Globalstar Inc's Meteoric Rise: Unpacking the 29% Surge in Just 3 Months

Globalstar Inc (GSAT), a leading player in the telecommunications industry, has seen a significant surge in its stock price over the past three months. The company's stock price has risen from $0.9 to $1.32, marking a substantial increase of 29.46%. Over the past week alone, the stock has gained 36.79%. Despite this impressive performance, the company's GF Value stands at $1.79, suggesting that it is modestly undervalued. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. This indicates that there may still be room for growth for value investors.

Company Overview: Globalstar Inc (GSAT)

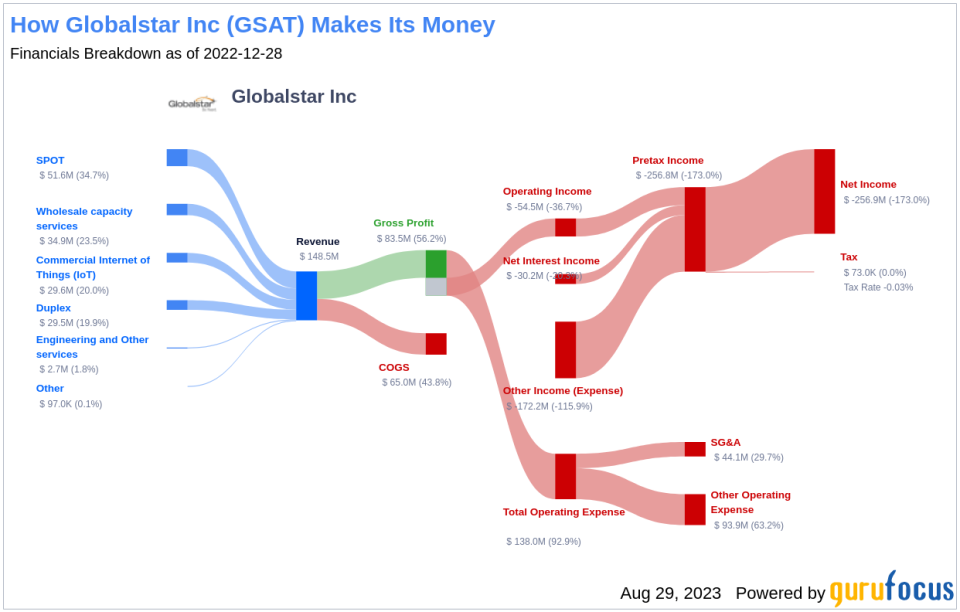

Globalstar Inc is a telecommunications company that primarily operates within the United States. The company generates revenue from the provision of mobile satellite services, which are typically used where existing terrestrial wireline and wireless communications networks are impaired or do not exist. Globalstar offers two-way voice and data transmission services, as well as one-way data transmission, using mobile or fixed devices. As an owner of satellite assets, the company plays a crucial role in the telecommunications industry.

