Gladstone Commercial Corp (GOOD) Reports Mixed Fiscal Year 2023 Results

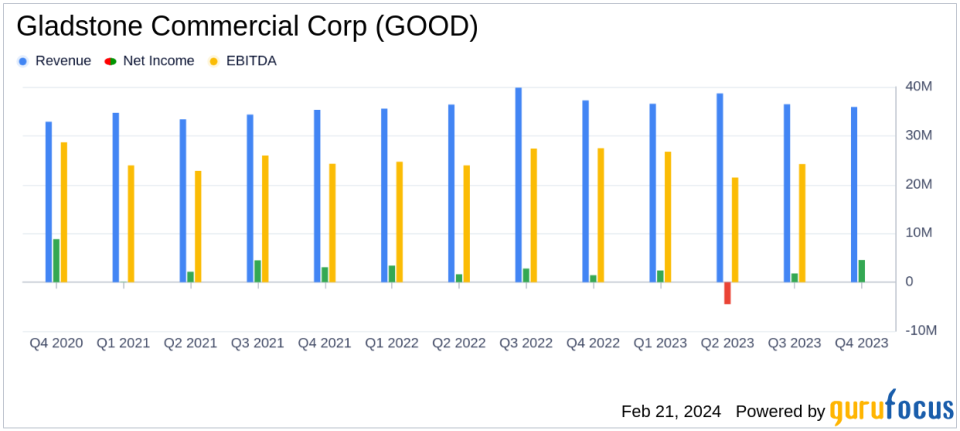

Revenue: Total operating revenue for the year ended December 31, 2023, slightly decreased by 0.9% to $147.6 million.

Net Income: Net income for the year dropped significantly by 54.3% to $4.9 million.

Funds from Operations (FFO): FFO for the fourth quarter increased by 10.1% to $14.6 million, while annual FFO decreased by 3.1% to $59.2 million.

Dividends: Paid monthly cash distributions for the year totaling $1.20 per share on common stock and Non-controlling OP Units.

Debt and Equity: Issued Series F Preferred Stock and new debt, while repaying $58.9 million in fixed-rate mortgage debt.

Occupancy: Maintained a strong occupancy rate of 96.8% for the year.

Portfolio Activity: Acquired five properties and sold seven non-core properties as part of the capital recycling strategy.

Gladstone Commercial Corp (NASDAQ:GOOD) released its 8-K filing on February 21, 2024, detailing its financial results for the fourth quarter and the fiscal year ended December 31, 2023. The real estate investment trust, which focuses on net leased industrial, commercial, and retail real property, faced a challenging economic environment yet managed to achieve certain financial milestones.

Financial Performance Overview

For the fourth quarter, Gladstone Commercial reported a net income of $4.6 million, a substantial increase from $1.8 million in the previous quarter, primarily due to gains on sale of real estate and debt extinguishment. However, the annual net income saw a significant decline from the previous year, dropping to $4.9 million from $10.8 million, a 54.3% decrease. This decline was attributed to increased other expenses and dividends attributable to preferred and senior common stock.

The company's total operating revenue for the year slightly decreased by 0.9% to $147.6 million. Despite the decrease in revenue, the company's FFO for the fourth quarter increased by 10.1% to $14.6 million, or $0.36 per share. However, the annual FFO decreased by 3.1% to $59.2 million, or $1.46 per share. Core FFO, which adjusts for certain non-recurring items, also saw a decrease of 3.1% for the year, amounting to $59.9 million, or $1.47 per share.

Strategic Portfolio Management

Gladstone Commercial's portfolio management strategy involved acquiring properties and selling non-core assets. The company acquired five fully-occupied properties for $29.5 million at a weighted average cap rate of 9.56% and sold seven non-core properties for $39.6 million. These transactions are part of the company's capital recycling strategy aimed at deleveraging the portfolio and focusing on growth markets, particularly industrial investment opportunities.

The company also reported a strong occupancy rate of 96.8% for the year, maintaining consistent performance and stabilized revenues. Gladstone Commercial collected 100% of the base rental charges owed throughout 2023, indicating robust rent collection and growth.

Financial Position and Future Outlook

Gladstone Commercial's balance sheet reflects a total asset value of $1.13 billion, with total equity and mezzanine equity at $324.3 million. The company's mortgage notes payable, net borrowings under the revolver, and term loan, net, stood at $738.9 million.

Despite the economic uncertainties, including the lingering effects of the pandemic, inflation, rising interest rates, and geopolitical tensions, Gladstone Commercial's President, Buzz Cooper, expressed confidence in the company's tenant credit underwriting and its ability to navigate the current economic climate. The company anticipates positive outcomes from its active marketing of vacant space and expects to continue accessing debt and equity markets for added liquidity.

Gladstone Commercial's focus remains on investing in target markets, with an emphasis on industrial properties and active portfolio management. The company's consistent payment of monthly cash distributions, which has never been skipped or deferred since its inception, underscores its commitment to delivering shareholder value.

Investors and stakeholders are encouraged to review the detailed financial results and future plans as outlined in the company's 8-K filing and to participate in the upcoming conference call to discuss the earnings results.

Explore the complete 8-K earnings release (here) from Gladstone Commercial Corp for further details.

This article first appeared on GuruFocus.