Gibraltar (ROCK) Q3 Earnings & Net Sales Beat, Stock Up

Gibraltar Industries, Inc. ROCK reported solid results for third-quarter 2023. Quarterly earnings surpassed the Zacks Consensus Estimate and increased on a year-over-year basis.

Net sales were in line with the year-ago period but beat the consensus mark.

The company’s quarterly results reflect organic growth, improving solar module supply, increased volume, accretive 80/20 initiatives, better price and cost alignment, along with supply-chain optimization initiatives and improvements in project management systems. Gibraltar is optimistic about its upcoming growth prospects with its solid end-market fundamentals, backed by increased backlog levels. Backed by the aforementioned tailwinds, ROCK increased its 2023 adjusted earnings and free cash flow outlook.

Shares of the company rose 5.57% on Nov 2 after the earnings release.

Inside the Headlines

Gibraltar’s adjusted earnings of $1.38 per share surpassed the Zacks Consensus Estimate and increased year over year by 23.2% from $1.12. This was driven by solid execution in all its operating segments.

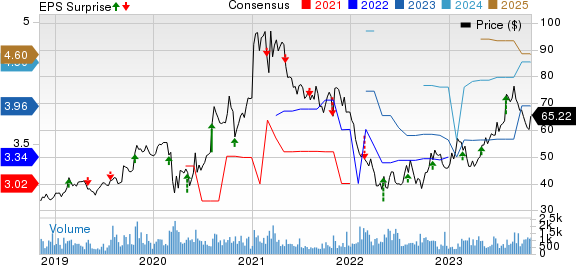

Gibraltar Industries, Inc. Price, Consensus and EPS Surprise

Gibraltar Industries, Inc. price-consensus-eps-surprise-chart | Gibraltar Industries, Inc. Quote

Net sales of $390.74 million outpaced the consensus mark of $383.31 million by 1.9% but decreased slightly from the prior-year level of $391.3 million. Benefits received from recent acquisitions and market participation gains across the business were offset by the timing of active projects shifting from the third quarter in project-based businesses and price management initiatives in the Residential business. On an adjusted basis, the top line inched up 0.3% year over year to $390 million.

Segmental Details

Renewable Energy: Net sales in the segment decreased 4.2% from the year-ago quarter to $106.4 million. The module supply, local permitting delays and further delay of the final Inflation Reduction Act tax credit guidelines impacted customer start dates of contracted and active projects in the quarter. The backlog was up 13.3% year over year.

The adjusted operating margin of 16.7% expanded a whopping 380 basis points (bps) year over year. The adjusted EBITDA margin increased 390 bps from the prior-year quarter to 18.9%.

Residential Products: Net sales in the segment were up 5.6% year over year to $227.7 million. This was backed by an 8.8% contribution from acquisitions. Organic revenues remained challenged (down 3.2%), owing to the negative impact of price adjustments undertaken in response to commodity cost prices as well as 80/20 initiatives targeting less attractive product lines. These were partially offset by participation gains with new and existing customers in core products and expansion into new regions.

The adjusted operating margin of 18.8% expanded 200 bps in the quarter. The adjusted EBITDA margin fell 220 bps from the prior-year quarter to 20.2%.

Agtech: Sales declined 28.3% year over year to $31.7 million and adjusted sales fell 26.3% to $30.9 million. The downside was due to delayed new project construction. Backlogs were up 9.4% sequentially.

The adjusted operating margin fell 510 bps year over year to 5.6%. The adjusted EBITDA margin contracted 540 bps year over year to 8.1%.

Infrastructure: Sales in the segment rose 22.5% year over year to $25 million, driven by solid end-market demand and participation gains. Backlog rose 6.2% year over year on strong demand.

The adjusted operating margin of 25.6% expanded 1,300 bps year over year. The adjusted EBITDA margin also expanded 1,230 bps from the prior-year quarter to 29.1%.

Operating Highlights

Adjusted operating profit grew 19% to $31 million. The adjusted operating margin expanded 230 bps year over year to 15%.

Adjusted EBITDA rose 18% to $67 million in the reported period. The adjusted EBITDA margin also increased 260 bps from the prior year to 17.3%.

Balance Sheet & Cash Flow

As of Sep 30, 2023, Gibraltar had liquidity of $482 million, including cash and cash equivalents worth $85.5 million compared with $17.6 million at the 2022-end.

There was no long-term debt at the end of third-quarter 2023 versus $88.8 million as of Dec 31, 2022.

In the first nine months of 2023, net cash provided by operating activities totaled $206.7 million compared with $38.6 million in the prior year.

Free cash flow was up 23% to $90 million in the reported quarter.

2023 Guidance

Gibraltar expects net sales of $1.37-$1.40 billion, whereas it reported $1.38 billion in 2022. Adjusted earnings are expected to be $4.05-$4.15 per share, suggesting a rise from the $3.40 reported in 2022. Earlier it expected net sales in $1.36-$1.41 billion range and adjusted earnings within $3.90-$4.10 per share.

Zacks Rank & Recent Construction Releases

Gibraltar currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

UFP Industries, Inc. UFPI reported tepid results for third-quarter 2023, wherein earnings and revenues missed the Zacks Consensus Estimate and declined on a year-over-year basis. Lower pricing and organic unit sales hurt the company’s quarterly results.

Despite a tough year-over-year comparison, UFPI's emphasis on innovation, efficiencies and value-added solutions helped in margin expansion. The company remains focused on expanding its business through new products and acquisitions on the back of strong cash flow generation and a solid balance sheet position.

Vulcan Materials Company VMC reported stellar results for the third quarter of 2023, surpassing the Zacks Consensus Estimate for both earnings and revenues.

VMC’s adjusted EPS of $2.29 increased 28.7% from the year-ago level of $1.78. Total revenues of $2,185.8 million increased 4.7% year over year.

United Rentals, Inc.’s URI third-quarter 2023 earnings and revenues surpassed the Zacks Consensus Estimate. On a year-over-year basis, earnings and revenues increased, courtesy of sustained growth across the business, profitability and returns, underpinned by broad-based activity.

URI’s adjusted EPS of $11.73 increased 26.5% from the prior-year figure of $9.27 per share. Total revenues of $3.77 billion grew 23.4% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UFP Industries, Inc. (UFPI) : Free Stock Analysis Report

Vulcan Materials Company (VMC) : Free Stock Analysis Report

Gibraltar Industries, Inc. (ROCK) : Free Stock Analysis Report

United Rentals, Inc. (URI) : Free Stock Analysis Report