Global Commercial Printing Market Report 2022 to 2030 - Players Include Quad/Graphics, Acme Printing, Cenevo and LSC Communications US

Global Commercial Printing Market

Dublin, Dec. 26, 2022 (GLOBE NEWSWIRE) -- The "Commercial Printing Market Size, Share & Trends Analysis Report By Printing Technology (Digital Printing, Lithography Printing, Flexographic, Screen Printing, Gravure Printing), By Application, By Region, And Segment Forecasts, 2022 - 2030" report has been added to ResearchAndMarkets.com's offering.

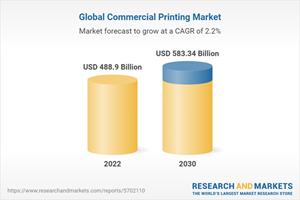

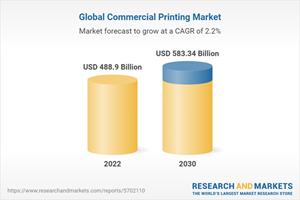

The global commercial printing market size is expected to reach USD 583.34 billion by 2030, expanding at a CAGR of 2.2% from 2022 to 2030.

Report Attribute | Details |

No. of Pages | 120 |

Forecast Period | 2022 - 2030 |

Estimated Market Value (USD) in 2022 | $488.9 Billion |

Forecasted Market Value (USD) by 2030 | $583.34 Billion |

Compound Annual Growth Rate | 2.2% |

Regions Covered | Global |

The rising demand for commercial printing for producing promotional material such as brochures, flyers, newspaper inserts, and pamphlets, among others, is expected to be one of the driving factors for the target market growth. The demand for commercial printing spans several industries, including manufacturing, advertising, food and beverage, retail, and healthcare.

The growing advertising needs of businesses contribute significantly to the demand for commercial printing of advertising materials. Commercial printing primarily involves printing on different types of paper and canvas for packaging, publishing, or advertising needs. Typesetting, bookbinding, fulfillment services, designing services, and finishing, which include folding, cutting, and binding, are some of the ancillary services provided by the market players, along with printing services. The fulfillment services include packaging, storage, and delivery of the printed material services.

The growth of online shopping and the demand for personalized experiences have boosted the demand for commercial printing from the packaging sector. Packaging is considered one of the most important marketing tools, and hence businesses are utilizing packaging to display products' best features. Also, the packaging is being used as a tool to create an unboxing experience for the users.

As a result, many packaging companies are investing in high-technology commercial printing solutions. For instance, in October 2022, Comexi, a flexible packaging service provider, announced the launch of Digiflex, a machine designed for flexible packaging and label converters to print variable data such as QR codes, data matrix variable codes, barcodes, alphanumeric text, and other numbering & marking applications.

The COVID-19 pandemic severely impacted the commercial printing market. The pandemic led to reduced demand for commercial printing as businesses, and their operations were halted. Furthermore, the outbreak disrupted the supply chain and led to an increase in costs of raw materials and labor, and also severely impacted the distribution, which in turn impacted the growth of the target market negatively.

The advent of digital media is restricting the growth of the target market as it continues to replace print media with digital media. Users are adopting the digital form of books and magazines instead of the printed medium. Also, businesses are utilizing digital media for advertising purposes. Despite the impact of digitization, the print industry is, however, pivoting its business models by taking into account the changing needs, trends, and new realities of the market.

Commercial Painting Market Report Highlights

The digital printing segment is expected to grow at the fastest CAGR of 3.4% during the forecast period. The rising awareness of digital printing across various sectors, such as educational establishments, among others across the globe is fueling the segment's growth

The packaging segment held the largest market share of about 54% in 2021 and is expected to maintain its dominant position over the forecast period. The development of the segment can be attributed to the increasing demand for packaging products

Asia Pacific is expected to register the fastest growth of 2.7% over the forecast period. The booming e-commerce industry across the region is expected to play a decisive role in driving the development of the regional industry

Key Topics Covered:

