Global Payments' (GPN) Beats on Q2 Earnings, Raises '23 EPS View

Global Payments Inc. GPN reported second-quarter 2023 adjusted earnings per share (EPS) of $2.62, which outpaced the Zacks Consensus Estimate by 1.6%. The bottom line improved 11% year over year.

Adjusted net revenues of $2,202.8 million rose 7% year over year in the second quarter. The top line beat the consensus mark by 0.7%.

The better-than-expected quarterly results gained from solid contributions from its merchant and core issuer businesses. Both businesses benefited from rising transaction volumes. However, an elevated expense level partly offsets the upside.

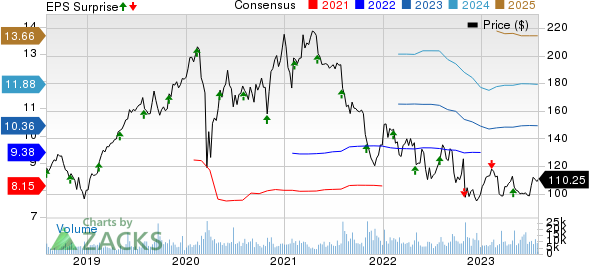

Global Payments Inc. Price, Consensus and EPS Surprise

Global Payments Inc. price-consensus-eps-surprise-chart | Global Payments Inc. Quote

Operating Performance

The adjusted operating income advanced 9.4% year over year to $987 million in the second quarter but lagged our estimate by 0.2%.

The adjusted operating margin of 44.8% improved 100 basis points (bps) year over year but lagged our estimate by 300 bps.

Total operating expenses declined 34.2% year over year to $1,849.7 million in the quarter under review. The significant decline was due to the impairment of goodwill incurred in the prior-year quarter. The metric lagged our estimate by 0.4%. Interest and other expenses of $191.4 million rose 93% year over year and surpassed our estimate by 9.9%.

Segmental Performances

Merchant Solutions: Adjusted revenues of the segment amounted to $1,682.1 million, which grew 17.3% year over year in the second quarter. The improvement came from double-digit vertical market growth, mid-teens integrated growth and record new sales. The company’s recent acquisition of EVO business also added to the upside. The reported figure lagged our estimate by 0.6%.

The segment’s adjusted operating income of $815.2 million improved 13.3% year over year but fell short of our consensus mark by 1.5%.

Issuer Solutions: The segment recorded adjusted revenues of $815.2 million, which rose 13.3% year over year in the quarter under review, thanks to core issuer constant currency growth and expanding commercial card transactions. The figure lagged our estimate by 1.5%.

Adjusted operating income came in at $235.9 million, up 11.6% year over year, beating our estimate by 0.3%.

Consumer Solutions: The segment’s adjusted revenues of $33.8 million fell 79.1% year over year in the second quarter. Adjusted operating income declined 57.4% year over year to $15.9 million.

Financial Position (as of Jun 30, 2023)

Global Payments exited the second quarter with cash and cash equivalents of $1,919.6 million, which declined from $1,997.6 million at 2022-end.

Total assets of $48,150.9 million grew from $44,809 million at 2022-end.

Long-term debt amounted to $16,975.4 million, which increased from $12,289.2 million at 2022-end. The current portion of long-term debt amounted to $75.7 million at the end of the second quarter.

Total equity of $22,416 million dipped from $22,540 at 2022-end.

In the first half of 2023, GPN generated operating cash flows of $1,164.5 million, which tumbled 2.8% year over year.

Capital Deployment Update

In the second quarter, Global Payments bought back common shares worth $207.5 million. Management sanctioned a quarterly dividend of 25 cents per share, which will be paid out on Sep 29, 2023, to its shareholders of record as of Sep 15.

2023 Guidance Raised

On the basis of the robust financial results delivered in the second quarter of 2023, management hiked the 2023 guidance for some metrics.

Adjusted net revenues are currently forecasted to be between $8,660 million and $8,735 million, which improved from the prior guidance of $8,635-$8,735 million. The midpoint of the revised outlook implies an improvement of 7-8% from the 2022 reported figure.

Adjusted net revenue growth in the Merchant Solutions segment is reaffirmed to stay at the higher end of the 15-16% range in 2023. Meanwhile, the Issuer Solutions segment’s adjusted net revenues are projected to be in the 5-6% band.

Adjusted EPS is anticipated to lie between $10.35 and $10.44 this year, indicating an improvement from the previous guidance of $10.32-$10.44. The midpoint of the updated guidance suggests 11-12% growth from the 2022 figure. GPN expects to convert almost 100% of adjusted net income into adjusted free cash flow.

The adjusted operating margin is continued to be expected to increase up to 120 bps in 2023.

Zacks Rank

Global Payments currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Business Services Sector Releases

Of the other Business Services sector industry players that have reported second-quarter results so far, the bottom-line results of The Interpublic Group of Companies, Inc. IPG, Omnicom Group Inc. OMC and Equifax Inc. EFX beat the Zacks Consensus Estimate.

Interpublic Group reported second-quarter 2023 adjusted earnings of 74 cents per share, beating the Zacks Consensus Estimate by 23.3% but declining 17.5% on a year-over-year basis. Net revenues of $2.33 billion missed the consensus estimate by 2.9% and decreased 14.9% on a year-over-year basis. IPG’s operating income in the quarter came in at $310.7 million, down 11% from the prior-year quarter’s levels. Adjusted EBITA came in at $331.9 million, decreasing 10.3% from the prior-year quarter’s level.

Omnicom’s second-quarter 2023 earnings of $1.81 per share beat the consensus estimate by 0.6% and increased 7.7% year over year. Total revenues of $3.6 billion lagged the consensus estimate by 0.3% but increased 1.2% year over year.

Across fundamental disciplines, revenues from Advertising & Media were up 5.1%, compared with our estimated growth of 6.3%. Precision marketing revenues jumped 2.3%, compared with our estimate of 14% growth. EBITA of OMC in the quarter came in at $570 million, up 1.4% year over year.

Equifax reported second-quarter 2023 adjusted earnings of $1.71 per share, beating the Zacks Consensus Estimate by 2.4% but declining 18.2% from the year-ago figure. Total revenues of $1.32 billion missed the consensus estimate by 0.4% while matching the year-ago figure on a reported basis.

The top line gained 1% on a local-currency basis. Revenues in the Workforce Solutions segment of EFX totaled $582.8 million, down 4% from the year-ago quarter’s figure. Adjusted EBITDA in the second quarter totaled $431.3 million, down 30% from the year-ago quarter’s level.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

Interpublic Group of Companies, Inc. (The) (IPG) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

Global Payments Inc. (GPN) : Free Stock Analysis Report