GitLab Inc CFO Brian Robins Sells 13,000 Shares

Brian Robins, the CFO of GitLab Inc (NASDAQ:GTLB), executed a sale of 13,000 shares in the company on February 13, 2024, according to a recent SEC Filing.

GitLab Inc is a company that operates in the technology sector, providing a complete DevOps platform delivered as a single application. This platform fundamentally changes the way Development, Security, and Ops teams collaborate and build software. GitLab simplifies the process by helping teams to be more productive and efficient with a seamless, collaborative experience.

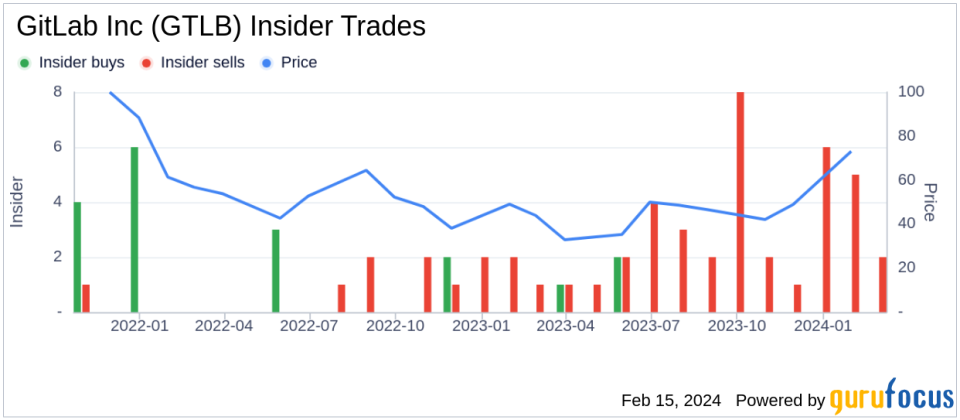

Over the past year, the insider has sold a total of 221,000 shares and has not made any purchases of the company's stock. The recent transaction is part of a series of sales by the insider, indicating a consistent pattern of share disposals over the period.

The insider transaction history for GitLab Inc shows a trend of more insider sales than purchases over the past year. There have been 3 insider buys and 37 insider sells during this timeframe.

On the date of the insider's recent sale, shares of GitLab Inc were trading at $72.56, which places the company's market cap at $11.54 billion.

Investors and stakeholders often monitor insider transactions as they can provide insights into the company's performance and insider perspectives on the stock's value. However, insider transactions are not necessarily indicative of future stock performance and can be influenced by various factors, including personal financial requirements or portfolio diversification strategies.

For more detailed information on insider transactions and stock performance, investors are encouraged to review the full SEC filings and consider the broader market context.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.