Global Business Travel Group Inc (GBTG) Surges with Strong Q4 and Full-Year 2023 Results

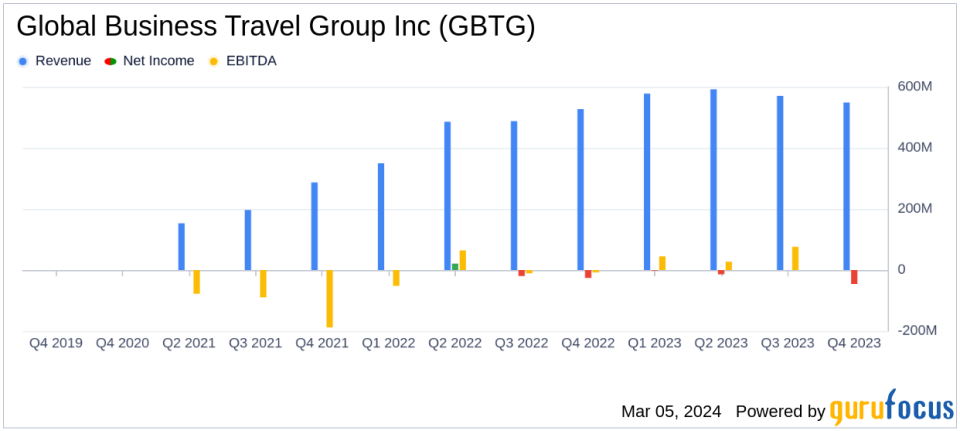

Revenue Growth: GBTG reported a 24% increase in annual revenue, reaching $2.29 billion.

Adjusted EBITDA: Adjusted EBITDA soared by 269% to $380 million for the full year.

Customer Retention: The company maintained a high customer retention rate of 96%.

Free Cash Flow: Positive full-year Free Cash Flow of $49 million, a significant improvement from the previous year.

Debt Reduction: Net Debt reduced to $886 million with a leverage ratio of 2.3x.

2024 Outlook: GBTG forecasts 6-9% revenue growth and 18-32% Adjusted EBITDA growth for 2024.

On March 5, 2024, Global Business Travel Group Inc (NYSE:GBTG) released its 8-K filing, announcing robust financial results for the fourth quarter and the full year ended December 31, 2023. The company, which operates as a business-to-business travel platform, has shown remarkable financial performance, surpassing initial guidance with significant revenue and Adjusted EBITDA growth.

GBTG's business model focuses on providing software and services to manage travel, expenses, and meetings and events for companies of all sizes. With a commitment to building the most valuable marketplace in B2B travel, GBTG offers unrivaled choice, value, and experiences through its global presence and specialized services.

Financial Performance and Challenges

The company's financial achievements in 2023 are a testament to its resilience and strategic positioning in the B2B travel industry. GBTG's revenue growth of 24% to $2.29 billion and Adjusted EBITDA growth of 269% to $380 million reflect a robust recovery and demand for business travel services. The company's ability to maintain a 96% customer retention rate amidst a competitive landscape underscores its strong value proposition and customer satisfaction.

However, GBTG's performance also faced challenges, including the need to manage operating expenses, which grew by 12% to $2.298 billion. The company's net loss improved by 41% to $136 million, indicating progress towards profitability but also highlighting the importance of continued financial discipline and operational efficiency.

Key Financial Metrics

GBTG's financial strength is further evidenced by its positive cash flow and rapid deleveraging. The company reported a positive full-year Free Cash Flow of $49 million, a remarkable turnaround from the previous year's cash flow use. Additionally, GBTG's leverage ratio decreased significantly to 2.3x, reflecting a disciplined approach to debt management and a strong balance sheet.

The importance of these metrics cannot be overstated for a software and services company like GBTG, as they demonstrate the company's ability to generate cash, invest in growth opportunities, and maintain financial stability.

2024 Outlook and Management Commentary

Looking ahead to 2024, GBTG's management is optimistic, guiding to 6-9% revenue growth driven by stable growth in business travel and the company's continued market share gains. The focus on operating leverage and the use of automation and artificial intelligence (AI) is expected to deliver 18%-32% Adjusted EBITDA growth.

"In 2023, we delivered outstanding financial results, with revenue and Adjusted EBITDA finishing above the guidance issued at the start of the year. We expect our scalable model to generate 18% to 32% Adjusted EBITDA growth in 2024 as we settle into a more stable level of industry growth. We expect 2024 will be another year of share gains, strong growth in profits and cash flow and continued margin expansion," said Paul Abbott, Amex GBTs Chief Executive Officer.

Karen Williams, Amex GBTs Chief Financial Officer, added:

"Our 2024 guidance demonstrates the power of our financial model to leverage stable travel demand growth to above-industry revenue growth. It also leads to even stronger Adjusted EBITDA growth thanks to our focus on operating leverage and continued margin expansion. We anticipate a significant step-up in Free Cash Flow this year, driven by Adjusted EBITDA growth, a reduction in integration and restructuring costs and lower interest expense from our declining leverage and expected refinancing of our debt. As Free Cash Flow accelerates, we have a clear capital allocation strategy that supports organic and inorganic investments for long-term, sustained growth."

GBTG's strong performance and positive outlook are likely to appeal to value investors seeking companies with solid growth prospects, financial discipline, and strategic market positioning. The company's commitment to leveraging technology and innovation to drive efficiency and customer satisfaction positions it well for continued success in the evolving landscape of business travel.

For more detailed financial information and analysis, investors and interested parties are encouraged to visit the full 8-K filing and tune into the investor conference call hosted by Amex GBT.

Explore the complete 8-K earnings release (here) from Global Business Travel Group Inc for further details.

This article first appeared on GuruFocus.