GLAZER CAPITAL, LLC Adjusts Position in Tristar Acquisition I Corp

Overview of GLAZER CAPITAL, LLC (Trades, Portfolio)'s Recent Trade

GLAZER CAPITAL, LLC (Trades, Portfolio), a prominent investment firm, has recently made a significant adjustment to its holdings in Tristar Acquisition I Corp (NYSE:TRIS). On October 31, 2023, the firm reduced its position by 93,012 shares, which resulted in a 27.55% decrease from its previous holding. This transaction had a modest impact of -0.07% on the firm's portfolio, with the shares being traded at a price of $10.76 each. Following the trade, GLAZER CAPITAL, LLC (Trades, Portfolio)'s remaining stake in TRIS stands at 244,599 shares, accounting for 0.18% of its portfolio and representing a 2.31% ownership in the company.

GLAZER CAPITAL, LLC (Trades, Portfolio)'s Market Expertise

GLAZER CAPITAL, LLC (Trades, Portfolio), headquartered at 623 Fifth Avenue, New York, NY, is recognized for its expertise in the market. The firm manages an equity portfolio worth $1.43 billion and holds 216 stocks. Its investment philosophy emphasizes a strategic approach to market opportunities, with a particular focus on the Financial Services and Healthcare sectors. GLAZER CAPITAL, LLC (Trades, Portfolio)'s top holdings include Syneos Health Inc (NASDAQ:SYNH), Univar Solutions Inc (UNVR), Triton International Ltd (TRTN), Focus Financial Partners Inc (NASDAQ:FOCS), and Ares Acquisition Corp (NYSE:AAC). The firm's adeptness in navigating the financial landscape is reflected in its curated portfolio of investments.

Impact of the Trade on GLAZER CAPITAL, LLC (Trades, Portfolio)'s Portfolio

The recent trade by GLAZER CAPITAL, LLC (Trades, Portfolio) has led to a notable change in its investment position in Tristar Acquisition I Corp. The reduction of 93,012 shares has slightly decreased the firm's exposure to TRIS, yet the company still holds a significant number of shares, indicating a sustained interest in the stock. This move could be part of a broader strategy to optimize the firm's portfolio performance or a response to market conditions or company performance.

Introduction to Tristar Acquisition I Corp

Tristar Acquisition I Corp, trading under the symbol TRIS, is a blank check company based in the USA. Since its IPO on December 6, 2021, the company has been involved in various financial service activities. With a market capitalization of $175.857 million and a current stock price of $10.75, TRIS operates within the Diversified Financial Services industry. Despite a PE Ratio of 30.98, indicating profitability, the company's stock valuation cannot be evaluated due to the absence of GF Value data.

Financial Health and Performance Rankings of TRIS

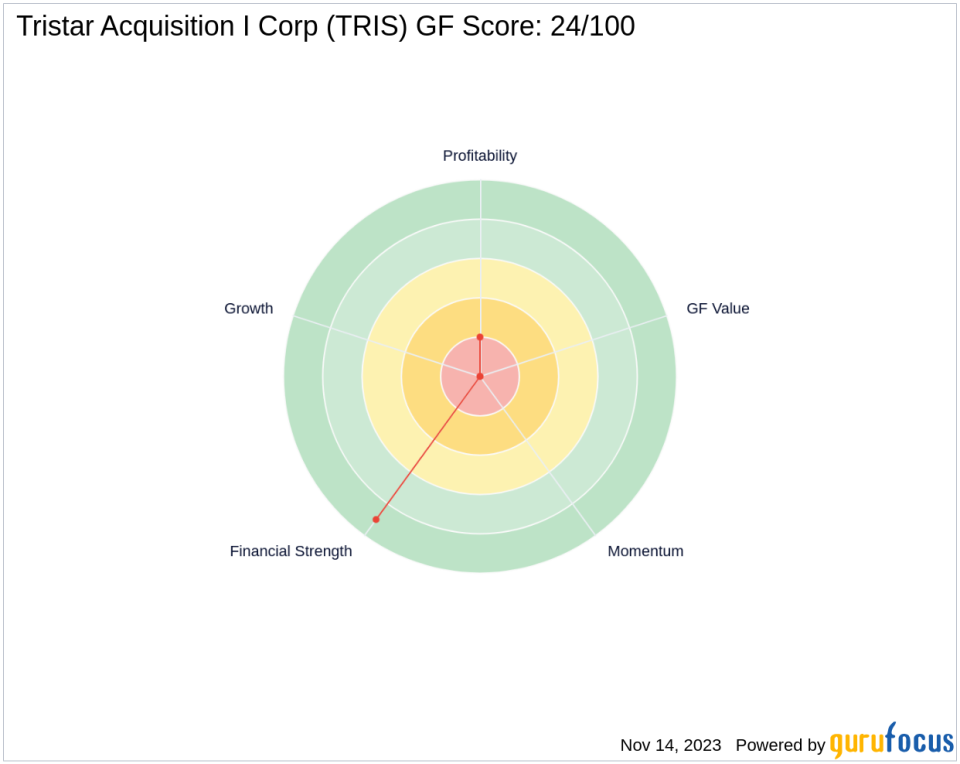

Tristar Acquisition I Corp's financial health is indicated by a Financial Strength rank of 9/10, suggesting a robust balance sheet. However, its Profitability Rank stands at a lower 2/10, and it has a GF Score of 24/100, indicating potential challenges in future performance. The company's Piotroski F-Score is 3, and it has an Altman Z score of 0.00, which could raise concerns about its financial stability.

Market Reaction and Stock Valuation

Following GLAZER CAPITAL, LLC (Trades, Portfolio)'s trade, TRIS's stock price has experienced a marginal decline of 0.09%. The stock has seen a 9.14% increase since its IPO and a 6.33% rise year-to-date. However, due to the lack of GF Value data, it is challenging to assess the stock's valuation accurately.

Sector and Market Context

The trade must be contextualized within the broader market and industry benchmarks. TRIS operates in the Financial Services and Healthcare sectors, where GLAZER CAPITAL, LLC (Trades, Portfolio) has shown a strategic interest. Comparing TRIS's performance with market and industry benchmarks could provide insights into the firm's decision to adjust its position.

Conclusion

GLAZER CAPITAL, LLC (Trades, Portfolio)'s recent transaction involving Tristar Acquisition I Corp reflects a strategic adjustment in its portfolio. While the firm has reduced its stake, it maintains a notable position in TRIS. The trade's impact on the firm's portfolio was minimal, but it underscores the firm's active management approach. For value investors, understanding the implications of such trades, especially in the context of the company's financial health and market performance, is crucial for informed decision-making.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.