Glaukos (GKOS) Hits 52-Week High: What's Aiding the Stock?

Shares of Glaukos Corporation GKOS scaled a new 52-week high of $81.84 on Dec 15, before closing the session marginally lower at $81.48.

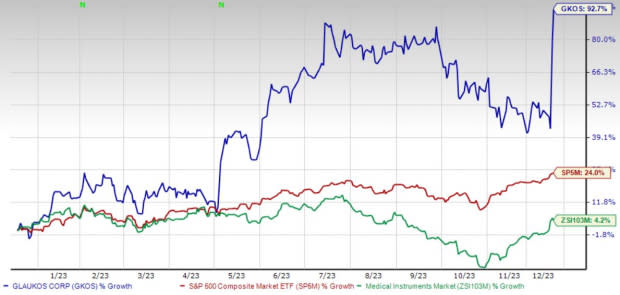

Over the past year, this Zacks Rank #3 (Hold) stock has surged 92.7% compared with the 4.2% rise of the industry and the S&P 500’s 24.1% growth.

The company’s expected growth rate of 8.2% for 2024 compares with the industry’s growth projection of 21.9%. Glaukos’ earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 5.7%.

Glaukos is witnessing an upward trend in its stock price, prompted by its strength in its flagship iStent. The optimism led by a solid third-quarter 2023 performance and a strong product pipeline to support its long-term growth are expected to contribute further. However, vendor uncertainty and stiff competition continue to concern the company.

Image Source: Zacks Investment Research

Let’s delve deeper.

Key Growth Drivers

Strength in iStent: Investors are optimistic about Glaukos’ prospects with respect to its iStent. The company advanced the commercial rollout of iStent inject W during the first quarter of 2022 in key international markets, including Australia, Japan and several European countries. The product has received stand-alone indication approval in Australia and regulatory approval in India, along with registering continued progress across many of the key market access initiatives. New local coverage determinations proposed in June 2023 are likely to remove certain ophthalmic goniotomy and canaloplasty procedures from coverage that will likely have a positive impact on the iStent business.

Strong Pipeline: Investors are optimistic about Glaukos’ focus on strengthening its product pipeline. It is currently developing several pipeline products like iDose TR, iDose TREX, iDose ROCK and iLution Travoprost. These next-generation extended-release candidates are in different stages of clinical development.

This month, Glaukos announced the FDA’s approval for its New Drug Application for a single administration per eye of iDose TR (travoprost intracameral implant) 75 mcg.

Strong Q3 Results: Glaukos’ robust third-quarter 2023 results raise investors’ optimism. The company registered solid year-over-year top-line and segmental performances.

Downsides

Stiff Competition: Glaukos’ competitors include medical companies, academic and research institutions or others that develop new drugs, therapies, medical devices or surgical procedures to treat glaucoma. The company’s present or future products could be rendered obsolete as a result of advances by one or more of its present or future competitors, or by other surgical or pharmaceutical therapy development. Glaukos must continue to develop and commercialize new products, technologies, and therapies to remain competitive in the ophthalmology industry.

Vendor Uncertainty: Glaukos currently relies on a limited number of third-party suppliers, in some cases sole suppliers, to supply components for the iStent, the iStent inject models and other pipeline products. If any one or more of these suppliers cease to provide the company with sufficient quantities of components or drugs in a timely manner or on acceptable terms, the company would have to seek alternative sources of supply.

Key Picks

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, HealthEquity, Inc. HQY and Integer Holdings Corporation ITGR.

DaVita, sporting a Zacks Rank #1 (Strong Buy), has an estimated long-term growth rate of 18.3%. DVA’s earnings surpassed estimates in all the trailing four quarters, with an average surprise of 36.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 46.2% compared with the industry’s 8.9% rise in the past year.

HealthEquity, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 27.5%. HQY’s earnings surpassed estimates in all the trailing four quarters, with an average of 16.5%.

HealthEquity has gained 0.9% against the industry’s 7.2% decline over the past year.

Integer Holdings, flaunting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 15.8%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 11.9%.

Integer Holdings’ shares have rallied 44.3% compared with the industry’s 4.2% rise in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Glaukos Corporation (GKOS) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report