GitLab (GTLB) Posts Loss in Q3, Beats Revenue Estimates

GitLab GTLB reported non-GAAP earnings of 9 cents per share in third-quarter fiscal 2024, surpassing the Zacks Consensus Estimate of a loss of 1 cent. The company reported a loss of 10 cents in the year-ago quarter.

Total revenues of $149.7 million beat the consensus mark by 6.23% and rallied 32.5% year over year. The upside is attributed to the continued adoption of GitLab's DevSecOps Platform.

Top-Line Details

Subscriptions- self-managed and SaaS (87.5% of total revenues) revenues surged 33.1% year over year to $131 million. License- self-managed and other revenues (12.5% of total revenues) soared 28.4% year over year to $18.7 million.

Customers with more than $5K of Annual Recurring Revenues (ARR) increased to 8,175, up 26% year over year. Customers with more than $100K of ARR increased to 874, up 37% year over year.

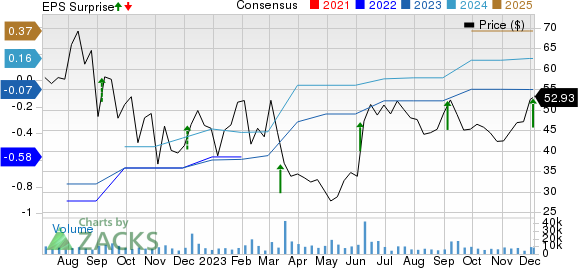

GitLab Inc. Price, Consensus and EPS Surprise

GitLab Inc. price-consensus-eps-surprise-chart | GitLab Inc. Quote

The Ultimate tier continued to be Gitlab’s fastest-growing tier, representing 50% of ARR in the third quarter compared with 39% of ARR in the year-ago quarter.

The dollar-based Net Retention Rate was 128% in the reported quarter.

Total Remaining Performance Obligation (RPO) surged 40% year over year to $548.1 million. Current RPO increased 34% to $371.8 million.

Operating Details

Third-quarter fiscal 2024 non-GAAP gross margin expanded 270 basis points from the year-ago quarter’s levels to 91%. The year-over-year upside was backed by higher growth in low-margin SaaS revenues.

On a non-GAAP basis, research & development expenses increased 16.6% year over year to $36.2 million. Sales and marketing expenses were up 3.4% to $70.5 million. General and administrative expenses rose 12.3% to $25.3 million in the reported quarter.

On a non-GAAP basis, operating profit was $4.7 million compared with the year-ago quarter’s loss of $21.6 million.

Balance Sheet

As of Oct 31, 2023, cash and cash equivalents and short-term investments were $989.6 million.

Guidance

For the fourth quarter of fiscal 2024, GitLab expects revenues between $157 million and $158 million, indicating growth rate of 28-29% year over year.

Non-GAAP operating loss is expected to be $5-$6 million for the fiscal fourth quarter. Non-GAAP earnings are expected between 8 cents per share and 9 cents.

For the fiscal 2024, GitLab expects revenues between $573 million and $574 million.

Non-GAAP operating loss is expected in the range of $10-$9 million for the fiscal year. Non-GAAP earnings are expected to be between 12 cents and 13 cents.

Zacks Rank & Stocks to Consider

Currently, GTLB carries a Zacks Rank #3 (Hold).

GitLab’s shares have gained 16.5% year to date compared with the Zacks Computer & Technology sector’s rally of 45.5%.

Pinterest PINS, NetEase NTES and Intel INTC are a few better-ranked stocks that investors can consider from the broader sector, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

PINS, NTES and INTC shares have returned 42.1%, 43.4% and 60.1%, respectively, on a year-to-date basis.

Long-term earnings growth rates for Pinterest, NetEase and Intel are pegged at 35.87%,15.98% and 14.18%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intel Corporation (INTC) : Free Stock Analysis Report

NetEase, Inc. (NTES) : Free Stock Analysis Report

Pinterest, Inc. (PINS) : Free Stock Analysis Report

GitLab Inc. (GTLB) : Free Stock Analysis Report