Glendon Capital Management LP Boosts Stake in Independence Contract Drilling Inc

Glendon Capital Management LP, a renowned investment firm, has recently increased its stake in Independence Contract Drilling Inc (NYSE:ICD). This article will delve into the details of the transaction, provide an overview of the guru and the traded company, and analyze the performance and prospects of the traded stock.

Details of the Transaction

The transaction took place on August 16, 2023, with Glendon Capital Management LP adding 1,036,133 shares of Independence Contract Drilling Inc to its portfolio. This move resulted in a 202.58% change in shares, impacting the firm's portfolio by 0.32%. The shares were acquired at a price of $2.97 each, bringing the total shares held by the firm to 1,547,614. This represents 0.48% of the firm's portfolio and 9.90% of the traded company's shares.

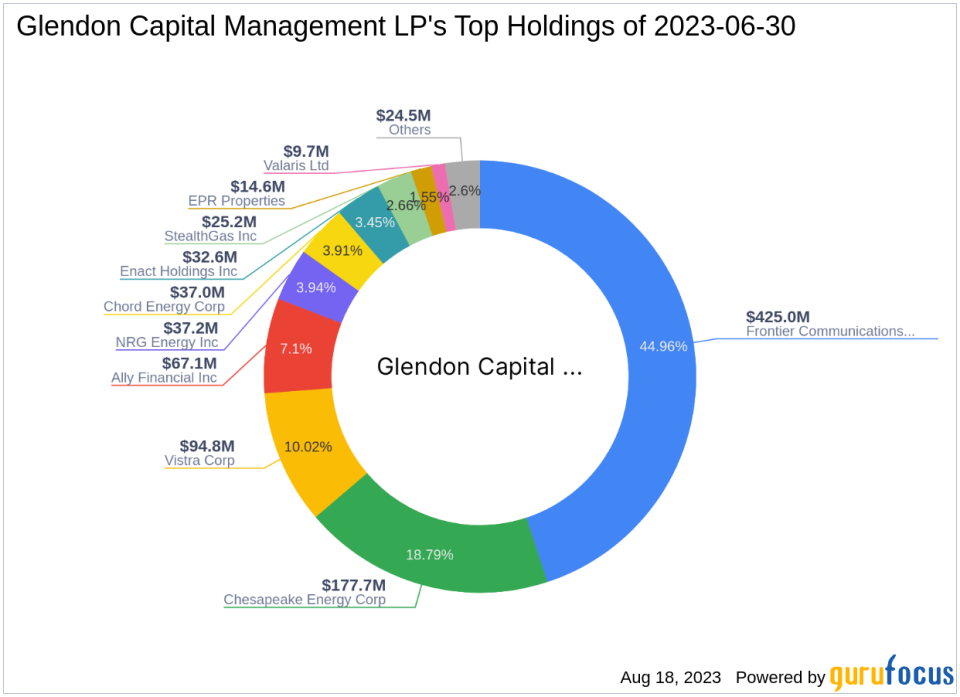

Profile of the Guru

Glendon Capital Management LP, based in Santa Monica, California, is an investment firm with a focus on distressed and special situations investments. The firm currently holds 18 stocks in its portfolio, with a total equity of $945 million. Its top holdings include Ally Financial Inc (NYSE:ALLY), NRG Energy Inc (NYSE:NRG), Vistra Corp (NYSE:VST), Chesapeake Energy Corp (NASDAQ:CHK), and Frontier Communications Parent Inc (NASDAQ:FYBR). The firm's investments are primarily concentrated in the Communication Services and Energy sectors.

Overview of the Traded Stock

Independence Contract Drilling Inc, based in the USA, is a provider of land-based contract drilling services for oil and natural gas producers. The company, which went public on August 8, 2014, operates a premium land rig fleet and develops its own ShaleDriller series rig. With a market capitalization of $42.817 million, the company's stock is currently priced at $3.0399. Despite a PE percentage of 0.00, indicating a loss, the stock is considered modestly undervalued with a GF Value of 4.23 and a price to GF Value ratio of 0.71.

