Global Payments Inc (GPN): A Strong Contender in the Business Services Industry with a GF Score ...

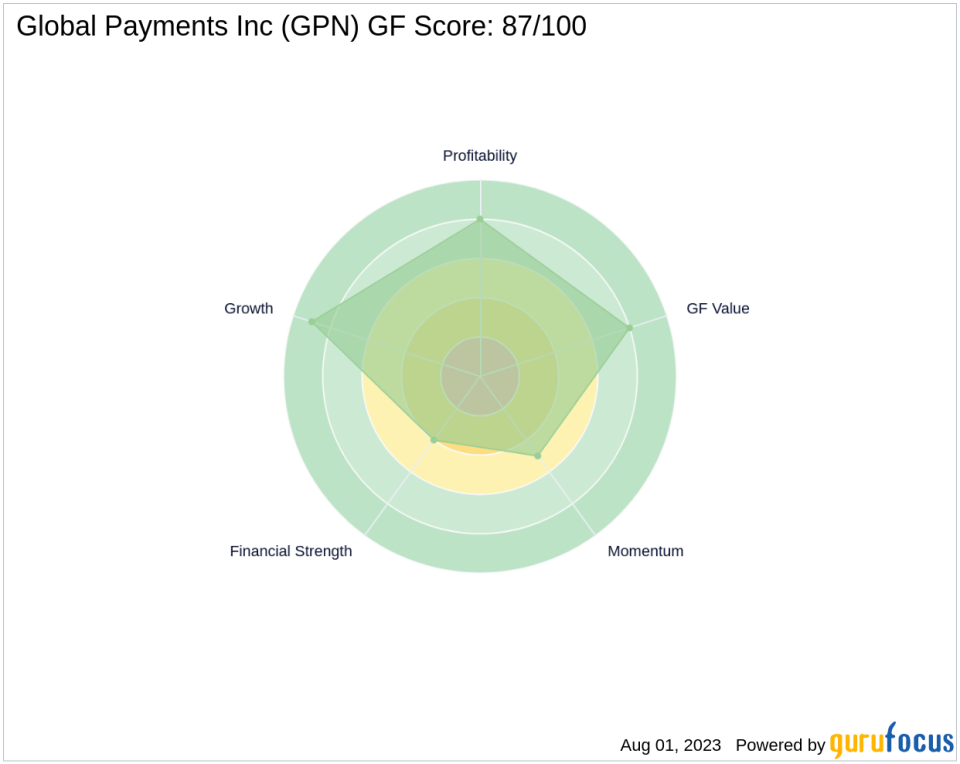

Global Payments Inc (NYSE:GPN), a major player in the Business Services industry, is currently trading at $119.17 with a market capitalization of $31.22 billion. The company's stock price has seen a gain of 8.09% today and a significant increase of 21.11% over the past four weeks. According to the GF Score, a stock performance ranking system developed by GuruFocus, GPN has a score of 87 out of 100, indicating good outperformance potential.

Financial Strength Analysis

Global Payments Inc has a Financial Strength Rank of 4/10. This rank is determined by several factors including the company's debt burden, debt to revenue ratio, and Altman Z-Score. GPN's interest coverage is 3.34, indicating its ability to cover interest expenses with its earnings. The company's debt to revenue ratio is 2.00, suggesting a moderate level of debt relative to its revenue. Its Altman Z score is 0.95, which is below the safe zone and indicates potential financial distress.

Profitability Rank Analysis

The company's Profitability Rank is 8/10, reflecting its strong profitability. GPN's Operating Margin is 17.54%, indicating efficient operations. Its Piotroski F-Score is 5, suggesting a stable financial situation. The company has shown a consistent profitability trend with an average operating margin increase of 0.50% over the past five years. Furthermore, GPN has maintained profitability for the past 10 years, demonstrating its financial resilience and operational efficiency.

Growth Rank Analysis

Global Payments Inc has a Growth Rank of 9/10, indicating strong growth potential. The company's 5-year revenue growth rate is 6.40%, and its 3-year revenue growth rate is 9.70%, both of which suggest a steady increase in revenue. Additionally, GPN's 5-year EBITDA growth rate is 6.10%, indicating a consistent growth in its business operations.

GF Value Rank Analysis

The company's GF Value Rank is 8/10, suggesting that the stock is fairly valued. This rank is determined by the price-to-GF-Value ratio, a proprietary metric calculated based on historical multiples and an adjustment factor based on a company's past returns and growth.

Momentum Rank Analysis

Global Payments Inc has a Momentum Rank of 5/10. This rank is determined using the standardized momentum ratio and other momentum indicators, reflecting the stock's price performance over the past year.

Competitor Analysis

When compared to its competitors in the same industry, GPN holds a strong position. Copart Inc (NASDAQ:CPRT) has a higher GF Score of 96 but a significantly larger market cap of $42.43 billion. Aramark (NYSE:ARMK) and Dolby Laboratories Inc (NYSE:DLB) have lower GF Scores of 73 and 83, respectively, and smaller market caps of $10.47 billion and $8.51 billion.

Conclusion

In conclusion, Global Payments Inc (NYSE:GPN) presents a compelling investment opportunity with a GF Score of 87, indicating good outperformance potential. Despite its poor financial strength, the company's strong profitability, growth potential, fair valuation, and competitive momentum make it a strong contender in the Business Services industry.

This article first appeared on GuruFocus.