Glaukos' (GKOS) New Tie-Up to Address Chronic Eye Disease

Glaukos Corporation GKOS recently entered into a collaboration and marketing agreement with Radius XR, Inc. Per the agreement terms, Glaukos will become the exclusive sales agent to market, promote and solicit orders for the Radius XR wearable patient engagement and diagnostic system within the United States.

However, Radius will continue to lead development and commercialization efforts for Radius XR.

The latest partnership is expected to significantly boost Glaukos’ business across the United States and solidify its foothold in the ophthalmic medical technology space.

Rationale Behind the Collaboration

The Radius XR platform is a portable vision diagnostic and patient engagement system designed to allow more efficient detection of eye disease and better management and treatment of sight-threatening conditions. Its comprehensive hardware and software system provides the tools to accurately diagnose patients, enhance patient engagement and reduce staff workload. It enables patients to perform self-guided vision tests with minimal supervision, thereby aiding in eye care practices' flow, efficiency and patient experience.

Glaukos’ management believes the partnership with Radius will likely strengthen commercialization efforts and expand patient access to Radius’ portable vision diagnostic system. Management also feels that the Radius XR platform can help drive more efficient and improved diagnosis for patients suffering from chronic eye diseases while creating efficiency and growth opportunities for eye care practices.

Per Radius’ management, the collaboration will likely provide it with the required resources to expedite product development, optimize benefits for eye care providers and enhance the overall quality of care and access for patients.

Industry Prospects

Per a report by Data Bridge Market Research, the global chronic eye diseases market was valued at $20.828 million in 2021 and is expected to reach $33.96 million by 2029 at a CAGR of 6.3%. Factors like the high prevalence rate of diabetes and other chronic conditions and the rising elderly population are expected to drive the market.

Given the market potential, the tie-up seems to have been timed well.

Notable Developments

Last month, Glaukos announced the completion of enrolment and randomization in its second Phase 3 confirmatory pivotal trial for Epioxa (Epi-on), its next-generation corneal cross-linking therapy for the treatment of keratoconus.

In May, Glaukos announced receipt of the “Day 74” notification from the FDA acknowledging the previously submitted New Drug Application for iDose TR (travoprost intraocular implant) is sufficiently complete to permit a substantive review.

Also in May, Glaukos announced its first-quarter 2023 results, wherein it registered a robust year-over-year uptick in its net sales, both on a reported and constant currency basis. Its Glaucoma and Corneal Health year-over-year net sales in the quarter were also strong.

Price Performance

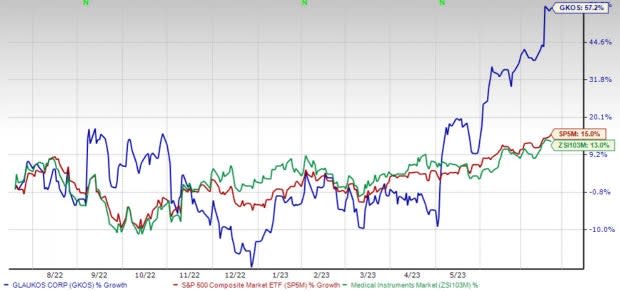

Shares of the company have lost 57.2% in the past year against the industry’s 13% rise and the S&P 500’s 15% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, Glaukos carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Becton, Dickinson and Company BDX, popularly known as BD, HealthEquity, Inc. HQY and Boston Scientific Corporation BSX.

BD, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 10.1%. BDX’s earnings surpassed estimates in all the trailing four quarters, with an average of 5.8%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

BD has gained 8.1% compared with the industry’s 18.9% rise over the past year.

HealthEquity, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 22%. HQY’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 9.1%.

HealthEquity has gained 8.7% against the industry’s 13.3% decline over the past year.

Boston Scientific, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11.5%. BSX’s earnings surpassed estimates in two of the trailing four quarters and missed in the other two, the average surprise being 1.9%.

Boston Scientific has gained 41.7% against the industry’s 22.5% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Glaukos Corporation (GKOS) : Free Stock Analysis Report