Gilead Sciences Inc (GILD) Reports Mixed Results Amidst Growth in HIV and Oncology

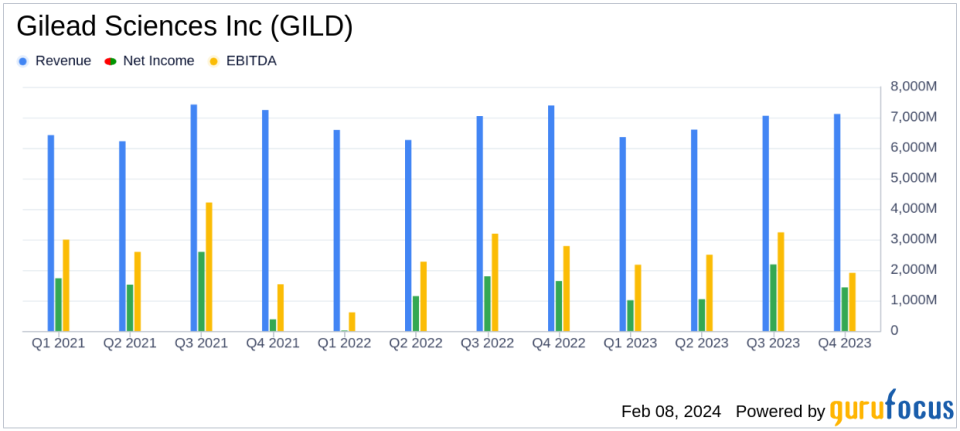

Total Revenue: Full year 2023 revenue decreased by 1% to $27.1 billion, with a 4% decline in Q4 2023 to $7.1 billion year-over-year.

Earnings Per Share (EPS): Diluted EPS for Q4 2023 was $1.14, down from $1.30 in Q4 2022, while full year EPS increased to $4.50 from $3.64.

Product Sales: Excluding Veklury, product sales rose by 7% for the full year 2023, driven by a 14% increase in Biktarvy sales and a 37% surge in Oncology sales.

Operating Cash Flow: Generated $2.2 billion in operating cash flow during Q4 2023.

Balance Sheet Strength: Cash, cash equivalents, and marketable debt securities stood at $8.4 billion as of December 31, 2023.

Dividends and Share Repurchases: Paid cash dividends of $943 million and utilized $150 million to repurchase common stock in Q4 2023.

2024 Guidance: Projects total product sales between $27.1 billion and $27.5 billion, with diluted EPS between $5.15 and $5.55.

On February 6, 2024, Gilead Sciences Inc (NASDAQ:GILD) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full year of 2023. The company, known for its innovative therapies for infectious diseases, including HIV and hepatitis B and C, as well as its foray into oncology through acquisitions, faced a slight revenue decrease over the year. However, the company's core business excluding Veklury, an antiviral drug, saw a year-over-year increase, signaling strength in its primary markets.

Financial Performance and Challenges

Gilead Sciences Inc (NASDAQ:GILD) reported a 4% decrease in total revenue for Q4 2023 to $7.1 billion, primarily due to lower Veklury and HIV sales, which was partially offset by higher Oncology sales. The company's diluted EPS also saw a decrease in Q4, attributed to higher total costs and expenses, and lower Veklury revenues, despite unrealized gains on equity investments and a lower tax expense. The full year 2023 revenue saw a marginal 1% decrease to $27.1 billion, with diluted EPS increasing to $4.50, up from $3.64 in 2022.

Despite these challenges, Gilead's financial achievements, particularly in its HIV and Oncology segments, are noteworthy. The company's HIV product sales, led by Biktarvy, increased by 6% to $18.2 billion for the full year, while Oncology sales jumped by 37%. These segments are critical for Gilead, as they represent the company's strategic focus areas and are key drivers of long-term growth within the competitive drug manufacturing industry.

Key Financial Metrics

Important metrics from Gilead's financial statements include a non-GAAP diluted EPS increase to $1.72 in Q4 2023 from $1.67 in the same period in 2022, reflecting the company's ability to manage costs effectively. The non-GAAP product gross margin was 86.1% in Q4 2023, slightly down from 86.8% in Q4 2022, indicating a strong but slightly decreased profitability on its products. Operating cash flow remained robust at $2.2 billion for the quarter, supporting the company's financial health and its ability to return value to shareholders through dividends and stock repurchases.

"This was another strong year of revenue growth for Gileads base business, driven by both HIV and Oncology," said Daniel ODay, Gileads Chairman and Chief Executive Officer. "The strength of the business provides a solid foundation as we enter a new catalyst-rich phase for the company."

The company's guidance for 2024 anticipates total product sales between $27.1 billion and $27.5 billion, with diluted EPS between $5.15 and $5.55. This outlook suggests confidence in Gilead's ability to maintain its financial performance in the coming year.

Analysis and Outlook

While Gilead Sciences Inc (NASDAQ:GILD) navigates the challenges of a post-pandemic market, particularly with the decline in Veklury sales, the company's growth in HIV and Oncology sales underscores its resilience and strategic focus. The company's robust pipeline and upcoming milestones in 2024, including updates on long-acting HIV prevention and treatment, Cell Therapy, and Trodelvy, position it for potential growth and innovation in its core markets.

Investors and stakeholders will be watching closely as Gilead continues to leverage its strong balance sheet and cash flow to invest in research and development, as well as strategic collaborations, to drive future growth. The company's commitment to advancing treatments for life-threatening diseases remains a cornerstone of its mission, and its financial strategies reflect this dedication.

For more detailed insights and analysis, investors are encouraged to review the full 8-K filing and stay tuned for further updates from Gilead Sciences Inc (NASDAQ:GILD).

Explore the complete 8-K earnings release (here) from Gilead Sciences Inc for further details.

This article first appeared on GuruFocus.