GF Score Analysis: WNS (Holdings) Ltd

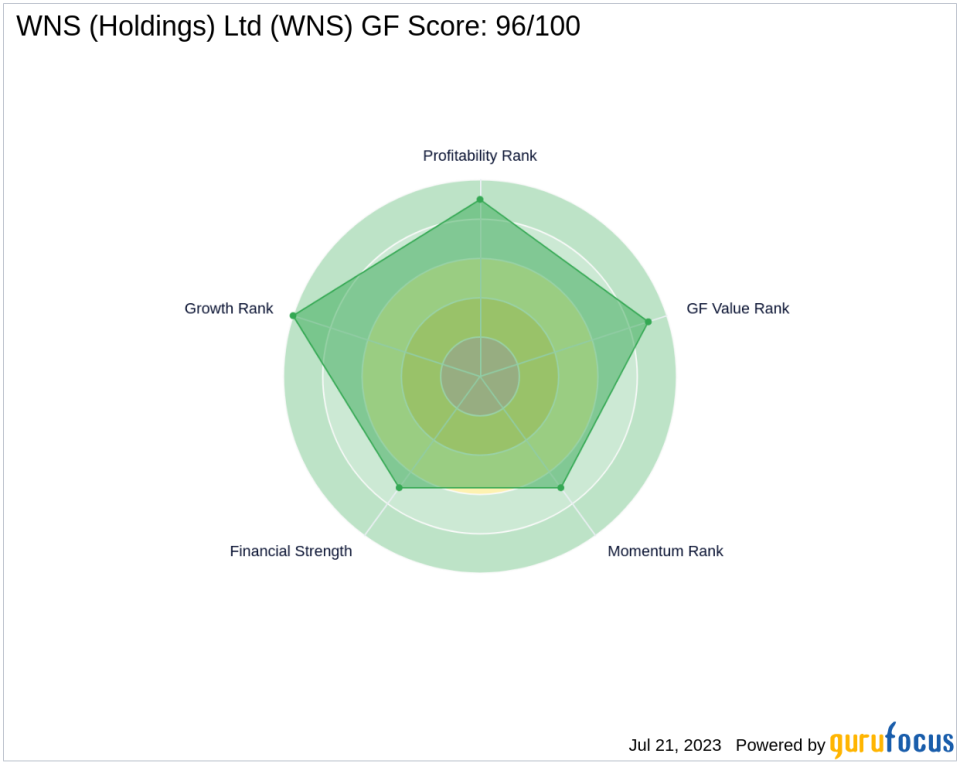

WNS (Holdings) Ltd (NYSE:WNS) is a leading player in the software industry. As of July 22, 2023, the company's stock price stands at $71.4, with a market capitalization of $3.45 billion. The stock has seen a gain of 4.34% today and a modest increase of 0.62% over the past four weeks. The company's GF Score is an impressive 96 out of 100, indicating a high outperformance potential.

Financial Strength Analysis

The Financial Strength of WNS (Holdings) Ltd is ranked at 7 out of 10. This rank is based on several factors including its interest coverage of 7.64, a debt to revenue ratio of 0.30, and an Altman Z score of 5.08. These figures suggest that the company has a strong financial situation and is capable of covering its debt obligations.

Profitability Rank Analysis

WNS (Holdings) Ltd has a Profitability Rank of 9 out of 10. This high rank is due to its operating margin of 13.58%, a Piotroski F-Score of 5, and a consistent profitability trend over the past 10 years. The company's predictability rank of 4.5 further indicates a strong likelihood of continued profitability.

Growth Rank Analysis

The company's Growth Rank is a perfect 10 out of 10, reflecting robust growth in terms of revenue and profitability. This is evidenced by a 5-year revenue growth rate of 10.80%, a 3-year revenue growth rate of 10.50%, and a 5-year EBITDA growth rate of 12.80%.

GF Value Rank Analysis

WNS (Holdings) Ltd has a GF Value Rank of 9 out of 10. This rank is determined by the price-to-GF-Value ratio, a proprietary metric calculated based on historical multiples and an adjustment factor based on the company's past returns and growth, as well as future estimates of the business' performance.

Momentum Rank Analysis

The company's Momentum Rank is 7 out of 10, indicating a positive momentum in its stock price performance. This rank is determined using the standardized momentum ratio and other momentum indicators.

Competitor Analysis

When compared to its main competitors in the software industry, WNS (Holdings) Ltd holds a strong position. NCR Corp (NYSE:NCR) has a GF Score of 75, ASGN Inc (NYSE:ASGN) has a GF Score of 92, and Kyndryl Holdings Inc (NYSE:KD) has a GF Score of 18. This comparative analysis further highlights the strong performance of WNS (Holdings) Ltd.

Conclusion

In conclusion, WNS (Holdings) Ltd demonstrates strong financial strength, profitability, growth, value, and momentum. With a GF Score of 96, the company has a high potential for outperformance, making it a compelling choice for investors. However, as with any investment, it's crucial to conduct thorough research and consider the company's overall performance and market conditions before making a decision.

This article first appeared on GuruFocus.