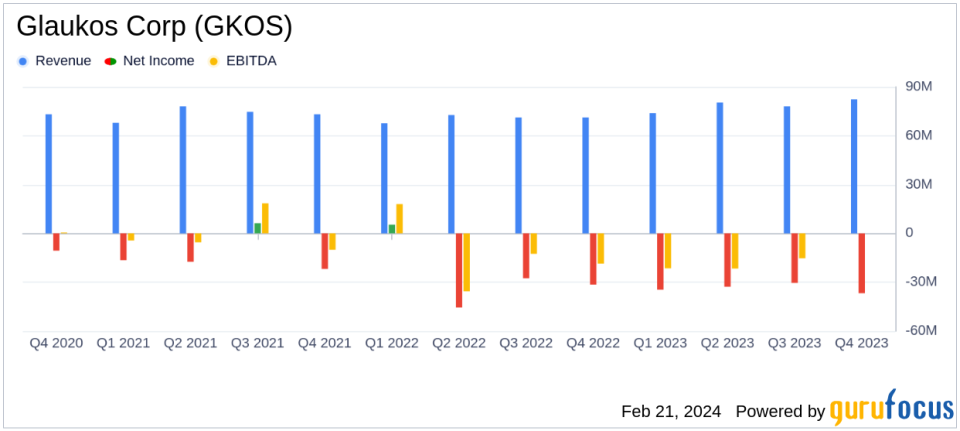

Glaukos Corp (GKOS) Reports Increased Sales but Widening Losses in Q4 and Full Year 2023

Net Sales: Q4 net sales rose to $82.4 million, a 16% increase year-over-year.

Gross Margin: Maintained at approximately 76% for the full year, with a slight increase in Q4.

Operating Expenses: SG&A and R&D expenses saw significant increases in both Q4 and the full year.

Net Loss: Q4 net loss widened to $36.8 million, with a full-year net loss of $134.7 million.

2024 Revenue Guidance: Projected net sales of $350 million to $360 million.

Liquidity Position: Ended the year with $301 million in cash, cash equivalents, and restricted cash.

On February 21, 2024, Glaukos Corp (NYSE:GKOS), a leader in ophthalmic medical technology, released its 8-K filing, detailing the financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its innovative products like the iStent for glaucoma treatment, reported a year of growth in net sales but also faced challenges with increasing losses.

Financial Performance Overview

Glaukos Corp (NYSE:GKOS) achieved a 16% increase in net sales for Q4 2023, reaching $82.4 million, up from $71.2 million in the same period in 2022. The full-year net sales also saw an 11% increase to $314.7 million. The company's gross margin remained stable at approximately 76% for the full year, with a slight improvement in Q4 2023 to 77%.

However, the company's operating expenses, including Selling, General and Administrative (SG&A) and Research and Development (R&D), increased notably. SG&A expenses rose by 21% in Q4 and 16% for the full year, while R&D expenses increased by 3% in Q4 and 13% for the full year. These rising expenses contributed to a widening loss from operations, which grew from $33.7 million in Q4 2022 to $38.6 million in Q4 2023, and from an $82.3 million loss in 2022 to a $128.7 million loss in 2023.

Challenges and Strategic Outlook

Despite the revenue growth, Glaukos faced a widening net loss, which increased from $31.5 million in Q4 2022 to $36.8 million in Q4 2023, and from $99.2 million in 2022 to $134.7 million in 2023. The company's CEO, Thomas Burns, remains optimistic, stating:

Our record fourth quarter results cap off a successful year of global execution and key milestone achievements, leaving us well positioned to execute our strategic plans as we enter into what we believe will be a transformative period for our company over the coming years.

For 2024, Glaukos expects net sales to be in the range of $350 million to $360 million. The company ended the year with a strong liquidity position, with approximately $301 million in cash and cash equivalents, short-term investments, and restricted cash.

Financial Health and Metrics

The balance sheet shows that Glaukos has a total asset value of $940.4 million as of December 31, 2023, with a slight decrease from $1,002.4 million in the previous year. The company's total liabilities stand at $478.6 million, with stockholders' equity at $461.8 million.

Glaukos' financial achievements and challenges are critical for investors, especially in the Medical Devices & Instruments industry, where innovation and R&D are pivotal for growth. The company's ability to maintain a stable gross margin amidst rising expenses is noteworthy, but the increasing net losses highlight the need for a strategic focus on cost management and operational efficiency.

Value investors and potential GuruFocus.com members should continue to monitor Glaukos Corp (NYSE:GKOS) for its ability to leverage its product pipeline and capitalize on market opportunities while managing its expense growth to achieve profitability.

Explore the complete 8-K earnings release (here) from Glaukos Corp for further details.

This article first appeared on GuruFocus.