Performance of the Traded Stock

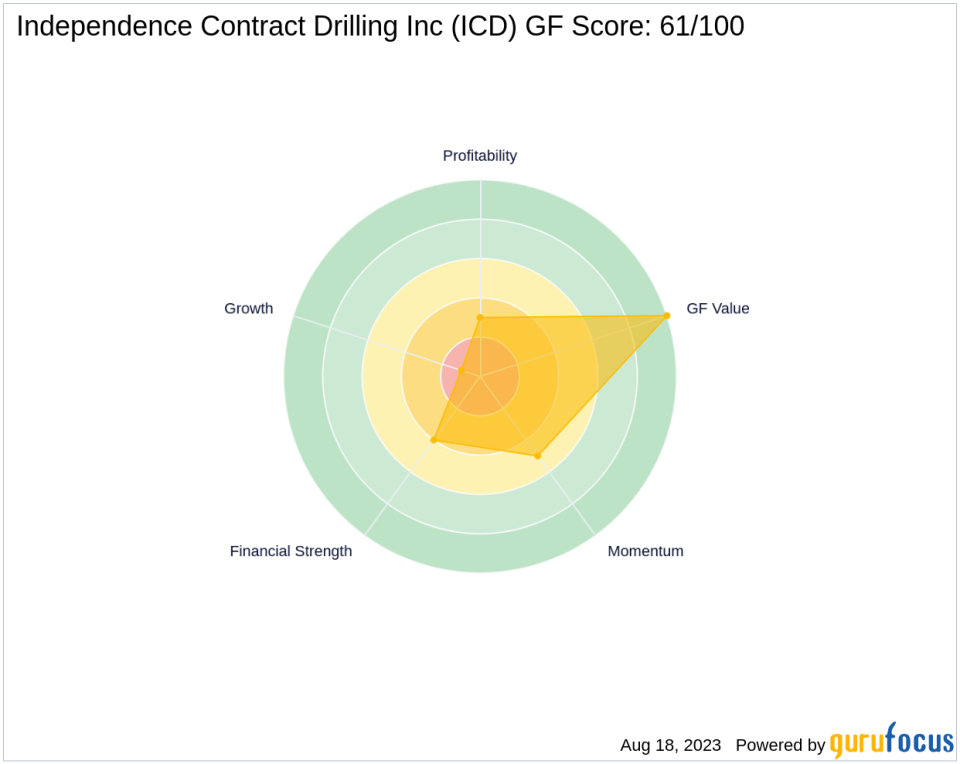

Since the transaction, the stock has gained 2.35%, although it has lost 98.62% since its IPO. The stock's year-to-date performance stands at 0.66%. According to the GF-Score, the stock has a score of 61/100, indicating a potential for average performance. The stock's Financial Strength is ranked 4/10, its Profitability Rank is 3/10, its Growth Rank is 1/10, its GF Value Rank is 10/10, and its Momentum Rank is 5/10. The stock's Piotroski F-Score is 6, its Altman Z score is -0.50, and its cash to debt ratio is 0.04.

Industry Overview of the Traded Stock

Independence Contract Drilling Inc operates in the Oil & Gas industry. The company's interest coverage is 0.63, its ROE is -3.69, and its ROA is -1.88. Over the past three years, the company's revenue has declined by 35.70%, while its EBITDA and earnings have grown by 27.30% and 32.20% respectively.

Momentum and Predictability of the Traded Stock

The stock's RSI 5 day is 55.54, its RSI 9 day is 53.84, and its RSI 14 day is 53.70. The stock's momentum index 6 - 1 month is -20.67, and its momentum index 12 - 1 month is -13.94. The stock's predictability rank is currently not available.

Largest Guru Holding the Traded Stock

The largest guru holding Independence Contract Drilling Inc is Fairfax Financial Holdings, although the exact share percentage is not available.

In conclusion, Glendon Capital Management LP's recent acquisition of Independence Contract Drilling Inc shares has increased its stake in the company, potentially influencing the stock's performance and the firm's portfolio. As of August 18, 2023, all data and rankings are accurate and based on the provided relative data.

This article first appeared on GuruFocus.