Gladstone Capital Corp Reports Mixed Q1 2024 Financial Results

Total Investment Income: Decreased by 2.3% to $23.2 million in Q1 2024.

Net Investment Income: Increased by 8.6% to $11.9 million, or $0.274 per share.

Net Asset Value: Increased by 2.3% to $9.61 per common share as of December 31, 2023.

Total Investments: Grew by 6.4% to $749.9 million at fair value.

Net Unrealized Appreciation: Significant increase to $7.8 million, contributing to a net increase in net assets from operations of 52.7%.

Distributions: Cash distribution per common share decreased by 7.5% to $0.2475.

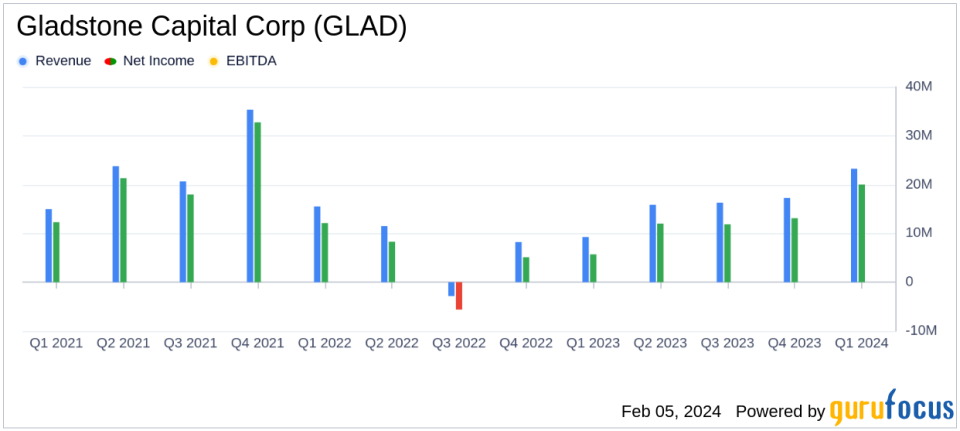

Gladstone Capital Corp (NASDAQ:GLAD) released its 8-K filing on February 5, 2024, detailing financial results for the first fiscal quarter ended December 31, 2023. The company, an externally managed investment firm focusing on debt securities and equity investments, reported a slight decrease in total investment income but saw an increase in net investment income and net asset value per share.

Financial Performance Overview

For the quarter ended December 31, 2023, Gladstone Capital Corp experienced a 2.3% decrease in total investment income, which amounted to $23.2 million. This decline was attributed to a decrease in interest income and other income, including a drop in prepayment fee income. Despite the lower total investment income, the company managed to reduce its total expenses by 11.6%, leading to an 8.6% increase in net investment income, which stood at $11.9 million or $0.274 per share.

The company's net asset value per common share increased by 2.3% to $9.61, while total investments at fair value grew by 6.4% to $749.9 million. A notable financial achievement was the significant net unrealized appreciation of $7.8 million, contributing to a 52.7% net increase in net assets resulting from operations.

Challenges and Achievements

The decrease in total investment income poses a challenge for Gladstone Capital Corp, as it reflects a potential slowdown in income-generating activities. However, the company's ability to increase its net investment income and net asset value per share demonstrates resilience and effective cost management. The growth in net unrealized appreciation is particularly important as it indicates potential long-term capital appreciation for shareholders.

The company's financial achievements are critical in the asset management industry, where the ability to generate and grow income, as well as manage investments effectively, is key to success and investor confidence.

Subsequent Events and Management Changes

Following the end of the quarter, Gladstone Capital Corp reported several distributions per common share and Series A Preferred Stock. Additionally, the company held a Special Meeting of Stockholders where a new investment advisory agreement was approved, following an anticipated change in control of the Adviser. This change involves the establishment of a voting trust agreement but does not alter the fee structure or the company's investment strategies.

The company will hold an earnings release conference call to discuss these results and future prospects. Investors and stakeholders are encouraged to review the detailed financial statements and notes in the company's Form 10-Q, which provide a comprehensive view of its financial position and performance.

For value investors and potential members of GuruFocus.com, Gladstone Capital Corp's latest earnings report presents a mixed picture with both challenges and achievements. The company's ability to navigate a decrease in total investment income while still increasing net investment income and net asset value per share is noteworthy. The significant net unrealized appreciation also suggests potential for future growth, making GLAD a company worth watching in the asset management sector.

Explore the complete 8-K earnings release (here) from Gladstone Capital Corp for further details.

This article first appeared on GuruFocus.