Gibraltar Industries Inc (ROCK) Reports Solid Q4 and Full Year 2023 Earnings

Net Sales: Q4 net sales up 5.1% year-over-year, full-year sales remain flat.

Net Income: Q4 GAAP net income surges, full-year net income increases significantly.

EPS Growth: Q4 adjusted EPS up 18.1%, full-year GAAP EPS up 40%, and adjusted EPS up 21%.

Operating Cash Flow: Strong cash generation of $218 million in 2023.

2024 Outlook: Revenue expected to grow 4-9%, with EPS projected to increase 12-20%.

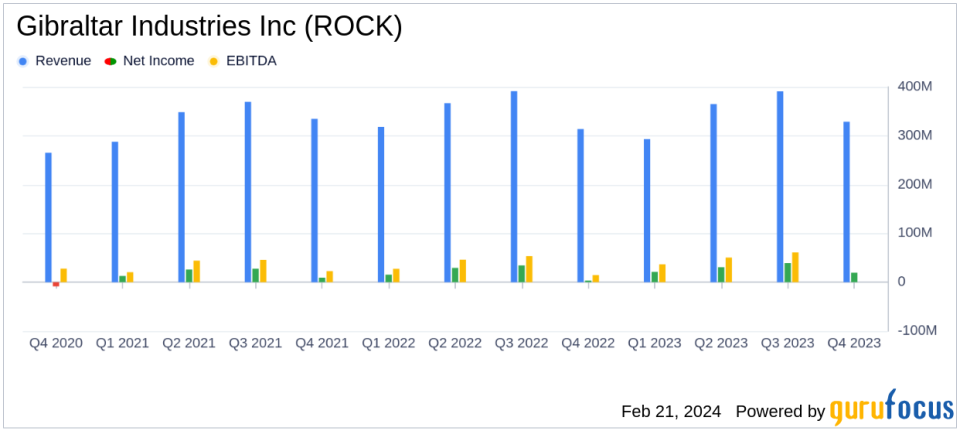

Gibraltar Industries Inc (NASDAQ:ROCK), a leading manufacturer and provider of products for the renewable energy, residential, agtech, and infrastructure markets, announced its financial results for the fourth quarter and full year ended December 31, 2023. The company released its 8-K filing on February 21, 2024, showcasing a strong finish to the year with a 5% revenue growth in Q4, a 50 basis point adjusted operating margin expansion, and an 18% increase in adjusted EPS. Despite flat annual net sales, Gibraltar Industries managed to increase both GAAP and adjusted EPS, along with free cash flow, aligning with the higher outlook from Q3 2023.

Performance Highlights and Segment Results

For Q4, Gibraltar Industries saw net sales rise to $328.8 million, a 5.1% increase from the previous year, with all segments contributing to the growth. The company's GAAP earnings for the quarter increased to $19.4 million, or $0.63 per share, while adjusted net income rose 16.1% to $26.0 million, or $0.85 per share. The Renewables segment experienced a modest sales increase of 1.9%, driven by backlog conversion despite scheduling challenges. However, adjusted operating margin in this segment decreased due to warranty costs.

The Residential segment reported a 4.3% increase in net sales, with adjusted operating margin expanding by 410 basis points, attributed to improved price/cost alignment, volume, and productivity initiatives. The Agtech segment's adjusted net sales grew by 12.8%, with operating results impacted by a charge related to a distressed cannabis customer. The Infrastructure segment saw a 12.1% increase in net sales and a significant 490 basis point increase in operating margin, driven by strong demand and market participation gains.

2024 Business Outlook and Investor Relations

Chairman and CEO Bill Bosway expressed optimism for 2024, anticipating strong performances across all segments, with top-line growth expected in Renewables and Agtech, and continued performance in Residential and Infrastructure. Gibraltar Industries projects full-year 2024 consolidated revenue to range between $1.43 billion and $1.48 billion, with GAAP EPS expected between $4.04 and $4.29, and adjusted EPS between $4.57 and $4.82.

Investors and interested parties can access the conference call details and related presentation materials on the company's website, or by dialing in to the provided numbers. A webcast replay will also be available for one year on the company's website.

Financial Tables and Reconciliation of Adjusted Measures

Gibraltar Industries has provided detailed financial statements, including consolidated statements of income, balance sheets, and cash flows. The company also offers reconciliation of adjusted financial measures, which exclude certain charges and adjustments to provide a clearer picture of the company's core operating results and facilitate comparison across reporting periods.

For value investors and potential GuruFocus.com members, Gibraltar Industries Inc (NASDAQ:ROCK)'s solid financial performance, coupled with its positive outlook for 2024, presents an intriguing opportunity. The company's ability to generate strong cash flow and improve margins, even with flat sales, demonstrates operational efficiency and resilience in a challenging market. As Gibraltar Industries continues to leverage its operating engine and drive revenue growth, it remains a company to watch in the construction industry.

For more detailed information and analysis, readers are encouraged to visit GuruFocus.com, where they can explore Gibraltar Industries Inc (NASDAQ:ROCK)'s financials, stock performance, and investment potential in greater depth.

Explore the complete 8-K earnings release (here) from Gibraltar Industries Inc for further details.

This article first appeared on GuruFocus.