Profitability Analysis

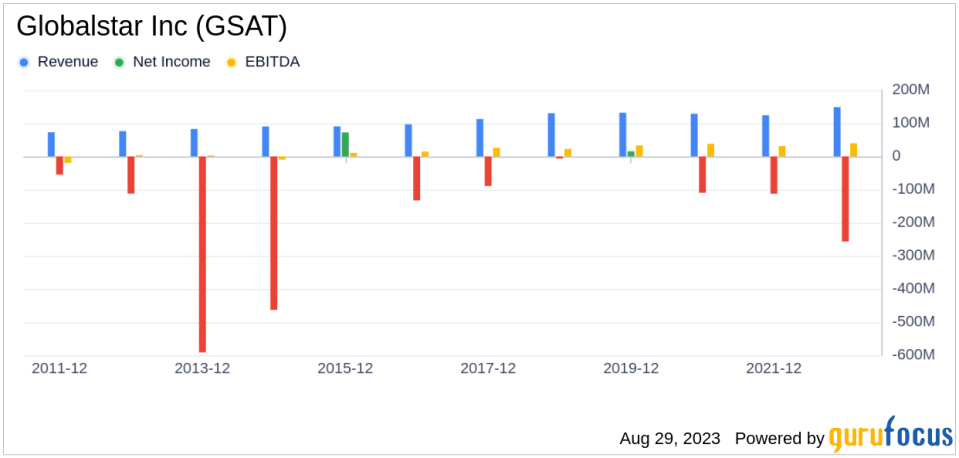

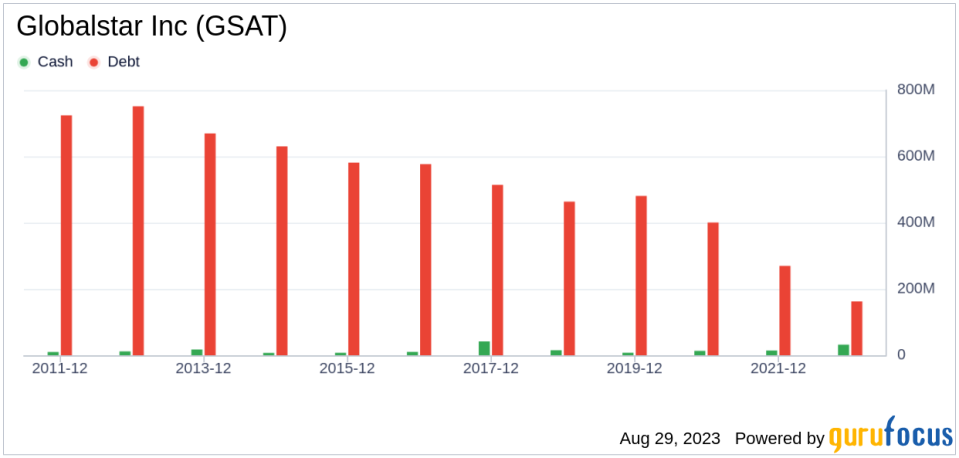

Globalstar's Profitability Rank stands at 3/10, indicating a relatively low level of profitability. The company's Operating Margin is -10.46%, which is better than 11.89% of the companies in the industry. Furthermore, the company's ROE and ROA are -75.87% and -25.37% respectively, suggesting that the company is struggling to generate profits. The company's ROIC of -2.33% is better than 20.56% of the companies in the industry. Over the past 10 years, the company has only been profitable for 2 years.

Growth Prospects

Globalstar's Growth Rank is 4/10, indicating moderate growth. The company's 3-year and 5-year revenue growth rates per share are 0.80% and -5.50% respectively. Furthermore, the company's 3-year and 5-year EPS without NRI growth rates are both negative, suggesting that the company's earnings per share have been declining.

Major Shareholders

Jim Simons (Trades, Portfolio) and Steven Cohen (Trades, Portfolio) are the top two shareholders of Globalstar Inc, holding 0.07% and 0% of the company's shares respectively.

Competitive Landscape

Globalstar Inc operates in a competitive industry, with major competitors including Liberty Latin America Ltd (NASDAQ:LILA), Telephone and Data Systems Inc (NYSE:TDS), and InterDigital Inc (NASDAQ:IDCC). These companies have market capitalizations ranging from $1.93 billion to $2.23 billion, indicating a highly competitive market environment.

Conclusion

In conclusion, Globalstar Inc has seen a significant surge in its stock price over the past three months, with a gain of 29.46%. Despite this, the company's GF Value suggests that it is modestly undervalued, indicating potential for further growth. However, the company's low profitability and growth ranks, along with its negative operating margin, ROE, ROA, and ROIC, suggest that it is struggling to generate profits and grow. Therefore, while the company's recent stock performance is impressive, potential investors should carefully consider these factors before making an investment decision.

This article first appeared on GuruFocus.