Global Partners LP Reports Solid Q4 and Full-Year 2023 Results Amid Strategic Acquisitions

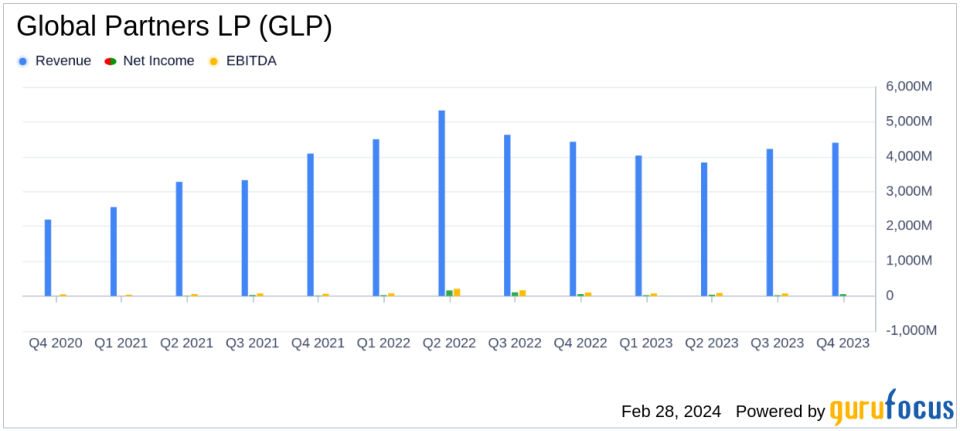

Net Income: $55.3 million in Q4 2023, slightly down from $57.5 million in Q4 2022.

Adjusted EBITDA: Increased to $112.1 million in Q4 2023 from $106.9 million in the same period last year.

Distributable Cash Flow (DCF): Rose to $59.4 million in Q4 2023 compared to $57.3 million in Q4 2022.

Gross Profit: Remained stable at $280.4 million in Q4 2023 versus $281.6 million in Q4 2022.

Total Sales: Held steady at $4.4 billion in both Q4 2023 and Q4 2022.

Volume: Increased to 1.6 billion gallons in Q4 2023 from 1.4 billion gallons in Q4 2022.

On February 28, 2024, Global Partners LP (NYSE:GLP) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full year ended December 31, 2023. The company, a major player in the midstream logistics and marketing of petroleum and related products, operates across several segments, with the Wholesale segment being the most significant revenue contributor.

Strategic Growth and Market Positioning

GLP's President and CEO, Eric Slifka, highlighted 2023 as a transformational year, marked by the acquisition of 25 liquid energy terminals from Motiva Enterprises and the first acquisition in a retail joint venture with ExxonMobil. These strategic moves have nearly doubled GLP's terminal storage capacity and expanded its operational footprint, particularly in fast-growing regions.

Financial Performance

Despite a slight decrease in net income from $57.5 million in Q4 2022 to $55.3 million in Q4 2023, GLP's financial health appears robust. The company's adjusted EBITDA saw an increase to $112.1 million, up from $106.9 million in the same quarter of the previous year. This growth in adjusted EBITDA is indicative of GLP's ability to maintain profitability amidst market fluctuations.

Distributable cash flow also saw an uptick, reaching $59.4 million, compared to $57.3 million in the fourth quarter of the prior year. This metric is crucial for investors as it reflects the company's ability to generate cash flow to support distributions.

Operational Highlights

The Gasoline Distribution and Station Operations (GDSO) segment product margin increased to $245.4 million in Q4 2023, up from $223.2 million in the same period of 2022, driven by higher fuel margins. However, the Wholesale segment experienced a decrease in product margin to $51.9 million, primarily due to less favorable market conditions in distillates, partially offset by gains in gasoline and residual oil. The Commercial segment also saw a slight decline in product margin due to less favorable bunkering conditions.

Looking Forward

Entering 2024, GLP is poised with a strong balance sheet and cash flows, according to CEO Slifka. The company is well-positioned to continue executing its strategic priorities, which could signal further growth and stability for investors.

For a more detailed analysis of GLP's financial results, including reconciliations of non-GAAP financial measures to their most directly comparable GAAP financial measures, investors and analysts can refer to the full 8-K filing.

Global Partners LP will continue to review its financial results in a teleconference call, providing an opportunity for analysts and investors to gain further insights into the company's performance and outlook.

For additional information on Global Partners LP and its operations, please visit the company's website at www.globalp.com.

Explore the complete 8-K earnings release (here) from Global Partners LP for further details.

This article first appeared on GuruFocus.