Chapter 1. Methodology and Scope

Chapter 2. Executive Summary

Chapter 3. Market Variables, Trends, & Scope Outlook

3.1. Market Segmentation

3.2. Commercial printing market Size & Growth Prospects

3.3. Commercial printing market - Value Chain Analysis

3.4. Commercial printing market Dynamics

3.4.1. Market Driver Analysis

3.4.2. Market Restraint Analysis

3.4.3. Market Opportunity Analysis

3.5. Commercial printing Penetration & Growth Prospects Mapping

3.6. Commercial printing market - Porter's Five Forces Analysis

3.6.1. Supplier power

3.6.2. Buyer power

3.6.3. Substitution threat

3.6.4. Threat from new entrant

3.6.5. Competitive rivalry

3.7. Commercial printing market - PEST Analysis

3.7.1. Political landscape

3.7.2. Economic landscape

3.7.3. Social landscape

3.7.4. Technology landscape

3.8. COVID-19 Impact Analysis

Chapter 4. Commercial printing market Printing Technology Outlook

4.1. Commercial printing market, By Printing Technology Analysis & Market Share, 2021 & 2030

4.2. Digital Printing

4.2.1. Market estimates and forecasts, 2017 - 2030 (USD Billion)

4.3. Lithography Printing

4.3.1. Market estimates and forecasts, 2017 - 2030 (USD Billion)

4.4. Flexographic Printing

4.4.1. Market estimates and forecasts, 2017 - 2030 (USD Billion)

4.5. Screen Printing

4.5.1. Market estimates and forecasts, 2017 - 2030 (USD Billion)

4.6. Gravure Printing

4.6.1. Market estimates and forecasts, 2017 - 2030 (USD Billion)

4.7. Others

4.7.1. Market estimates and forecasts, 2017 - 2030 (USD Billion)

Chapter 5. Commercial printing market Application Outlook

5.1. Commercial printing market, By Application Analysis & Market Share, 2021 & 2030

5.2. Packaging

5.2.1. Market estimates and forecasts, 2017 - 2030 (USD Billion)

5.3. Advertising

5.3.1. Market estimates and forecasts, 2017 - 2030 (USD Billion)

5.4. Publishing

5.4.1. Market estimates and forecasts, 2017 - 2030 (USD Billion)

5.4.2. Books

5.4.2.1. Market estimates and forecasts, 2017 - 2030 (USD Billion)

5.4.3. Newspaper

5.4.3.1. Market estimates and forecasts, 2017 - 2030 (USD Billion)

5.4.4. Magazines

5.4.4.1. Market estimates and forecasts, 2017 - 2030 (USD Billion)

5.4.5. Others

5.4.5.1. Market estimates and forecasts, 2017 - 2030 (USD Billion)

Chapter 6. Commercial printing market: Regional Estimates & Trend Analysis

Chapter 7. Competitive Analysis

7.1. Recent Developments and Impact Analysis, by Key Market Participants

7.2. Company/Competition Categorization (Key Innovators, Market Leaders, Emerging, Niche Players)

7.3. Vendor Landscape

7.3.1. Key company market share analysis, 2021

7.4. Company Analysis Tools

7.4.1. Market Position Analysis

7.4.2. Competitive Dashboard Analysis

Chapter 8. Competitive Landscape

8.1. Company Profiles

8.2. Quad/Graphics Inc.

8.2.1. Company overview

8.2.2. Financial performance

8.2.3. Product Benchmarking

8.2.4. Strategic initiatives

8.3. Acme Printing

8.3.1. Company overview

8.3.2. Financial performance

8.3.3. Product Benchmarking

8.3.4. Strategic initiatives

8.4. Cenevo

8.4.1. Company overview

8.4.2. Financial Performance

8.4.3. Product Benchmarking

8.4.4. Strategic initiatives

8.5. Transcontinental Inc.

8.5.1. Company overview

8.5.2. Financial performance

8.5.3. Product Benchmarking

8.5.4. Strategic initiatives

8.6. LSC Communications US, LLC.

8.6.1. Company overview

8.6.2. Financial performance

8.6.3. Product Benchmarking

8.6.4. Strategic initiatives

8.7. Gorham Printing, Inc.

8.7.1. Company overview

8.7.2. Financial performance

8.7.3. Product Benchmarking

8.7.4. Strategic initiatives

8.8. Dai Nippon

8.8.1. Company overview

8.8.2. Financial performance

8.8.3. Product Benchmarking

8.8.4. Strategic initiatives

8.9. The Magazine Printing Company

8.9.1. Company overview

8.9.2. Financial performance

8.9.3. Product Benchmarking

8.9.4. Strategic initiatives

8.10. Cimpress PLC

8.10.1. Company overview

8.10.2. Financial performance

8.10.3. Product Benchmarking

8.10.4. Strategic initiatives

8.11. Duncan Print Group

8.11.1. Company overview

8.11.2. Financial performance

8.11.3. Product Benchmarking

8.11.4. Strategic initiatives

8.12. Quebecor World Inc.

8.12.1. Company overview

8.12.2. Financial performance

8.12.3. Product Benchmarking

8.12.4. Strategic initiatives

For more information about this report visit https://www.researchandmarkets.com/r/ylwpqi

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900