Global Internet of People (NASDAQ:SDH shareholders incur further losses as stock declines 16% this week, taking one-year losses to 47%

While not a mind-blowing move, it is good to see that the Global Internet of People, Inc. (NASDAQ:SDH) share price has gained 16% in the last three months. But in truth the last year hasn't been good for the share price. In fact the stock is down 47% in the last year, well below the market return.

With the stock having lost 16% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Global Internet of People

Because Global Internet of People made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In just one year Global Internet of People saw its revenue fall by 68%. If you think that's a particularly bad result, you're statistically on the money Meanwhile, the share price dropped by 47%. We would want to see improvements in the core business, and diminishing losses, before getting too excited about this one.

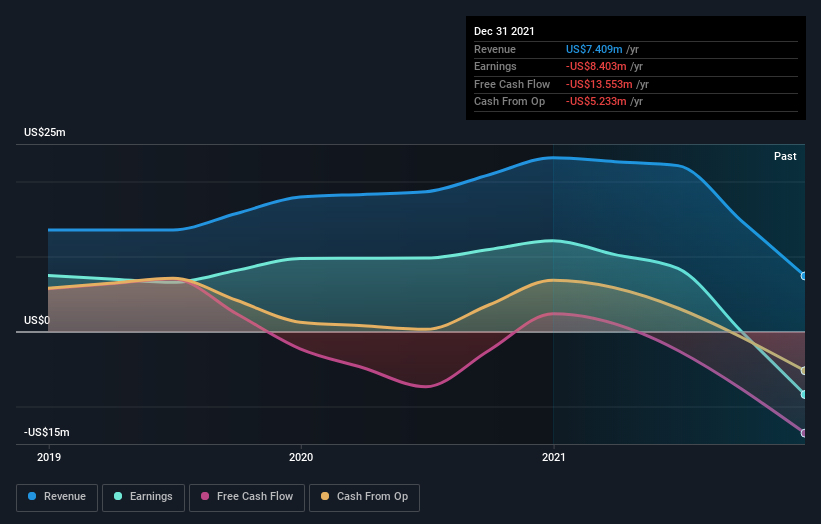

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We doubt Global Internet of People shareholders are happy with the loss of 47% over twelve months. That falls short of the market, which lost 10%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. It's great to see a nice little 16% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). It's always interesting to track share price performance over the longer term. But to understand Global Internet of People better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Global Internet of People (of which 1 is concerning!) you should know about.

We will like Global Internet of People better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.