Glaxo (GSK) to Report Q1 Earnings: What's in the Cards?

GlaxoSmithKline plc GSK will report first-quarter 2022 results on Apr 27, before market open. In the last reported quarter, the company delivered an earnings surprise of 9.52%.

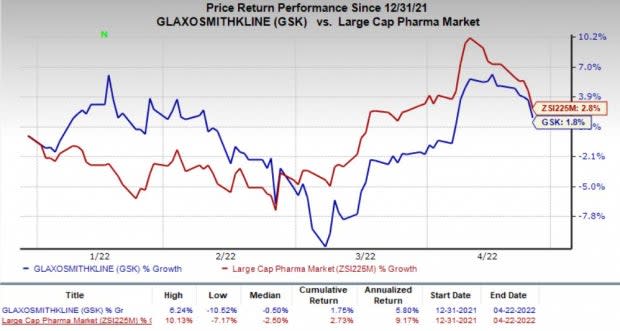

Shares of Glaxo have outperformed the industry so far this year. The stock has gained 1.8% compared with the industry’s increase of 2.8%.

Image Source: Zacks Investment Research

Glaxo’s earnings surpassed estimates in three of the trailing four quarters and met the same once, delivering a beat of 20.52%, on average.

Factors to Consider

During the first quarter, Glaxo’s revenues are likely to have been primarily driven by the COVID-19 drug, Xevudy (sotrovimab) — which was developed in collaboration with Vir Biotechnology VIR. Higher sales from newer respiratory and HIV drugs are likely to have been offset by a decline in sales of older HIV drugs and Established Pharmaceuticals segment sales. The impact of COVID-19 vaccination programs across the globe on Glaxo’s vaccine portfolio sales remains to be seen. Currency movements are likely to have had a positive impact on the back of a stronger U.S. dollar year over year. The Zacks Consensus Estimate for revenues stands at $11.97 billion.

Vir-partnered Xevudy is likely to have generated significant sales during the first quarter from supply to the United States. Glaxo and Vir signed a new agreement with the U.S. government for the supply of 0.6 million doses of Xevudy in January. These doses were contracted to be supplied in the first quarter of 2022. The agreement also provides the U.S. government the option to purchase additional doses in the second quarter of 2022. Glaxo and Vir previously had U.S. government contracts for Xevudy doses worth approximately $1 billion signed in November last year. Xevudy had generated sales of £828 million ($1.12 billion) in the fourth quarter, contributing 20% to Pharmaceuticals sales growth. The trend is expected to have continued in the soon-to-be reported quarter. Moreover, authorizations in the United Kingdom and Europe in December last year are likely to have generated additional Xevudy sales during the soon-to-be-reported quarter.

The growth trend in Respiratory category sales is expected to have continued in the first quarter on the back of strong demand for Trelegy Ellipta and Nucala amid recovery following the pandemic. The label expansions of Nucala in chronic rhinosinusitis in the United States in July and Europe in November are likely to have boosted sales of the drug during the first quarter. However, older respiratory drugs — Advair and Relvar/Breo Ellipta — that face competitive and pricing pressure are likely to have unfavorably impacted Glaxo’s respiratory sales.

After recovering in the second and third quarters of 2021, Glaxo’s key vaccine, Shingrix’s sales were again hurt by the prioritization of the COVID-19 vaccination programs amid the Omicron outbreak during the fourth quarter. The negative impact of COVID-19 vaccinations is expected to continue in the first quarter. Sales of Meningitis vaccines are also likely to have declined during the first quarter amid a normal U.S. back-to-school season. Lower sales of established vaccines are likely to have hurt vaccine sales further.

Sales of Glaxo’s lupus drug, Benlysta, showed impressive growth in the last three quarters despite COVID-related disruption. We expect the momentum to have continued in the soon-to-be-reported quarter. The drug’s approval in China in February is likely to have brought additional sales during the first quarter.

Oncology sales, comprising Zejula and Blenrep, are also likely to have witnessed growth. The uptake trend of the newly-approved Jemperli remains to be seen.

The competitive environment and the shift in portfolio toward two-drug regimens may have hurt sales of three-drug regimens — Tivicay and Triumeq — and older HIV drugs. However, the strong growth trend witnessed in two-drug regimens, Juluca and Dovato, might have helped the company partially offset some of the losses in sales of the three-drug regimens. The uptake of its new HIV drug, Apretude, an extended-release cabotegravir, approved last December remains to be seen.

In January, Glaxo settled a global patent infringement litigation with Gilead GILD related to patents covering Glaxo’s dolutegravir-based drugs. Glaxo alleged that Gilead’s triple-drug HIV regimen, Biktarvy, infringed certain patents related to dolutegravir. The settlement resulted in a payment of $1.25 billion made by Gilead in the first quarter. Gilead will also have to pay royalty to GSK on U.S. sales of Biktarvy.

First-quarter sales of consumer healthcare business are likely to have continued the recovery momentum from the past two quarters. The demerger of the consumer healthcare business is expected to be completed in July. The separate consumer healthcare entity will be listed with the name of Haleon.

Glaxo may provide an update related to the development of its respiratory syncytial virus (RSV) maternal vaccine candidate on its first-quarter earnings call. Enrollment and vaccination in a late-stage study evaluating its RSV maternal vaccine candidate was paused in February following a routine safety assessment. Glaxo may also discuss the progress with its COVID-19 vaccine candidate, which is being developed in collaboration with Sanofi on the earnings call.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Glaxo this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that is not the case here.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate, is 0.00%. The Zacks Consensus Estimate stands at 77 cents per ADS. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Glaxo has a Zacks Rank #3.

GlaxoSmithKline plc Price and EPS Surprise

GlaxoSmithKline plc price-eps-surprise | GlaxoSmithKline plc Quote

Stock to Consider

Here is one large biotech stock that you may want to consider, as our model shows that it has the right combination of elements to post an earnings beat this season.

Vertex Pharmaceuticals VRTX has an Earnings ESP of +0.87% and a Zacks Rank #2. You can seethe complete list of today’s Zacks #1 Rank stocks here.

Vertex’s stock has surged 23.1% so far this year. VRTX topped earnings estimates in the last four reported quarters. Vertex has a four-quarter earnings surprise of 10.01%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GlaxoSmithKline plc (GSK) : Free Stock Analysis Report

Gilead Sciences, Inc. (GILD) : Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

Vir Biotechnology, Inc. (VIR) : Free Stock Analysis Report

To read this article on Zacks.com click here.