GitLab (GTLB) to Report Q3 Earnings: What's in the Cards?

GitLab GTLB is set to release its third-quarter fiscal 2024 results on Dec 4.

The company anticipates third-quarter fiscal 2024 revenues to be between $140 million and $141 million. Non-GAAP loss is anticipated between 1 cent and 2 cents per share.

The Zacks Consensus Estimate for revenues is pegged at $140.71 million, indicating an increase of 24.5% from the year-ago quarter’s reported figure.

The consensus mark for loss has been stable in the past 30 days at 1 cent per share. GitLab had incurred a loss of 10 cents per share in the year-ago quarter.

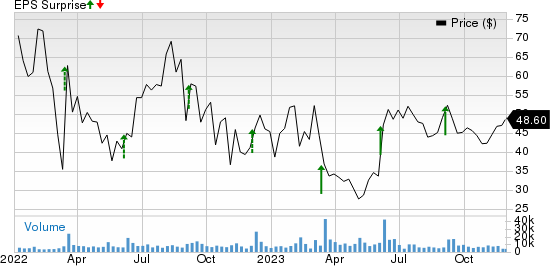

Notably, the company beat the Zacks Consensus Estimate in the last four quarters, delivering an earnings surprise of 76.99%, on average.

GitLab Inc. Price and EPS Surprise

GitLab Inc. price-eps-surprise | GitLab Inc. Quote

Let’s see how things have shaped up prior to the announcement.

Factors Likely to Influence Q3 Results

GitLab’s third-quarter results are expected to benefit from a strong subscription-based business model and robust adoption of its AI-powered DevSecOps platform.

Strong growth in subscription revenues has been driving GitLab’s top-line prospects. In second-quarter fiscal 2024, subscription, self-managed and SaaS revenues increased 37.3% year over year and accounted for 87.5% of revenues. The trend is expected to have continued in the to-be-reported quarter.

Customers with more than $5,000 of Annual Recurring Revenues (ARR) increased 33% year over year to reach 7,815 in the last reported quarter. Customers with ARR of more than $100,000 increased 37% year over year to reach 810. The number of customers is expected to have increased in the soon-to-be-reported quarter.

The company’s plan to enhance user limits on its free-sized tier, resulting in the upgrade of its free users to premium, is expected to have driven its top line in the quarter.

Key Q3 Developments

Gitlab announced updates to GitLab Duo Chat, which is intended to increase team communication, lower security and compliance risks associated with artificial intelligence adoption, and help users with real-time guidance, insights, and suggestions to analyze code. It is also intended to assist with planning, fixing security issues and addressing merge requests.

What Our Model Says

Per the Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

GitLab has an Earnings ESP of 0.00% and currently carries a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Here are a few companies you may want to consider, as our model shows that these have the right combination of elements to post earnings beat in their upcoming releases:

Science Applications International SAIC has an Earnings ESP of +3.01% and currently has a Zacks Rank of 2. You can find the complete list of today’s Zacks #1 Rank stocks here.

Science Applications International is set to announce fourth-quarter and fiscal 2023 results on Dec 4. Science Applications International’s shares are up 4.6% year to date.

Veeva Systems VEEV has an Earnings ESP of +1.11% and carries a Zacks Rank of 3, at present.

Veeva Systems is set to announce fourth-quarter and fiscal 2023 results on Dec 6. Veeva Systems’ shares are up 7.4% year to date.

Micron Technology MU has an Earnings ESP of +30.54% and carries a Zacks Rank of 3, at present.

Micron Technology is set to announce fourth-quarter and fiscal 2023 results on Dec 20. MU’s shares are up 53.3% year to date.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

Science Applications International Corporation (SAIC) : Free Stock Analysis Report

Veeva Systems Inc. (VEEV) : Free Stock Analysis Report

GitLab Inc. (GTLB) : Free Stock Analysis Report