Global Net Lease Inc (GNL) Reports Q4 2023 Results: Strategic Dispositions and Leasing Momentum

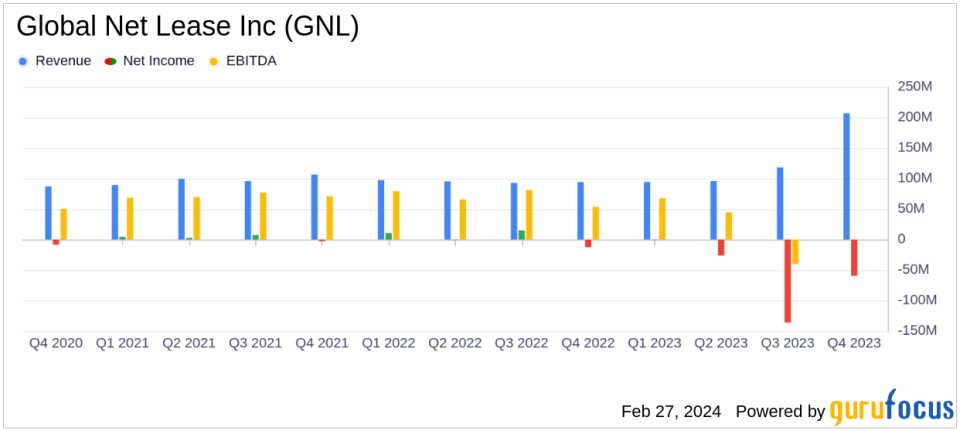

Revenue: $206.7 million in Q4 2023.

Net Loss: $59.5 million, or $0.26 per diluted share in Q4 2023.

NOI: $169.7 million in Q4 2023.

Core FFO: $48.3 million, or $0.21 per diluted share in Q4 2023.

AFFO: $71.7 million, or $0.313 per diluted share in Q4 2023.

Occupancy Rate: Portfolio maintained a 96% occupancy rate.

Lease Renewals and New Leases: 70 completed for over 2.1 million square feet.

On February 27, 2024, Global Net Lease Inc (NYSE:GNL) released its 8-K filing, detailing the financial and operational results for the fourth quarter and full year ended December 31, 2023. GNL, a real estate investment trust, manages a globally diversified portfolio of commercial properties, with a focus on acquiring and managing strategically-located commercial real estate properties.

Financial Performance and Strategic Initiatives

GNL reported a revenue of $206.7 million for the fourth quarter of 2023. However, the company faced a net loss of $59.5 million, or $0.26 per diluted share. The net operating income (NOI) stood at $169.7 million, while core funds from operations (Core FFO) were reported at $48.3 million, or $0.21 per diluted share. Adjusted funds from operations (AFFO) were $71.7 million, or $0.313 per diluted share, reflecting certain non-recurring expenses and a European tax restructure expected to reduce income tax expense beginning in the first quarter of 2024.

GNL's strategic initiatives in the fourth quarter included the completion of 70 lease renewals and new leases, spanning over 2.1 million square feet, resulting in over $19 million of net new straight-line rent. The portfolio maintained a strong occupancy rate of 96%, with minimal near-term lease maturities and a weighted average remaining lease term of 6.8 years.

Challenges and Deleveraging Strategy

Despite the reported net loss, GNL has recognized $68 million in annualized synergies by the end of the year and is on track to recognize the full $75 million balance by the third quarter of 2024. The company's deleveraging strategy includes $400 to $600 million of strategic dispositions, aimed at reducing leverage and enhancing the balance sheet. This approach is designed to be earnings neutral, with the expectation of a decrease in net debt to adjusted EBITDA by almost one full turn.

"We take great pride in our achievements at GNL throughout 2023, especially the seamless integration of our transformative merger. With the Merger and Internalization behind us, we remain focused on positioning ourselves as an industry leader with a global, diversified and primarily investment-grade portfolio," stated Michael Weil, Co-CEO of GNL.

For the full year 2024, GNL has provided guidance with an AFFO per share range of $1.30 to $1.40 and a net debt to adjusted EBITDA range of 7.4x to 7.8x. The company also announced a reduced annual dividend to $1.10 per share of common stock starting with the dividend expected to be declared in April 2024.

Balance Sheet and Liquidity

As of December 31, 2023, GNL had liquidity of $135.7 million and $206 million of capacity under the company's revolving credit facility. The net debt stood at $5.3 billion, including $2.7 billion of mortgage debt. The weighted average debt maturity at the end of 2023 was 3.2 years, with minimal debt maturity in 2024, and 80% fixed debt across the portfolio.

GNL's financial achievements and strategic dispositions are critical for the company's future growth and stability. The focus on deleveraging and optimizing the portfolio is expected to position GNL favorably in the competitive real estate investment trust market.

For more detailed information, investors are encouraged to review the full earnings release and financial statements filed with the SEC.

Explore the complete 8-K earnings release (here) from Global Net Lease Inc for further details.

This article first appeared on GuruFocus.