GitLab (NASDAQ:GTLB) Beats Q4 Sales Targets But Stock Drops 13.6%

Software development tools maker GitLab (NASDAQ:GTLB) reported results ahead of analysts' expectations in Q4 FY2024, with revenue up 33.3% year on year to $163.8 million. The company also expects next quarter's revenue to be around $165.5 million, coming in 2.1% above analysts' estimates. It made a non-GAAP profit of $0.15 per share, improving from its loss of $0.05 per share in the same quarter last year.

Is now the time to buy GitLab? Find out by accessing our full research report, it's free.

GitLab (GTLB) Q4 FY2024 Highlights:

Revenue: $163.8 million vs analyst estimates of $158.3 million (3.5% beat)

EPS (non-GAAP): $0.15 vs analyst estimates of $0.08 ($0.07 beat)

Revenue Guidance for Q1 2025 is $165.5 million at the midpoint, above analyst estimates of $162 million

Management's revenue guidance for the upcoming financial year 2025 is $728 million at the midpoint, missing analyst estimates by 1.3% and implying 25.5% growth (vs 37.3% in FY2024)

Free Cash Flow of $24.52 million is up from -$6.70 million in the previous quarter

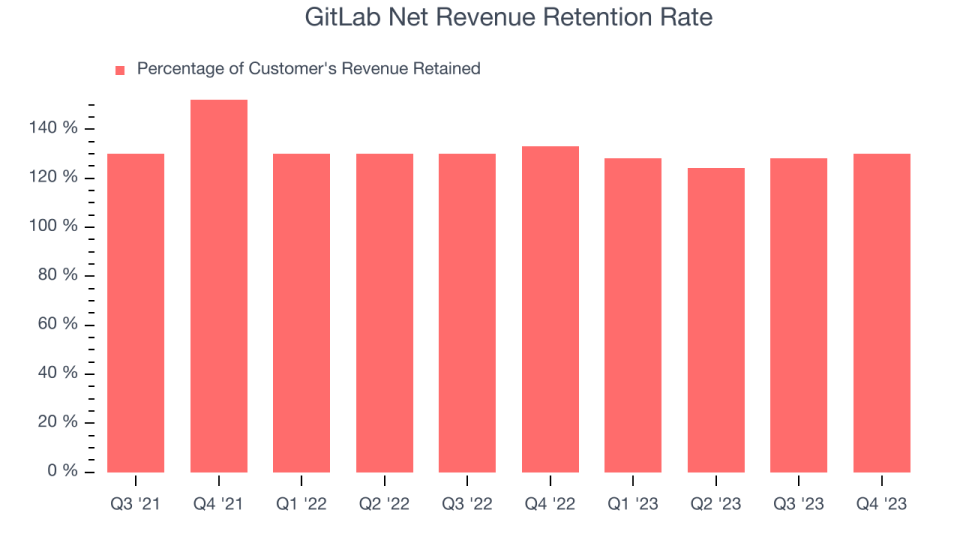

Net Revenue Retention Rate: 130%, in line with the previous quarter

Gross Margin (GAAP): 90.2%, up from 88.4% in the same quarter last year

Market Capitalization: $11.41 billion

“We delivered a strong fourth quarter and continue to see large enterprise customers standardize on GitLab to realize business value,” said Sid Sijbrandij, GitLab CEO and Co-Founder.

Founded as an open-source project in 2011, GitLab (NASDAQ:GTLB) is a leading software development tools platform.

Developer Operations

As Marc Andreessen says, "software is eating the world" which means the volume of software produced is exploding. But building software is complex and difficult work which drives demand for software tools that help increase the speed, quality, and security of software deployment.

Sales Growth

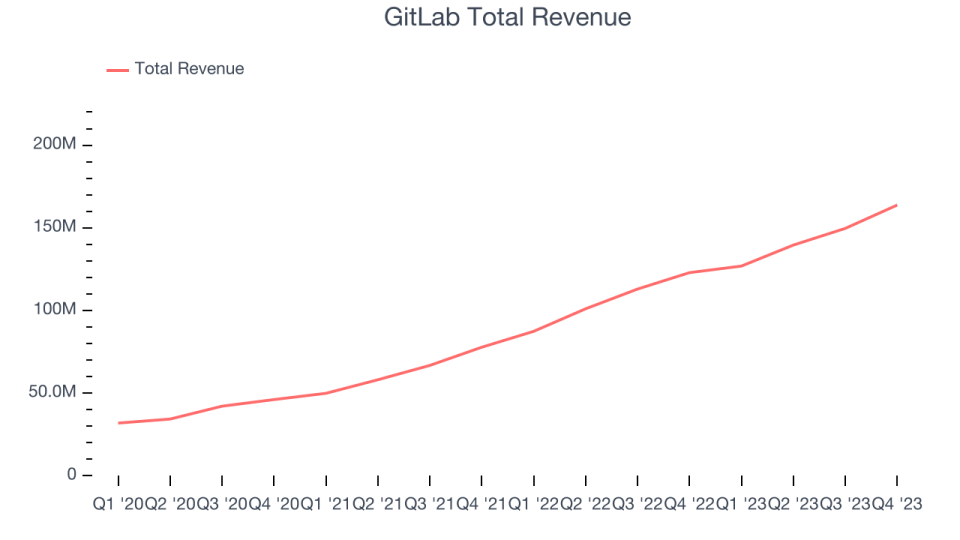

As you can see below, GitLab's revenue growth has been exceptional over the last two years, growing from $77.8 million in Q4 FY2022 to $163.8 million this quarter.

Unsurprisingly, this was another great quarter for GitLab with revenue up 33.3% year on year. On top of that, its revenue increased $14.11 million quarter on quarter, a very strong improvement from the $10.09 million increase in Q3 2024. This is a sign of acceleration of growth and great to see.

Next quarter's guidance suggests that GitLab is expecting revenue to grow 30.4% year on year to $165.5 million, slowing down from the 45.2% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $728 million at the midpoint, growing 25.5% year on year compared to the 36.7% increase in FY2024.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Product Success

One of the best parts about the software-as-a-service business model (and a reason why SaaS companies trade at such high valuation multiples) is that customers typically spend more on a company's products and services over time.

GitLab's net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 130% in Q4. This means that even if GitLab didn't win any new customers over the last 12 months, it would've grown its revenue by 30%.

Significantly up from the last quarter, GitLab has an excellent net retention rate. This data point proves that the company sells useful products, and we can see that its customers are satisfied and increasing usage over time.

Key Takeaways from GitLab's Q4 Results

It was good to see GitLab beat Wall Street's revenue estimates, driven by a better-than-expected net revenue retention rate (130% vs estimates of 127%). Furthermore, its number of customers with more than $100k in ARR significantly outperformed (955 vs estimates of 859). On the other hand, its full-year revenue guidance was below expectations and its full-year EPS guidance significantly missed, coming in 43% below analysts' forecasts.

During the quarter, GitLab appointed Sabrina Farmer as its Chief Technology Officer. Farmer joined the company from Google, where she was VP of Engineering.

Overall, the results could have been better. Software names have been showing weaker 2024 guidance across the board this quarter, and GitLab was not spared. The company is down 14.1% on the results and currently trades at $64 per share.

So should you invest in GitLab right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.