Glenn Greenberg's Firm Bolsters Stake in OneMain Holdings Inc

Strategic Portfolio Addition

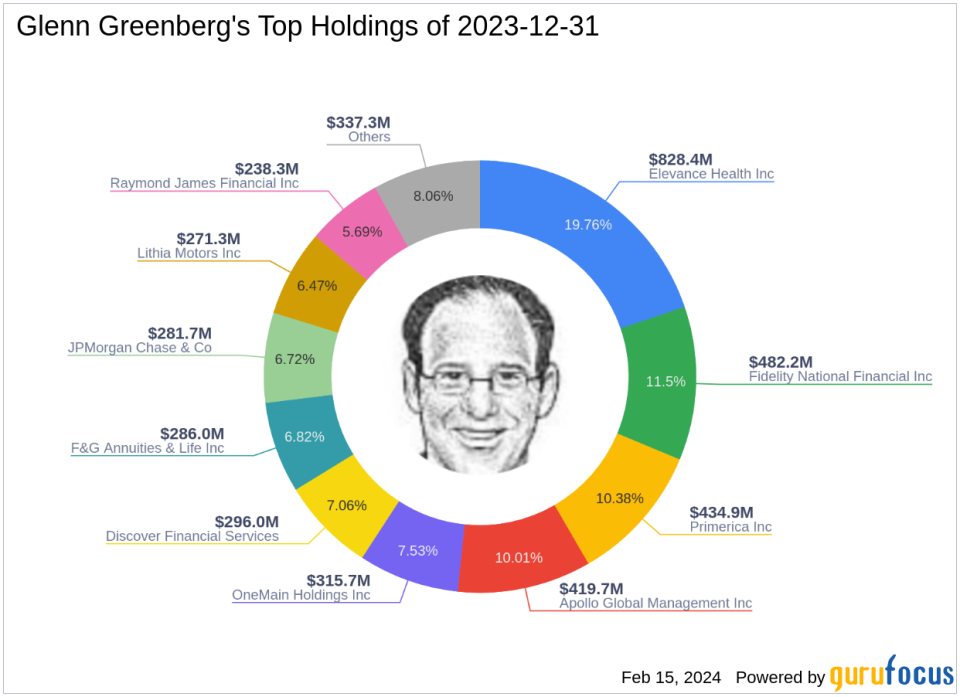

Glenn Greenberg (Trades, Portfolio)'s investment firm, Brave Warrior Advisors, has recently increased its investment in OneMain Holdings Inc (NYSE:OMF), a prominent player in the nonprime consumer finance sector in the United States. On December 31, 2023, the firm added 1,118,166 shares to its position, marking a 21.10% change in shareholding. This transaction had a 1.35% impact on the portfolio, with the shares purchased at a price of $49.20 each. Following the trade, Brave Warrior Advisors holds a total of 6,416,800 shares in OneMain Holdings Inc, which represents 7.77% of the firm's portfolio and 5.36% of the company's outstanding shares.

Glenn Greenberg (Trades, Portfolio)'s Investment Approach

Glenn Greenberg (Trades, Portfolio), a notable figure in the investment community, co-founded Chieftain Capital Management in 1984 and later spearheaded Brave Warrior Advisors. The firm is known for its disciplined investment strategy, which has historically yielded significant returns. Greenberg's philosophy centers on a concentrated portfolio as a defense against ignorance, focusing on companies with minimal competition and high return on invested capital. Brave Warrior Advisors currently manages an equity portfolio worth $4.19 billion, with top holdings in sectors such as Financial Services and Healthcare.

OneMain Holdings Inc at a Glance

OneMain Holdings Inc, with its IPO dating back to October 16, 2013, operates a substantial branch-based consumer finance business complemented by an online presence. The company specializes in personal loans, credit and noncredit insurance, and strategic asset acquisitions and dispositions. With a market capitalization of $5.59 billion, OneMain Holdings has demonstrated a solid track record since its IPO, with a 144.19% increase in stock price. The company's current stock price stands at $46.64, slightly below the trade price, and is deemed "Fairly Valued" with a GF Value of $46.97.

Impact of the Trade on Greenberg's Portfolio

The recent acquisition of OneMain Holdings Inc shares by Brave Warrior Advisors has significantly bolstered the firm's stake in the company, making it a more influential component of the portfolio. The trade has increased the firm's exposure to the Financial Services sector, aligning with Greenberg's strategy of investing in companies with strong competitive advantages and potential for high returns on capital.

