Gladstone Investment Corp (GAIN) Reports Mixed Q3 Results with Net Asset Value Dip

Total Investment Income: Increased by 13.8% to $23.1 million for the quarter.

Net Investment Income: Rose significantly to $9.7 million, or $0.28 per share, reversing a previous loss.

Net Asset Value (NAV): Decreased by 7.3% to $13.01 per share as of December 31, 2023.

Net Increase in Net Assets: Declined by 86.1% to $6.6 million for the quarter.

Distributions: Cash distribution from net investment income was $0.43 per share, up 115%.

Portfolio Activity: Total dollars invested were $68.2 million, with $77.9 million repaid from sales and recapitalizations.

Weighted-Average Yield: On interest-bearing investments slightly decreased to 14.4%.

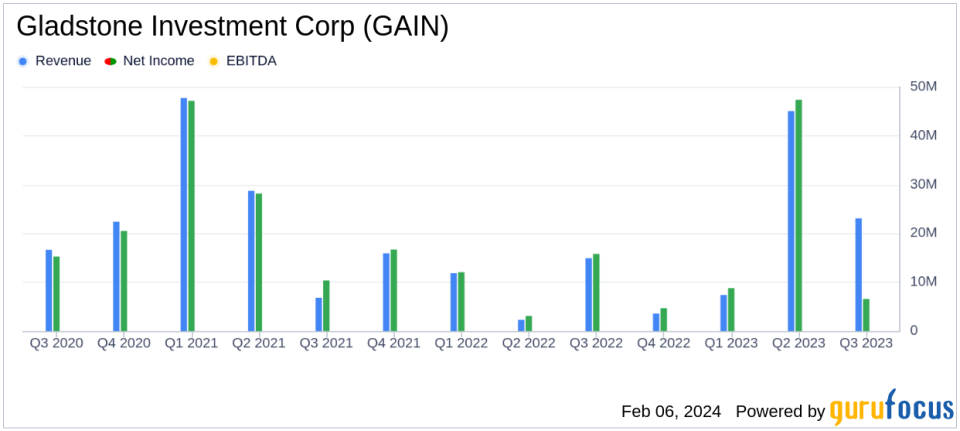

Gladstone Investment Corp (NASDAQ:GAIN), a business development company, released its 8-K filing on February 6, 2024, detailing the financial results for the third fiscal quarter ended December 31, 2023. The company, which focuses on debt securities and equity investments in established businesses, reported a mixed set of financials characterized by a robust increase in total investment income but a notable decrease in net asset value (NAV) per share.

Financial Performance and Challenges

The company's total investment income for the quarter was $23.1 million, a 13.8% increase from the previous quarter, primarily due to a rise in interest and dividend income. Net investment income saw a remarkable turnaround, posting $9.7 million, or $0.28 per share, compared to a net investment loss in the prior quarter. This positive shift was largely attributed to a decrease in total expenses, net of credits, and an increase in total investment income.

However, the quarter was not without its challenges. GAIN experienced a significant net unrealized depreciation of $46.6 million, which, along with distributions paid to shareholders, contributed to a decrease in NAV per share from $14.03 to $13.01. This depreciation reflects the potential volatility in the valuation of the company's investment portfolio and underscores the inherent risks in investment activities.

Financial Achievements and Importance

Despite the challenges, GAIN reported a net increase in net assets resulting from operations, although it was an 86.1% decrease from the previous quarter. The company's ability to generate a net increase in assets is crucial for sustaining its dividend payments and for potential future growth. Additionally, the company's investment activity remained strong, with $68.2 million invested during the quarter and $77.9 million repaid from sales and recapitalizations, indicating active portfolio management and liquidity events.

Key Financial Metrics

Key metrics such as the weighted-average yield on interest-bearing investments slightly decreased to 14.4%, reflecting the competitive nature of the lending environment. The total number of portfolio companies decreased by one to 25, suggesting a strategic refinement of the company's investment portfolio.

"During the quarter, we invested an additional $64.7 million in SFEG Holdings, Inc. to fund an add-on acquisition and exited our investment in Counsel Press, Inc., which resulted in success fee income of $1.4 million, a realized gain of $43.5 million, and the repayment of our debt investment of $27.5 million at par," the company reported.

The company's financing activities included amending its credit facility, which involved extending the maturity date and adjusting the base spread rate, demonstrating proactive financial management.

Analysis of Company Performance

GAIN's performance this quarter reflects the dual nature of investment operations, where income generation and asset appreciation can be offset by market-driven unrealized depreciation. The company's strategic investments and exits have led to substantial realized gains, contributing positively to the overall financial health. However, the decrease in NAV per share is a concern for value investors, as it indicates a reduction in the intrinsic value of the company's shares.

For value investors, GAIN's ability to generate increased investment income and manage its portfolio actively are positive signs. However, the volatility in unrealized appreciation/depreciation and the decrease in NAV per share will be key factors to monitor in the future.

For further details and insights, investors are encouraged to review the full 8-K filing and the upcoming earnings conference call scheduled for February 7, 2024.

Explore the complete 8-K earnings release (here) from Gladstone Investment Corp for further details.

This article first appeared on GuruFocus.