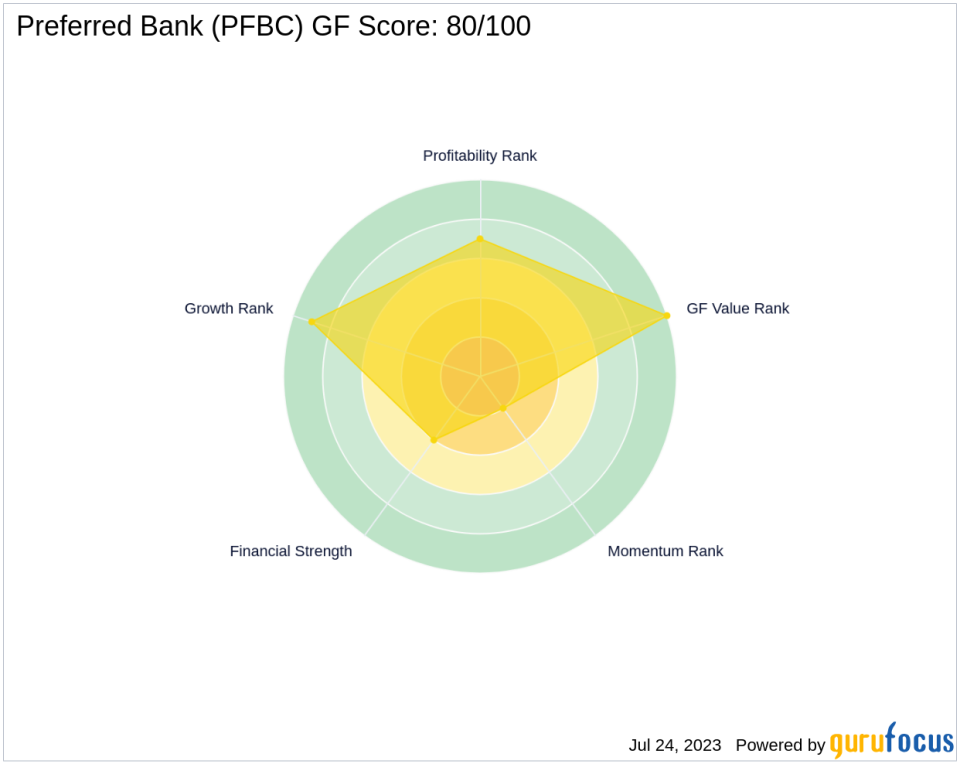

Preferred Bank (NASDAQ:PFBC), a prominent player in the banking industry, is currently trading at $65.25 with a market cap of $927.649 million. The stock has seen a gain of 3.08% today and a significant increase of 22.59% over the past four weeks. In this article, we will delve into the GF Score of Preferred Bank, which stands at 80 out of 100, indicating a likelihood of average performance. The GF Score is a comprehensive stock performance ranking system developed by GuruFocus, which is closely correlated with the long-term performance of stocks.

Financial Strength Analysis

The Financial Strength of Preferred Bank is ranked at 4 out of 10. This rank is determined by several factors, including the debt burden, measured by its interest coverage, and the debt to revenue ratio, which stands at 1.16 for PFBC. The lower this ratio, the better the company's financial strength. However, the Altman Z-Score, another crucial component of this rank, is not available for PFBC.

Profitability Rank Analysis

Preferred Bank's Profitability Rank is 7 out of 10, indicating a relatively high level of profitability. This rank is determined by factors such as the operating margin, which is currently not available for PFBC, and the Piotroski F-Score, which stands at 8. The company has also demonstrated consistent profitability over the past 10 years.

Growth Rank Analysis

The Growth Rank of Preferred Bank is 9 out of 10, indicating a strong growth trajectory. This rank is determined by the 5-year revenue growth rate, which stands at 11.10 for PFBC, and the 3-year revenue growth rate, which is 14.80. However, the 5-year EBITDA growth rate is not available.

GF Value Rank Analysis

Preferred Bank's GF Value Rank is 10 out of 10, indicating that the stock is significantly undervalued. This rank is determined by the price-to-GF-Value ratio, a proprietary metric calculated based on historical multiples and an adjustment factor based on a company's past returns and growth.

Momentum Rank Analysis

The Momentum Rank of Preferred Bank is 2 out of 10, indicating a relatively low momentum. This rank is determined by the standardized momentum ratio and other momentum indicators.

Competitor Analysis

When compared to its main competitors, Preferred Bank holds a competitive position. Brookline Bancorp Inc (NASDAQ:BRKL) has a GF Score of 74, Southside Bancshares Inc (NASDAQ:SBSI) has a GF Score of 64, and Farmers & Merchants Bancorp (FMCB) has a GF Score of 81. These scores indicate that Preferred Bank is performing well within its industry.

Conclusion

In conclusion, Preferred Bank's overall GF Score of 80 suggests a likelihood of average performance in the future. Despite some areas of concern, such as its low Momentum Rank, the bank's strong Growth Rank and GF Value Rank indicate potential for growth and value. Therefore, Preferred Bank may present a promising investment opportunity based on its GF Score and ranks.

This article first appeared on GuruFocus.