The giant flaw in Trump’s tax plan

To cut taxes on businesses, middle-class families and the wealthy, President Donald Trump’s tax plan relies on the elimination of key deductions that cost the federal Treasury many billions of dollars each year. Getting rid of those giveaways, in theory, will provide new federal revenue that will help offset the revenue loss that will come from lowering rates.

In principle, tax experts support the idea of a cleaner tax code with lower rates and fewer ways for people to reduce what they owe. But tax breaks tend to be popular and notoriously hard to roll back once they’re in place. And the biggest tax break Trump wants to kill — the deduction for state and local taxes, known as the SALT deduction — might just be impossible to kill.

Republicans have targeted the SALT deduction for elimination for a couple key reasons. First, it costs Washington roughly $100 billion per year in foregone revenue — a large sum that would provide a lot of headroom for other tax cuts if captured. Second, the SALT deduction disproportionately benefits residents of blue states that tend to vote Democrat. So taking it away would affect Dems more than Republicans. That supposedly makes it one of the safest ways Republicans who control Congress and the White House can effectively raise taxes on some voters, while suffering minimal electoral harm.

President Donald Trump speaks to the National Association of Manufactures at the Mandarin Oriental hotel, Friday, Sept. 29, 2017, in Washington. (AP Photo/Evan Vucci)

This is lousy logic, however, and a closer look at the numbers reveals a giant flaw in the strategy of placing the burden of tax reform disproportionately on residents of Democratic states. The SALT deduction doesn’t benefit Democratic states more just because they’re blue. It’s simply more popular in states with higher incomes and higher taxes, because it makes more sense to claim the deduction in such states. Those states tend to vote Democrat, but tax filers claim the SALT deduction in every state — including swing states that will be key to winning future elections.

Who claims SALT

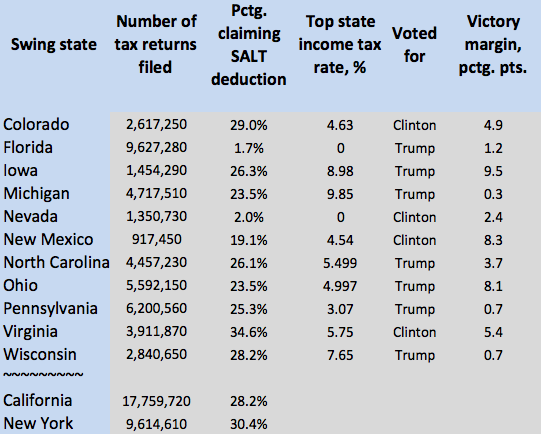

In eight of 11 swing states, more than 20% of filers claim the SALT deduction, according to Internal Revenue Service data analyzed by Yahoo Finance. In two of those states — Colorado and Virginia, the portion of filers claiming the SALT deduction is higher than it is in true-blue New York. Here’s 2015 data showing the portion of filers claiming the SALT deduction in the 11 states generally considered up for grabs in presidential elections, with New York and California as a basis for comparison.

The SALT deduction obviously makes less sense in states with no income tax, such as Florida and Nevada, since residents have a smaller state and local tax bill. But filers are still allowed to lump property taxes into the SALT deduction, along with sales taxes in lieu of income taxes. That’s why some people in states with no income tax still deduct SALT rather than claiming the standard deduction.

So, what makes this politically touchy? The likelihood that eliminating the SALT deduction and lowering rates would probably amount to a tax increase, on net, for some filers. If this happens in Democratic states, the Republican thinking goes, no big deal, since it would anger voters already opposed to the GOP agenda (although there are obviously some Republican districts in Democratic states.) But angering voters in swing states could flip votes and even elections, if voters inclined to vote Republican in the 2018 mid-terms or 2020 presidential election change their minds after absorbing a tax hike.

Someone will get a net tax increase

In the first serious third-party analysis of Trump’s tax proposal, the Tax Policy Center found that eliminating the SALT deduction and other tax breaks for individuals would generate a net tax increase for about 12% of voters the first year the plan went into effect. The changes would hit households earning between $150,000 and $300,000 per year the hardest. Those are generally working families, in some cases with two earners, rather than 1 percenters living off their investing portfolios. And a growing portion of taxpayers would be adversely affected during later years.

The TPC analysis is based on incomplete information, since GOP policymakers haven’t yet specified at what income levels their new, lower tax rates would go into effect. It’s possible they could set rates in a way that guarantees nobody will receive a net tax hike. But there’s countervailing pressure to raise new revenue somehow, because Congressional rules govern how much a new tax bill can add to the national debt. Cutting the tax obligation in one area basically necessitates raising it in others.

That’s where the swing state comes in. The GOP margin of victory in 2016 was less than 1 percentage point in Michigan, Pennsylvania, and Wisconsin. It was 1.2 points in all-important Florida. How many voters in those states can Republicans afford to raise taxes on? It sure as heck isn’t 12%. It might not even be 6%. Any tax cut, even one on a small portion of the wealthy, can turn off mainstream voters who fear they’re next.

In fact, the more you look at it, maybe it just makes sense to leave the SALT deduction alone — which is a distinctly possible outcome. Voters already distrust Washington, and they don’t really want anybody to move their cheese in the first place. Taking a big tax break away, and convincing voters it will benefit them, is likely to end up as a pitch no politician really wants to stake the next election on.

Confidential tip line: rickjnewman@yahoo.com. Encrypted communication available.

Rick Newman is the author of four books, including Rebounders: How Winners Pivot from Setback to Success. Follow him on Twitter: @rickjnewman