OneMain Holdings Inc's Market Dynamics

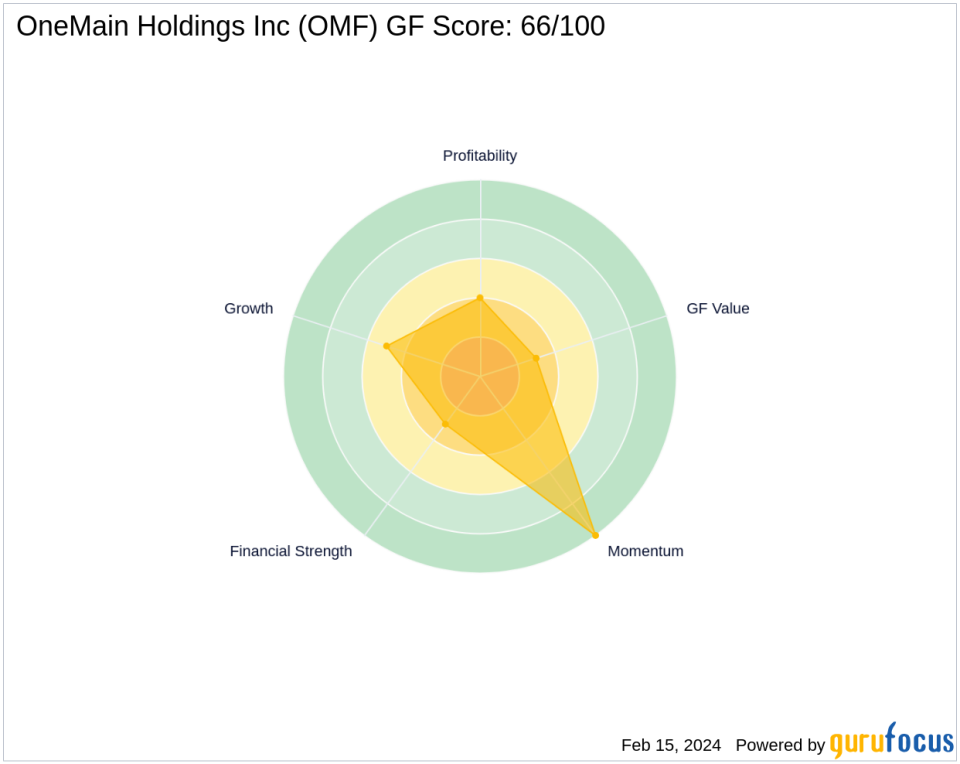

Despite a recent dip in stock price, resulting in a -5.2% gain percent since the transaction, OneMain Holdings Inc maintains a GF Score of 66/100, indicating a potential for average performance. The company's financial strength and profitability are areas of concern, with ranks of 3/10 and 4/10, respectively. However, its Momentum Rank stands at a perfect 10/10, suggesting a strong trend in stock price movement.

Industry Position and Financial Health

OneMain Holdings Inc is a key player in the Credit Services industry, with a robust return on equity (ROE) of 20.73% and return on assets (ROA) of 2.74%. Despite these strengths, the company's financial health could be better, as indicated by its low cash to debt ratio of 0.05 and a Financial Strength rank of 3/10.

Other Gurus' Stakes in OneMain Holdings Inc

Glenn Greenberg (Trades, Portfolio)'s firm is not the only notable investor in OneMain Holdings Inc. Other gurus such as Charles Brandes (Trades, Portfolio), Leon Cooperman (Trades, Portfolio), and Jefferies Group (Trades, Portfolio) also hold positions in the company. Brave Warrior Advisors, however, remains the largest guru shareholder, underscoring the firm's confidence in OneMain Holdings Inc's prospects.

Investment Outlook and Strategy Alignment

The recent trade by Glenn Greenberg (Trades, Portfolio)'s firm reflects a strategic move that aligns with the firm's investment philosophy. For value investors, this transaction underscores the potential that Brave Warrior Advisors sees in OneMain Holdings Inc, despite some financial metrics that suggest caution. The firm's increased stake in OneMain Holdings Inc is a testament to its belief in the company's future growth and profitability, fitting well within Greenberg's concentrated investment approach.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.