GitLab (NASDAQ:GTLB) Delivers Impressive Q3, Stock Jumps 16.4%

Software development tools maker GitLab (NASDAQ:GTLB) reported Q3 FY2024 results exceeding Wall Street analysts' expectations , with revenue up 32.5% year on year to $149.7 million. On top of that, next quarter's revenue guidance ($157.5 million at the midpoint) was surprisingly good and 5.4% above what analysts were expecting. It made a GAAP loss of $1.84 per share, down from its loss of $0.33 per share in the same quarter last year.

Is now the time to buy GitLab? Find out by accessing our full research report, it's free.

GitLab (GTLB) Q3 FY2024 Highlights:

Revenue: $149.7 million vs analyst estimates of $141 million (6.1% beat)

EPS (non-GAAP): $0.09 vs analyst estimates of -$0.01 ($0.10 beat)

Revenue Guidance for Q4 2024 is $157.5 million at the midpoint, above analyst estimates of $149.4 million

Free Cash Flow was -$6.70 million, down from $26.83 million in the previous quarter

Net Revenue Retention Rate: 128%, up from 124% in the previous quarter

Gross Margin (GAAP): 89.9%, up from 87.1% in the same quarter last year

“GitLab is the only DevSecOps company that integrates security, compliance, and AI into one platform. With enterprises facing complexity from all directions, they need a partner to help them realize business value. GitLab helps improve developer productivity and reduces software spend, which is why our customers report seeing 7x faster cycle times with GitLab,” said Sid Sijbrandij, GitLab CEO and co-founder.

Founded as an open-source project in 2011, GitLab (NASDAQ:GTLB) is a leading software development tools platform.

Developer Operations

As Marc Andreessen says, "software is eating the world" which means the volume of software produced is exploding. But building software is complex and difficult work which drives demand for software tools that help increase the speed, quality, and security of software deployment.

Sales Growth

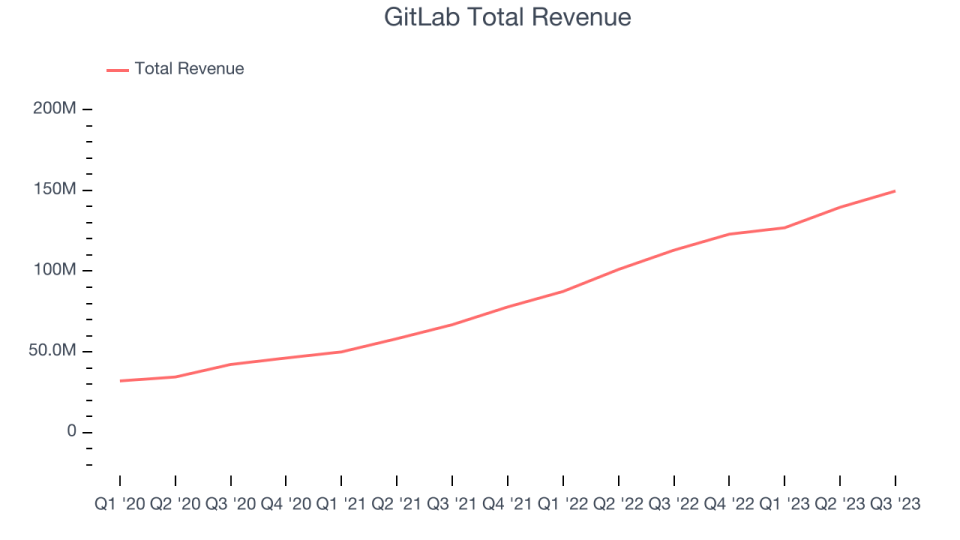

As you can see below, GitLab's revenue growth has been exceptional over the last two years, growing from $66.8 million in Q3 FY2022 to $149.7 million this quarter.

Unsurprisingly, this was another great quarter for GitLab with revenue up 32.5% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $10.09 million in Q3 compared to $12.7 million in Q2 2024. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter, GitLab is guiding for a 22% year-on-year revenue decline to $157.5 million, a further deceleration from the 58% year-on-year decrease it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 23.1% over the next 12 months before the earnings results announcement.

The pandemic fundamentally changed several consumer habits. There is a founder-led company that is massively benefiting from this shift. The business has grown astonishingly fast, with 40%+ free cash flow margins. Its fundamentals are undoubtedly best-in-class. Still, the total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Product Success

One of the best parts about the software-as-a-service business model (and a reason why SaaS companies trade at such high valuation multiples) is that customers typically spend more on a company's products and services over time.

GitLab's net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 128% in Q3. This means that even if GitLab didn't win any new customers over the last 12 months, it would've grown its revenue by 28%.

Significantly up from the last quarter, GitLab has an excellent net retention rate. This data point proves that the company sells useful products, and we can see that its customers are satisfied and increasing usage over time.

Key Takeaways from GitLab's Q3 Results

With a market capitalization of $8.12 billion, GitLab is among smaller companies, but its more than $285.3 million in cash on hand and near break-even free cash flow margins puts it in a stable financial position.

We were impressed by GitLab's revenue guidance and rosy outlook for the next quarter, which blew past analysts' expectations. We were also excited this quarter's revenue and free cash flow outperformed Wall Street's estimates, driven by extremely convincing beats in dollar-based net retention (128% vs estimates of 119%) and new large customer additions (874 total customers paying over $100k compared to estimates of 752). It's rare to see beats of this magnitude for those KPIs. Zooming out, we think this was a fantastic quarter that should have shareholders cheering. The stock is up 16.4% after reporting and currently trades at $61.57 per share.

GitLab may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.