GF Score Analysis: WSFS Financial Corp

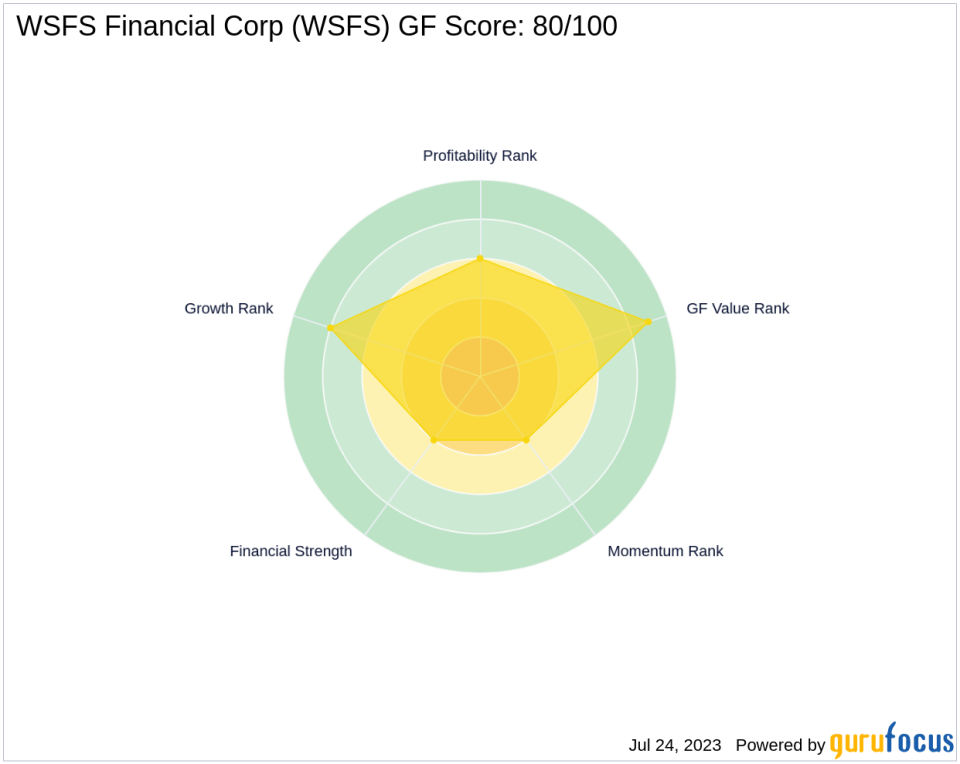

WSFS Financial Corp (NASDAQ:WSFS) is a prominent player in the banking industry, with a market capitalization of $2.66 billion. As of July 24, 2023, the company's stock price stands at $43.27, marking a gain of 3.94% on the day and a significant increase of 22.97% over the past four weeks. This article aims to provide a comprehensive analysis of WSFS Financial Corp's performance using the GF Score, a proprietary ranking system developed by GuruFocus. The GF Score, ranging from 0 to 100, evaluates a company's potential performance based on five key aspects: Financial Strength, Profitability Rank, Growth Rank, GF Value Rank, and Momentum Rank. WSFS Financial Corp currently holds a GF Score of 80/100, indicating a likelihood of average performance.

Financial Strength of WSFS Financial Corp

The Financial Strength rank evaluates a company's financial stability and resilience. WSFS Financial Corp's Financial Strength rank is 4/10, indicating moderate financial health. The company's debt to revenue ratio is 1.18, suggesting a manageable level of debt. However, the Altman Z-Score is not available, limiting the assessment of the company's bankruptcy risk.

Profitability Rank Analysis

WSFS Financial Corp's Profitability Rank is 6/10, reflecting a decent profitability level. The company's Operating Margin is not available, but it has a Piotroski F-Score of 5, indicating a stable financial situation. Moreover, the company has consistently been profitable over the past ten years, further attesting to its financial stability.

Growth Rank of WSFS Financial Corp

The company's Growth Rank is 8/10, indicating strong growth potential. The 5-year revenue growth rate is 4.70%, and the 3-year revenue growth rate is 4.30%, suggesting a steady increase in revenue over time. However, the 5-year EBITDA growth rate is not available, limiting the assessment of the company's profitability growth.

GF Value Rank Analysis

WSFS Financial Corp's GF Value Rank is 9/10, suggesting that the stock is undervalued. This high rank indicates that the company's stock offers good value for money, making it an attractive investment option.

Momentum Rank of WSFS Financial Corp

The company's Momentum Rank is 4/10, indicating moderate price performance. This suggests that the stock's price momentum is relatively stable, but there is room for improvement.

Comparison with Competitors

When compared to its main competitors, WSFS Financial Corp holds its ground. Axos Financial Inc (NYSE:AX) has a slightly higher GF Score of 84, while Simmons First National Corp (NASDAQ:SFNC) and First BanCorp (NYSE:FBP) have lower GF Scores of 64 and 72, respectively. This comparison suggests that WSFS Financial Corp is a competitive player in the banking industry, with a strong potential for future performance.

In conclusion, WSFS Financial Corp presents a promising investment opportunity, with a high GF Score and strong growth potential. However, investors should also consider the company's moderate financial strength and momentum rank when making investment decisions.

This article first appeared on GuruFocus.