GLAZER CAPITAL, LLC Adjusts Position in Integrated Wellness Acquisition Corp

Overview of GLAZER CAPITAL, LLC (Trades, Portfolio)'s Recent Stock Transaction

GLAZER CAPITAL, LLC (Trades, Portfolio), a prominent investment firm, has recently made a significant adjustment to its holdings in Integrated Wellness Acquisition Corp (NYSE:WEL). On October 31, 2023, the firm reduced its position by a striking 99.92%, selling off 746,500 shares. This transaction, executed at a price of $11 per share, has led to a new total of 600 shares held by the firm, impacting its portfolio by -0.57%. Despite the substantial reduction, GLAZER CAPITAL, LLC (Trades, Portfolio) maintains a 0.01% stake in the company.

Investment Philosophy and Holdings of GLAZER CAPITAL, LLC (Trades, Portfolio)

GLAZER CAPITAL, LLC (Trades, Portfolio), headquartered at 623 Fifth Avenue, New York, NY, operates with a keen investment philosophy that has shaped its portfolio. The firm's top holdings include Syneos Health Inc (NASDAQ:SYNH), Univar Solutions Inc (UNVR), Triton International Ltd (TRTN), Focus Financial Partners Inc (NASDAQ:FOCS), and Ares Acquisition Corp (NYSE:AAC). With an equity of $1.43 billion, GLAZER CAPITAL, LLC (Trades, Portfolio) has a diversified portfolio, with a particular focus on the Financial Services and Healthcare sectors, comprising 216 stocks in total.

Integrated Wellness Acquisition Corp's Market Presence

Integrated Wellness Acquisition Corp, trading under the symbol WEL in the USA, is a blank check company that made its market debut on January 18, 2022. Operating within the Diversified Financial Services industry, the company has a market capitalization of $91.012 million and a current stock price of $11.01. Since its IPO, the stock has seen a price change of 12.35%, with a year-to-date performance of 7.1%.

Financial Metrics and Stock Performance

Integrated Wellness Acquisition Corp's stock performance has been under scrutiny since its IPO. With a PE Percentage of 148.78, indicating a premium valuation, the company's stock has experienced a marginal gain of 0.09% post the recent transaction by GLAZER CAPITAL, LLC (Trades, Portfolio). However, due to insufficient data, the stock's GF Value and price to GF Value cannot be evaluated, leaving investors to rely on other financial metrics and market performance indicators.

GLAZER CAPITAL, LLC (Trades, Portfolio)'s Strategic Positioning

Following the transaction, GLAZER CAPITAL, LLC (Trades, Portfolio)'s position in Integrated Wellness Acquisition Corp remains minimal, with the stock constituting only 0.01% of its portfolio. This move reflects a strategic decision by the firm, potentially based on the stock's current financial standing and market position. The impact of this trade on the firm's overall portfolio appears to be minor, yet it could signal a shift in GLAZER CAPITAL, LLC (Trades, Portfolio)'s investment strategy.

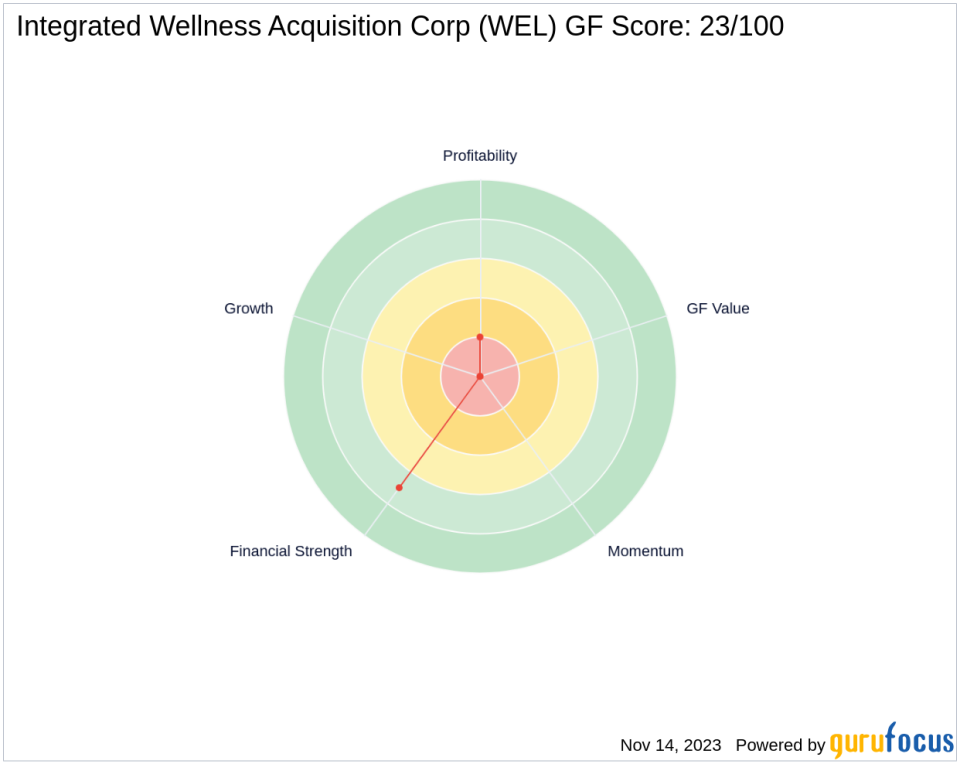

Valuation and Ranking Insights

Integrated Wellness Acquisition Corp's financial strength and valuation rankings are not available due to a lack of sufficient data. However, the stock's GF Score stands at 23/100, indicating potential challenges in future performance. The company's Financial Strength and Profitability Rank are 7/10 and 2/10, respectively, while the Growth Rank, GF Value Rank, and Momentum Rank are not applicable. The Piotroski F-Score is 6, suggesting a moderate financial situation, and the interest coverage ratio is exceptionally high at 10,000.00, although this figure should be approached with caution due to the nature of the company's business.

Market Indicators and Technical Analysis

Technical indicators such as the Relative Strength Index (RSI) show readings of 44.09, 49.81, and 52.49 for the 5-day, 9-day, and 14-day periods, respectively. These figures suggest a neutral momentum for the stock. The Momentum Index over 6 and 12 months are 3.20 and 7.66, respectively, indicating a moderate short-term momentum in the stock's price.

Conclusion

The recent transaction by GLAZER CAPITAL, LLC (Trades, Portfolio) in Integrated Wellness Acquisition Corp represents a significant reduction in the firm's holdings. While the impact on GLAZER CAPITAL, LLC (Trades, Portfolio)'s portfolio is minimal, it does reflect a strategic decision that could be based on the company's current financial metrics and market indicators. Integrated Wellness Acquisition Corp's financial standing, with a high interest coverage ratio and a moderate Piotroski F-Score, presents a mixed picture for investors. As the company continues to navigate the market, investors will be watching closely to see how these factors play out in its stock performance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.