Global Payments (GPN) Jumps 20% in 6 Months: More Growth Ahead?

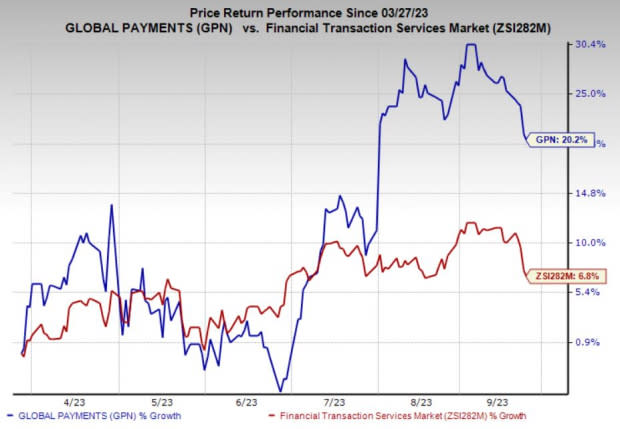

Global Payments Inc. GPN shares have jumped 20.2% in the past six months, outperforming the 6.8% increase of the industry, as investors like the solid contributions from its merchant and core issuer businesses. Also, its strong 2023 guidance and transaction growth are benefiting the stock.

Headquartered in Atlanta, GA, Global Payments is a payment technology and software solutions services provider worldwide. It has a market cap of $31 billion and currently has a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Can GPN Retain Momentum?

The answer is yes, thanks to the rising estimates, and growing operating and financial strengths.

The Zacks Consensus Estimate for 2023 earnings per share currently stands at $10.40, implying an 11.6% year-over-year increase. It has witnessed 10 upward estimate revisions in the past 60 days against one in the opposite direction. GPN beat earnings estimates in two of the last four quarters and missed on the other occasions, with an average surprise of 1.1%.

The Zacks Consensus Estimate for 2023 revenues is pegged at $8.7 billion, indicating a 7.2% year-over-year rise. This company is poised for long-term growth due to solid digital payment prospects.

With the rising demand for digital payment methods amid the growing digitalization of economies worldwide, Global Payments’ services are expected to generate a high yield. An increase in the middle-class demographic in emerging markets is likely to fuel growth. This is expected to bring more traffic to its network and boost transaction volumes.

In 2023, our estimate for revenues from the Merchant Solutions business indicates 16% year-over-year growth. New sales and the acquisition of the EVO business are expected to contribute to the upside. Similarly, core issuer growth and expanding commercial card transactions are likely to aid its Issuer Solutions business. We expect revenues from this unit to jump nearly 6% in 2023 from the year-ago levels.

The stock is significantly undervalued than the industry at the moment. It is trading at forward 12-month price to earnings of 10.35X, lower than the industry average of 20.62X.

Also, GPN’s strong financial flexibility is commendable. It had nearly $1.9 billion of cash and cash equivalents at June-end compared with the current portion of long-term debt of $75.7 million. Moreover, the company’s operating cash flows have been increasing over the years. It estimates to generate $15 billion of adjusted free cash flow cumulatively for the 2021-2025 period. Global Payments generated almost $1.2 billion of operating cash flow in the first half of 2023.

Risks

Despite the upside potential, there are a few factors that can hold back GPN’s growth. Rising operating costs are hampering its margins. For 2023, we expect adjusted total operating expenses to increase 5% year over year.

Also, emerging payment companies with significant growth are rapidly capturing markets, which can put pressure on GPN’s prices. Nevertheless, we believe that a systematic and strategic plan of action will drive its long-term growth.

Key Picks in Business Services

Some better-ranked stocks in the broader Business Services sector are Shift4 Payments, Inc. FOUR, Paysafe Limited PSFE and FirstCash Holdings, Inc. FCFS. While Shift4 Payments currently sports a Zacks Rank #1 (Strong Buy), Paysafe and FirstCash each carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Shift4 Payments’ current-year bottom line suggests 100.7% year-over-year growth. Based in Allentown, PA, FOUR beat earnings estimates in all the past four quarters, with an average surprise of 21.9%.

The Zacks Consensus Estimate for Paysafe’s current-year bottom line suggests 5.8% year-over-year growth. Headquartered in London, PSFE beat earnings estimates in three of the past four quarters and missed once, with an average surprise of 154%.

The Zacks Consensus Estimate for FirstCash’s current-year earnings indicates a 6.7% year-over-year increase. Fort Worth, TX-based FCFS beat earnings estimates in all the past four quarters, with an average surprise of 7.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FirstCash Holdings, Inc. (FCFS) : Free Stock Analysis Report

Global Payments Inc. (GPN) : Free Stock Analysis Report

Shift4 Payments, Inc. (FOUR) : Free Stock Analysis Report

Paysafe Limited (PSFE) : Free Stock Analysis Report